Boeing Takes Lead on Healthcare, As Insurers Battle DOJ

As the U.S. Department of Justice moves to block two mega-mergers in the healthcare industry, Aetna’s (NYSE:AET) $37 billion deal with Humana (NYSE:HUM) and Anthem’s (NYSE:ANTM) $48 billion bid for Cigna (NYSE:CI), has left many wondering what happens next to the health insurance industry? While the government and lawyers for the insurance companies battle it out, healthcare experts say the move could spur more innovation in the industry and create more choices for consumers.

“What we need from our health insurance industry is alot of innovation and I think that if we allowed the health insurance market to coalesce around a few mega-insurance companies that would hurt innovation,” says Alain Enthoven, healthcare economist and professor at Stanford University, who helped design the framework for managed competition in the healthcare industry.

Boeing Leads Innovation

Enthoven says by allowing more companies to compete, competition will give birth to new initiatives aimed at improving managed care and lowering costs. He says it is already happening. Boeing (NYSE:BA), for example, is negotiating directly with some medical service providers to offer healthcare to its employees, bypassing insurance companies. In California, the aerospace giant has teamed up with MemorialCare Health Systems to provide healthcare to its 15,000 employees in the state. If employees choose the plan, they can expect smaller paycheck deductions, full coverage for generic drug prescriptions and zero co-payments for primary care visits. Boeing, meantime, can negotiate better pricing and bring down healthcare expenses.

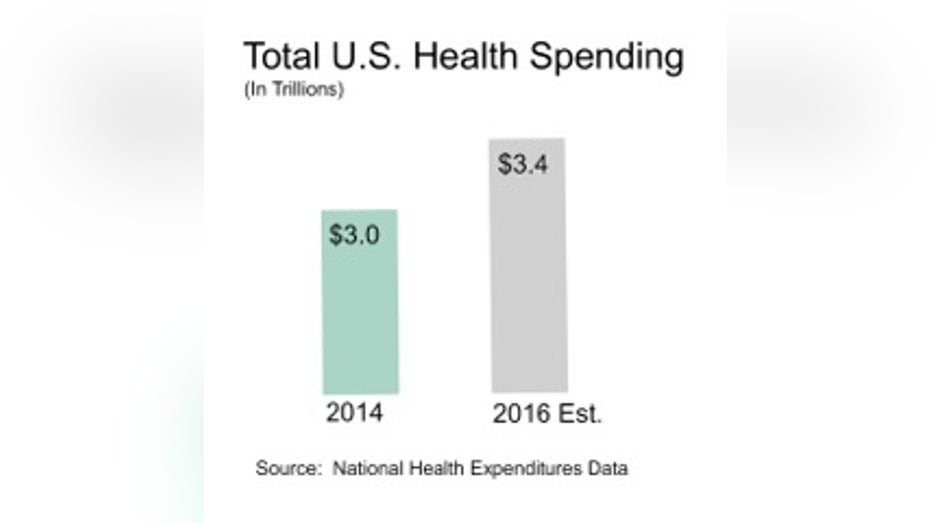

Total health spending in the U.S. is expected to soar to $3.4 trillion this year a 13% jump from 2014

Boeing isn’t alone in coming up with new cost-saving solutions. Wellmark Blue Cross & Blue Shield, the largest health insurer in Iowa, has also implemented a program to reward certain hospitals and clinics with financial incentives for providing high quality care and keeping patients healthy. The insurer said the move saved the company about $35 million in health care costs last year.

Healthcare Costs Soar

Total health spending in the U.S. is expected to soar to $3.4 trillion this year, up 13 percent from $3 trillion dollars in 2014. One contributing factor is the Affordable Care Act. More people are now insured and many are in need of medical attention, more than anticipated, therefore costs are ballooning. As a consequence, premiums for state healthcare exhanges in California, New Mexico, Maine and other states are expected to climb in 2017 and the increase could be dramatic. In Tennessee, Blue Cross and Blue Shield has asked for an average increase of 62 percent in premiums next year, citing higher than expected medical costs.

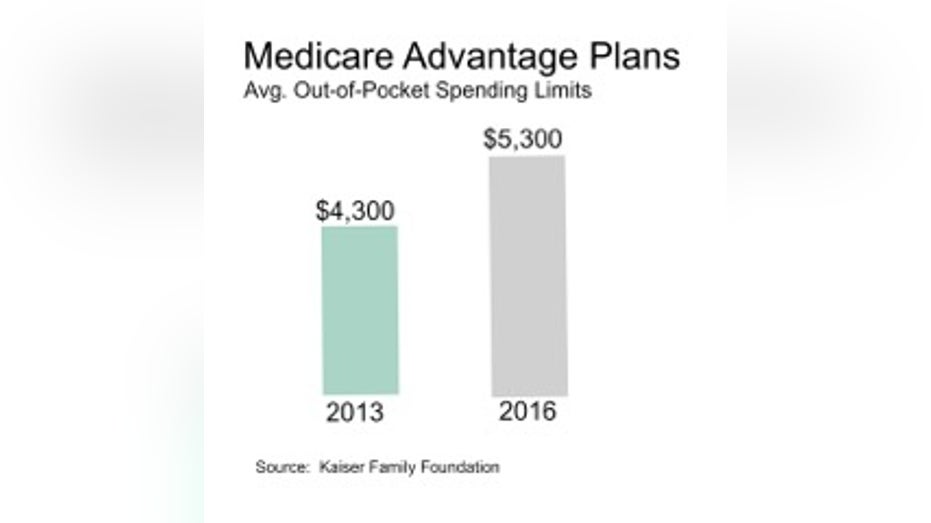

Premiums for Medicare plans run by private insurers, known as Medicare Advantage plans, have held steady over the past few years. Not the case for out-of-pocket spending limits according to Gretchen Jacobson, analyst at the Kaiser Family Foundation. She says out-of-pocket spending limits on these plans have gone from an average of $4,300 in 2013 to $5,300 this year, an increase of more than 23 percent. “We have seen that the out-of-pocket limits have increased pretty sharply over the past few years. So the out-of-pocket limits may be indicative that they (insurers) are changing other costs and benefits as well,” she says.

New Solutions Lower Costs

Enthoven says to better manage rising costs expect employers, insurers and medical providers to continue to find new ways to bring expenses down and improve medical care. He says greater competition and new initiatives like the one Boeing and others are implementing will help give consumers more choices and help drive down costs. “I am caustiously optimistic that competition for cost conscious and informed consumers could mitigate the growth in spending,” he says. “Competition can work, it’s a good thing for consumers and employers.”