CFPB tightens rules for buy now, pay later lenders

The consumer watchdog is requiring 'buy now, pay later' lenders to follow the same rules as credit card companies

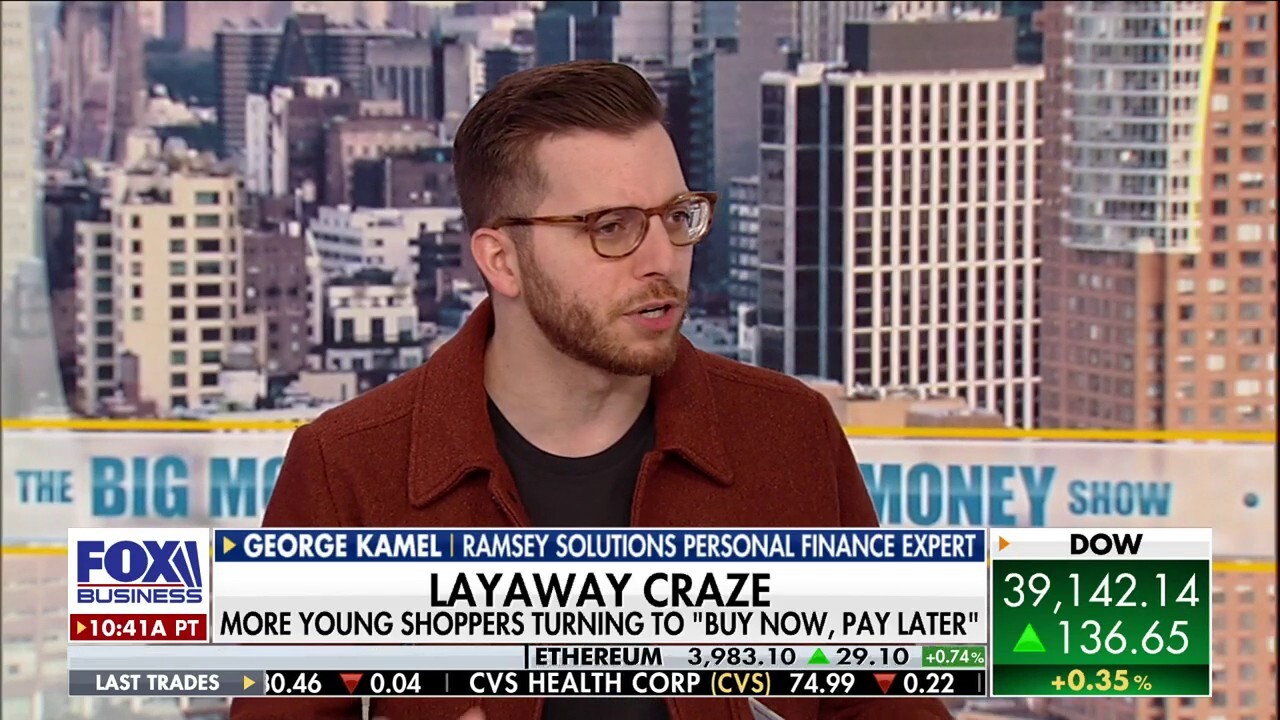

Buy now, pay later is adding more pain to peoples budgets: George Kamel

Ramsey Solutions personal finance expert and ‘The Ramsey Show’ co-host George Kamel discusses the buy now, pay later craze and the trend that celebrates the financial benefits of being childless.

The Consumer Financial Protection Bureau (CFPB) on Wednesday announced it will impose some of the same rules on buy now, pay later (BNPL) lenders that apply to credit card companies, bolstering regulations of the payment method that is growing in popularity among Americans.

Under an interpretive rule, the federal watchdog classified BNPL lenders as credit card providers, requiring them to allow consumers the right to dispute charges and the ability to demand a refund for purchases made using a BNPL loan.

