Biden won't block potential port strikes on East and Gulf Coast

A potential strike by East Coast and Gulf Coast dockworkers could cost the U.S. economy $5 billion a day, J.P. Morgan found

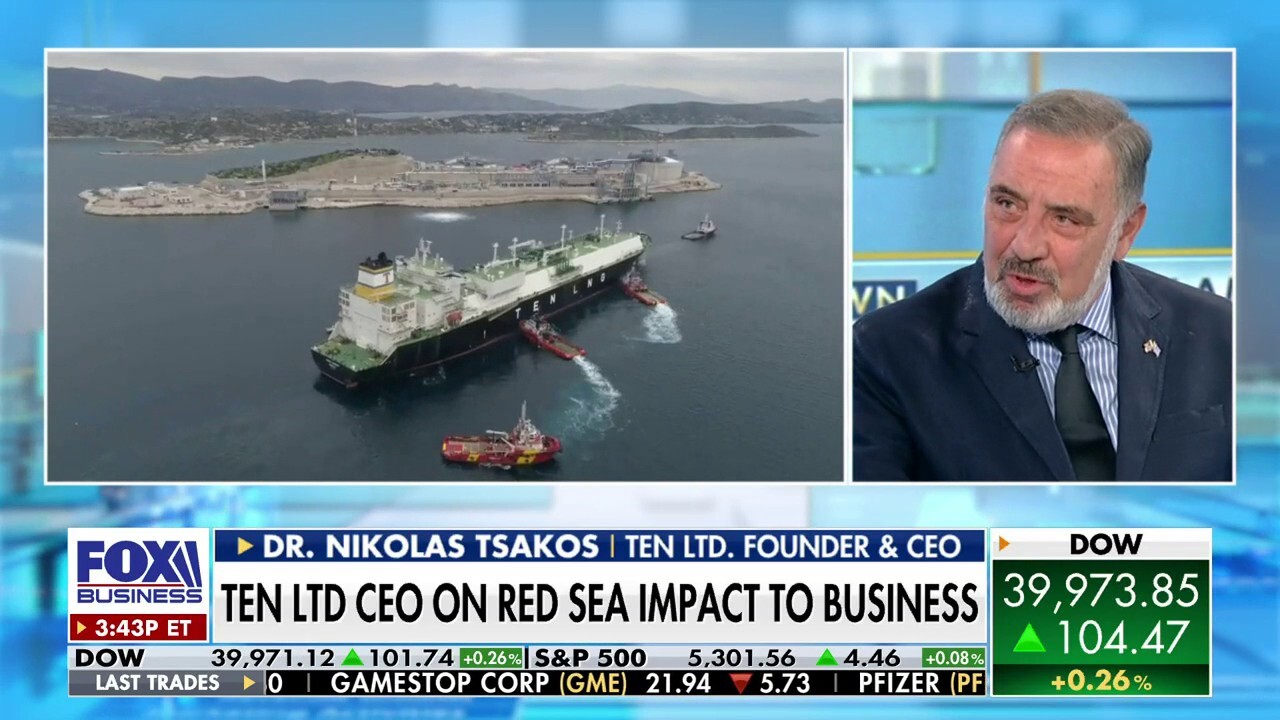

Ten LTD. CEO reveals how an alternative shipping route to avoid the Red Sea is impacting business

Ten LTD. Founder and CEO Dr. Nikolas Tsakos discusses rerouting to avoid the Red Sea amid Middle East tensions on The Claman Countdown.

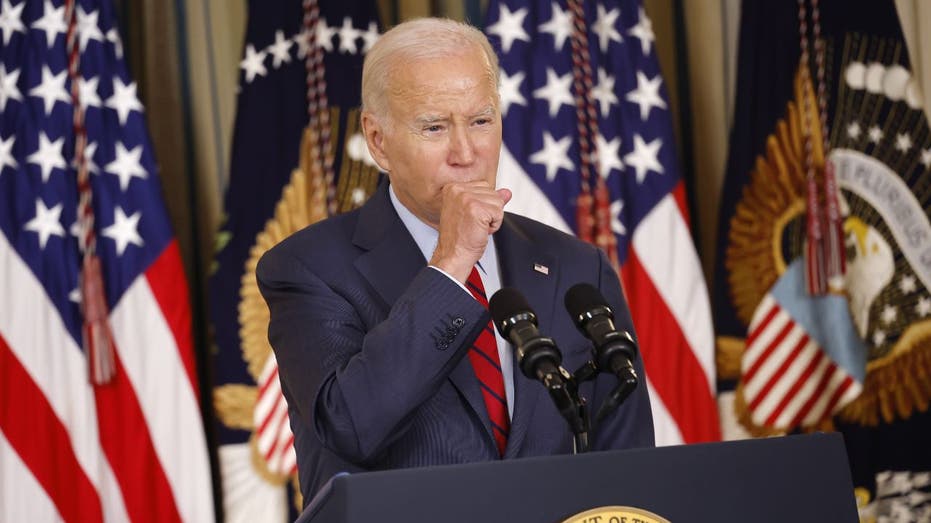

President Biden doesn't plan to intervene to prevent a strike at ports on the East Coast and in the Gulf of Mexico if dockworkers fail to negotiate a new labor contract before a deadline on Oct. 1, an administration official said Tuesday.

