Andy Puzder: Biden's 'Zombie Tax' will kill family businesses and haunt the living all across America

Democrats are unapologetic about their plans to significantly increase taxes on what they loosely define as wealth

Sen. Sanders spending bill would increase taxes, inflation: Sen. Portman

Sen. Rob Portman, R-Ohio, argues a $6 trillion spending package would 'really hurt' the economy and working families across America.

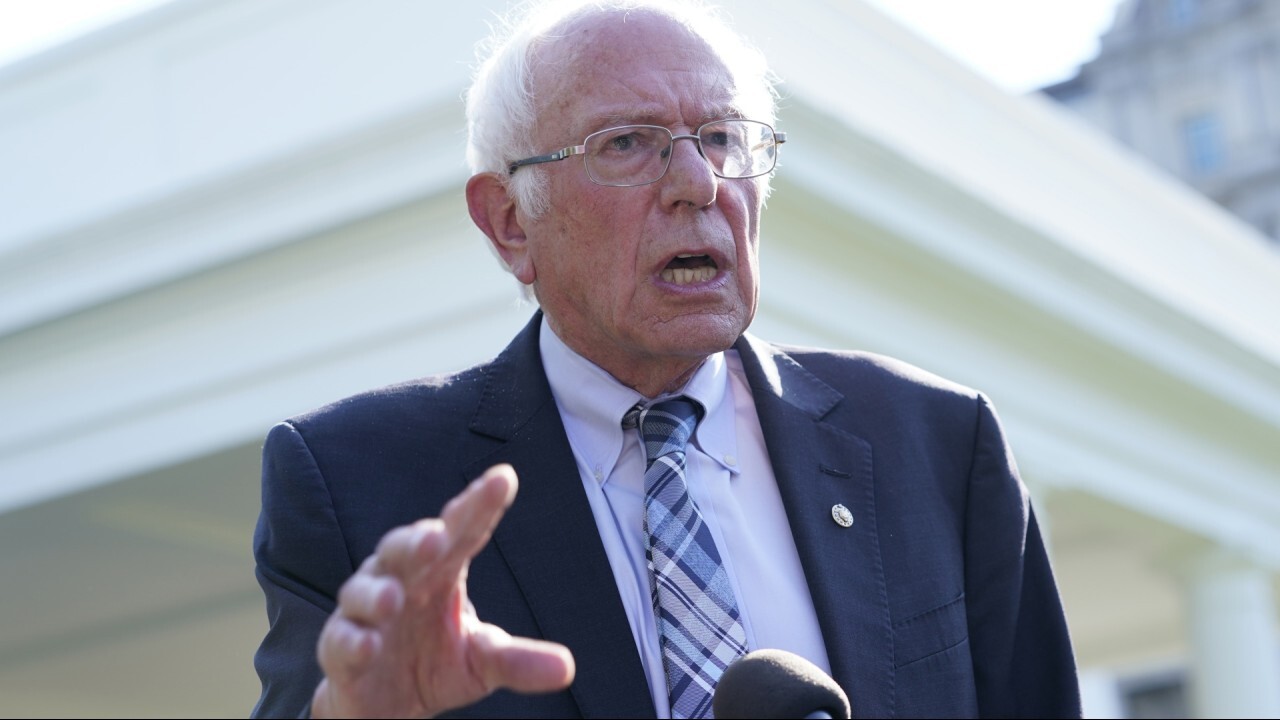

Democrats are unapologetic about their plans to significantly increase taxes on what they loosely define as "wealth." Senators Chris Van Hollen, D-Md., Cory Booker, D-N.J., Bernie Sanders, I-Vt., Sheldon Whitehouse D-R.I., and Elizabeth Warren, D-Mass., have proposed such a tax and President Biden is including it in his American Families Plan to help cover the whopping $1.8 trillion price tag. Deceptively named the Sensible Taxation and Equity Promotion (STEP) Act, it is more aptly known as the "Zombie Tax."

That’s because it comes back to haunt the living who attempt to carry on family businesses following the owner’s death.

Currently, when family members inherit a business the law steps up the asset’s cost basis to its value at the time of the owner’s death. When the heirs sell the asset, the step up limits the gain subject to tax to any increase in value subsequent to the owner’s death.