CFPB Director Rohit Chopra. (Andrew Harrer/Bloomberg via Getty Images / Getty Images)

"When consumers check out and choose Buy Now, Pay Later, they don’t know if they will get a refund if they return their product or whether the lender will help them if they didn’t get what was promised," CFPB Director Rohit Chopra said in a statement. "Regardless of whether a shopper swipes a credit card or uses Buy Now, Pay Later, they are entitled to important consumer protections under longstanding laws and regulations already on the books."

VISA CHANGES COMING THIS YEAR WILL MEAN FEWER CARDS FOR AMERICANS

The CFPB has been looking to crack down on BNPL lenders for years. The agency, which aims to ensure lenders treat borrowers fairly, opened a probe into major BNPL lenders like PayPal and Klarna in 2021 due to concerns over consumers accumulating debt and managing payments through frequent use of "buy now, pay later" options, which allow borrowers to break purchase payments into installments.

The Consumer Financial Protection Bureau said Wednesday it will be imposing tighter rules on BNPL lenders. (REUTERS/Andrew Kelly / Reuters)

The CFPB said Wednesday that their investigation found customers disputed or returned $1.8 billion in transactions in 2021 at the five firms the agency investigated.

Most major BNPL providers already voluntarily comply with credit card-like protections, but the new rule should offer consistency across the sector, a CFPB official told reporters.

CREDIT CARD DEBT IS SURGING AS AVERAGE AMERICAN OWNS $6,218

The rule will only apply to the popular "pay in four" installment product, the official said. And BNPL providers will not be required to comply with some other credit card rules, such as assessing a consumer's ability to repay, the agency said.

BNPL providers will not be required to comply with some other credit card rules, such as assessing a consumer's ability to repay, the CFPB said. (Reuters/Rachel Wisniewski)

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AFRM | AFFIRM HOLDINGS INC. | 57.03 | -2.39 | -4.02% |

| PYPL | PAYPAL HOLDINGS INC. | 40.42 | +0.52 | +1.30% |

BNPL loans drove $75 billion in online spending in 2023, up 14.3% from 2022, according to Adobe Analytics.

According to a 2022 CFPB report, consumers often use BNPL as a substitute for conventional credit cards, but consumer protection disclosures vary across major providers, and the loans can lead consumers to become over-indebted.

The Financial Technology Association, a trade group representing some BNPL lenders, issued a statement in response to the CFPB's move, disagreeing with the agency's determination that BNPL lenders are credit card providers.

"FTA member companies are committed to strong consumer protections, including for disputes and refunds, and agree these protections should be applied consistently across the industry and to those companies claiming to offer Buy Now Pay Later-like services," said Penny Lee, President and CEO of the Financial Technology Association. "BNPL products are fundamentally different from credit cards: these products have zero interest on outstanding balances, no ability to revolve a balance, and a profit model centered on user success. We look forward to providing additional comments to the CFPB and distinguishing BNPL from products whose business models rely on revolving debt and high consumer fees."

GET FOX BUSINESS ON THE GO BY CLICKING HERE

A Klarna spokesperson told FOX Business that the CFPB's move is "a significant step forward in regulating BNPL, which Klarna has actively called for over many years."

"[I]t is baffling that the CFPB has overlooked the fundamental differences between interest-free BNPL and credit cards, whose whole business model is based on trapping customers into a cycle of paying sky-high interest rates month after month," the spokesperson added.

Affirm, another major BNPL firm, also praised the CFPB's action.

"We are encouraged that the CFPB is promoting consistent industry standards, many of which already reflect how Affirm operates, to provide greater choice and transparency for consumers," an Affirm spokesperson said in a statement, noting that the company already offers "dispute and resolution assistance."

"We urge other companies that offer buy now, pay later products to live up to the industry’s promise to provide consumers with a more flexible and transparent alternative to other payment options," the Affirm spokesperson went on to say, adding the company is "committed to continuing to engage with the CFPB as we constantly improve the experience and value we deliver to consumers, as well as our practices."

FOX Business reached out to PayPal for comment.

The interpretive rule is open to comments until Aug. 1 and will be effective in 60 days, a CFPB official said.

Reuters contributed to this report.