The International Longshoremen's Association (ILA), which is negotiating on behalf of 45,000 dockworkers at three dozen U.S. ports from Maine to Texas that collectively handle about half of the country's seaborne imports, has warned its members are prepared to stop work if they don't have a new contract by the deadline.

The ILA's current contract with the United States Maritime Alliance (USMX) expires on Sept. 30, setting up a potential strike beginning next month if the two sides don't reach an agreement.

Presidents have the authority to intervene in labor disputes that pose a threat to national security or safety under a law known as the Taft-Hartley Act, which lets the president impose an 80-day cooling-off period under which workers go back to work while negotiations continue. However, the Biden administration has signaled it doesn't plan to use that authority if the longshoremen's union goes on strike at East and Gulf Coast ports.

BOEING FACES STRIKE OF ABOUT 32,000 WORKERS

President Biden signaled that he wouldn't intervene in a labor dispute between the longshoremen's union and port employers in the event of a strike. (Chip Somodevilla / Getty Images)

"We support collective bargaining and believe it’s the best way for American workers and employers to come to agreement," a Biden administration official told FOX Business. "That’s why we encourage all parties to remain at the bargaining table and negotiate in good faith."

"Since taking office, the Biden-Harris Administration has developed a comprehensive whole-of-government approach to monitor and mitigate potential supply chain impacts, from severe weather to transport service interruptions to this spring’s Key Bridge collapse in Baltimore. We’ve never invoked Taft-Hartley to break a strike and are not considering doing so now," the official added.

The signal comes after the National Retail Federation on Tuesday led a group of 177 trade organizations representing retailers, manufacturers, farmers, automakers and truckers in calling for Biden to help reach a deal.

TRAPPED VESSELS NAVIGATE PORT OF BALTIMORE AFTER BRIDGE COLLAPSE

An analysis by J.P. Morgan found an East Coast and Gulf Coast dockworkers strike could cost the U.S. economy up to $5 billion a day. (Joe Raedle / Getty Images)

Last summer, the Biden administration sent acting Labor Secretary Julie Su to help broker a deal in a similar labor dispute involving the West Coast longshoremen's union and seaport employers after unions disrupted operations at some busy California ports.

In that case, the two sides agreed to extend negotiations beyond their July 1, 2022, deadline because the COVID pandemic-related cargo boom was clogging critical supply chains and helping fuel inflation. They eventually reached a deal in June 2023 that boosted pay by 32% and was viewed as a template for labor negotiations at ports on the East and Gulf Coasts.

Negotiations between the ILA and USMX are at an impasse over a range of issues, including wages and benefits, as well as a cap on the automation of port terminals.

RED SEA ATTACKS IMPACTING GLOBAL TRADE AS MORE SHIPPERS BAN THE AREA DUE TO HOUTHI MILITANTS

A looming strike at East Coast and Gulf Coast ports could begin on Oct. 1 if a deal isn't reached. (Jim Watson/AFP via / Getty Images)

An analysis by J.P. Morgan found that the cost of a strike could run upwards of $5 billion a day, which could ramp up the pressure on Biden to intervene if the work stoppage goes ahead.

John Janson, vice president of global supply chain for SanMar, told PPAI that a strike at the East and Gulf Coast ports "would have a catastrophic effect on the overall U.S. economy" and noted that it's too late to shift imports to West Coast ports with a potential strike just weeks away.

Christian Roeloffs, co-founder and CEO of Container xChange, said in a report by gCaptain that because of the possibility of strikes at East Coast and Gulf Coast ports, shipping companies should "anticipate short-term spikes in demand for leased containers as retailers rush to secure goods ahead of potential disruptions, particularly for seasonal inventory and industrial shipments."

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Roeloffs also noted in the report that U.S. retailers have strong inventories after pulling forward orders to earlier dates that could mitigate some risks related to a potential strike because the "stockpile will act as an essential buffer, mitigating the risk of container rates spiking dramatically due to the strikes."

FOX Business' Edward Lawrence and Lydia Hu, and Reuters contributed to this report.