BIPARTISAN INFRASTRUCTURE PLAN IS THE ‘TROJAN HORSE’ FOR MASSIVE TAX INCREASES: MARC SHORT

This step up in basis is a recognition that the decedent’s assets above the current estate tax exemption (currently $11.7 million) were subject to a 40% estate tax before passing to the heirs.

The Zombie Tax would upend this balanced approach.

Will higher taxes tip the market?

Wealth Consulting Group CEO Jimmy Lee and WSJ assistant editorial page editor James Freeman discuss market movement in anticipation of tax hikes.

Let’s say the decedent owned a business. The Zombie Tax would both eliminate the step up in basis and impose a capital gains tax (currently 23.8%) as if the business were sold on the day the owner died. It would then reduce the business’s value by the amount of the tax and apply the 40% estate tax.

At the current federal capital gains and estate tax rates, the combined tax would be about 54%, or over half of the decedent’s estate. But Biden want to increase the capital gains tax rate to 43.4%. At that rate, the combined tax would be over 66%, or a whopping two-thirds of the decedent’s estate. Keep in mind this is all before any state capital gains or estate tax hits.

The estate would need to raise funds to pay these taxes at the time of death and the heirs would additionally have to pay the capital gains tax over the next 15 years. This would likely saddle the business with a burdensome debt – assuming it could get a loan on reasonable terms with a 15 year cash flow reducing capital gains tax obligation on its books. Otherwise, the estate would have to sell the business to pay the taxes.

Goodbye family business.

The Zombie Tax’s primary fault is its failure to recognize the nature of wealth. Anyone with a mortgage has heard the old adage of being "house rich and cash poor."

The same applies to asset-reliant businesses and farm households – think buildings, land, inventory, heavy equipment, etc. – but by multiple orders of magnitude. Many of these family enterprises operate on razor thin profit margins and seasonal income cycles, meaning they are often asset rich and cash flow poor.

THE BIDEN ADMINISTRATION IS WAGING A WAR ON SMALL BUSINESS – AND THEY ARE ON TRACK TO WIN

We’ve all met countless business owners, often made up of entire families, who scrapped and saved to achieve their piece of the American Dream. They’ve taken huge risks, worked seven day weeks, and paid significant taxes all along the way – creating jobs and supporting their communities.

These are not the hedge fund managers in the Hamptons or unemployable rich kids running vanity boutiques but rather diverse men and women of all races, nationalities, faiths and economic backgrounds who have worked to build businesses in the hopes of leaving them to their families to continue on and grow.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The Zombie Tax would compel many of these asset intensive family businesses to sell under pressure impacting not just heirs and family members, but also the jobs of longtime employees from factory workers and mid-level managers to ranch hands and research scientists. Ironically, it would also create opportunities for the same wealthy speculators proponents cite as the need for wealth taxes to scoop up these businesses at fire sale prices.

Absent leaving the law or adopting a rational solution, the personal and economic costs of this tax would be tremendous. A report prepared by the research firm REMI and commissioned by Committee to Unleash Prosperity found that the Zombie tax would result in the following:

*Sustained annual job losses ranging from over 500,000 to almost 1 million;

*10-year losses in economic output and GDP of about $2 trillion and $1 trillion, respectively, with a $600 billion loss in private investment, and a $6 billion loss in R&D spending; and,

*A 10-year loss in personal income of about $1 trillion, which translates to $8,000 – 10,000 per household.

Small wonder that all 50 Republican senators in Congress recently sent a letter to President Biden opposing the Zombie Tax.

CLICK HERE TO READ MORE ON FOX BUSINESS

Moderate Democrats in Congress should look very closely at imposing government mandated asset fire sales and upending decades of foundational tax principles that allow family-owned and private businesses to exist long after an owner’s death.

The long-term economic and societal benefits of doing so are far greater than any immediate cash grab that ill-advised revenue measures like the Zombie Tax – or other wealth taxes – could ever provide.

This Zombie Tax scheme is so counterproductive one wonders whether the Democrats’ goal is more about punishing success than either tax fairness or increased revenue.

Andy Puzder was chief executive officer of CKE Restaurants for more than 16 years, following a career as an attorney. He is currently a Senior Fellow at the Pepperdine University School of Public Policy. He was nominated by President Trump to serve as U.S. labor secretary. In 2018, Puzder authored "The Capitalist Comeback: The Trump Boom and the Left's Plot to Stop It" (Center Street). His latest piece, a Broadside by Encounter Books titled, "It’s Time to Let America Work Again" was released on July 20, 2020.