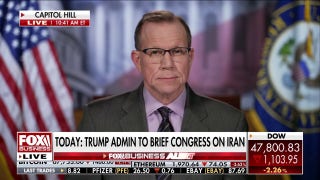

Dick Bove: Fannie Mae, Freddie Mac Need to Leave Govt. ASAP

The Trump Administration’s plan to privatize Fannie Mae and Freddie Mac is gaining momentum and banking analyst Dick Bove, of Rafferty Capital, is urging the President-elect to move quickly because he feels the two entities are in trouble.

“They’re [Fannie and Freddie] acknowledging that they’re going to have negative capital and that’s going to create a crisis,” he said. “Second, they’ve gone back to the policies that Cuomo and Clinton had in place, which put them into trouble in the first place. They’re buying mortgages for down payments of only 3% down. They’re putting money into trust funds which are basically being used to fund subprime mortgages,” he said.

Steve Mnuchin, Trump’s pick for Treasury Secretary, is promising to move quickly on the plan which he disclosed last week during an appearance on FOX Business Network’s Mornings With Maria. “It makes no sense that these are owned by the government and have been controlled by the government for as long as they have,” he said.

Privatizing the two is doable according to Bove because the companies are still capable of making money. However, one big problem, he added, is “no one understands” what they do.

“These companies are no longer mortgage banks that basically buy mortgages and put them onto their portfolios,” Bove said. “In 2012 the Treasury told them they had to stop doing that and they have stopped doing that and they’re getting rid of that portfolio. What they are is an insurance company. They are insuring mortgages against loss for the people who ultimately own them.”

If the new administration cannot act fast, Bove predicts the U.S. could be facing a crisis similar to 2008.

“By this summer we’re going to have a massive housing financial crisis again if Fannie and Freddie are not taken out of the government,” he said.