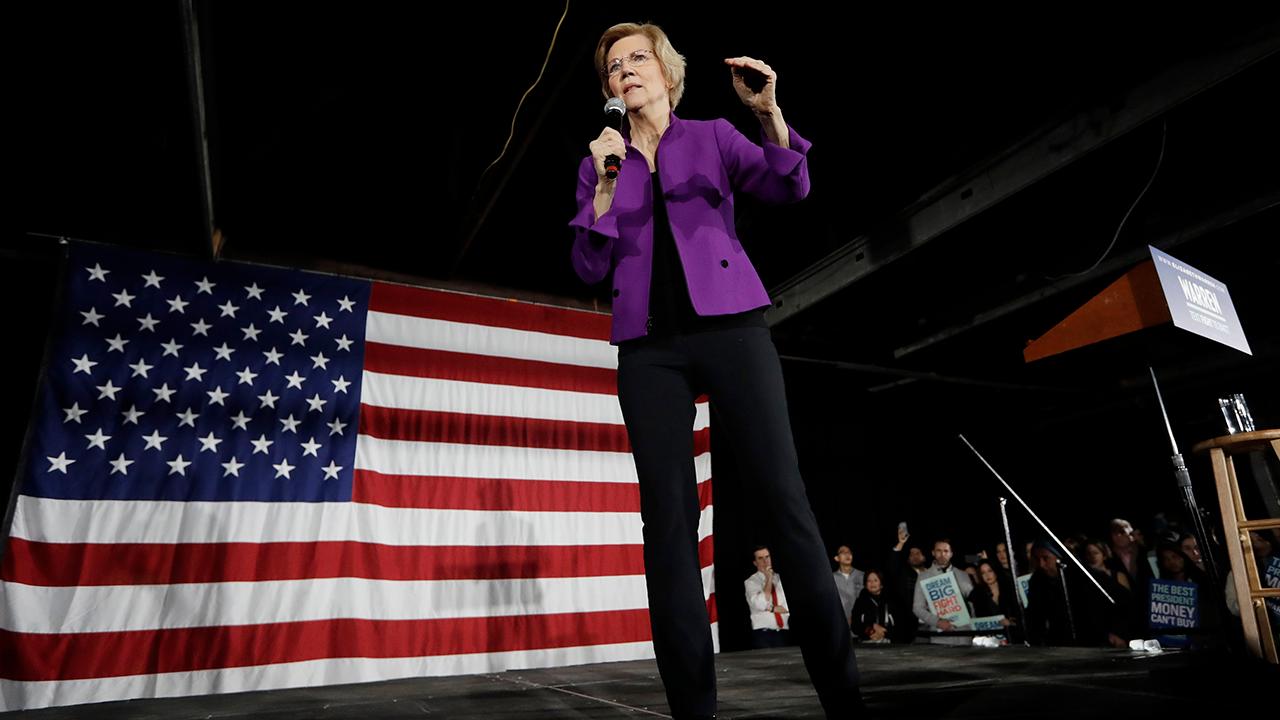

Elizabeth Warren, Ocasio-Cortez among Dems targeting complicated tax filing process

After New York Democratic Rep. Alexandria Ocasio-Cortez recently made headlines for her comments on the tax filing process, a group of Democratic senators, led by Elizabeth Warren, introduced legislation designed to ease the cost and time burdens associated with filing.

Called the Tax Filing Simplification Act, the bill aims to streamline the filing process for those with relatively simple tax situations.

Provisions include one that would direct the IRS to develop its own free, tax preparation and filing service, something that would be banned by an IRS reform bill currently advancing through Congress. Under Warren's proposed legislation, the IRS would be prohibited from entering agreements that restrict its ability to develop those services.

Additionally, taxpayers could choose a “return-free option,” whereby they would be provided a pre-prepared return. For those who still want to fill out their own forms, lawmakers are seeking to allow taxpayers to download third-party tax information that the IRS already has on file into a software program of their choosing.

Lawmakers also want more lower-income Americans to receive the tax credits they are eligible for, including the Earned Income Tax Credit.

Finally, the bill seeks to limit tax-related fraud by requiring third-party income information to be submitted to the IRS earlier in tax season and by beefing up other verification processes.

According to the bill’s sponsors, which include Independent Vermont Sen. Bernie Sanders and New Jersey Sen. Cory Booker – two other 2020 Democratic hopefuls – Americans spent an average 11 hours and $200 preparing their tax returns last year.

Warren first introduced a version of the legislation in 2016.

CLICK HERE TO GET THE FOX BUSINESS APP

A House version of the bill is expected to be introduced as well, with Ocasio-Cortez as a sponsor.

Ocasio-Cortez recently suggested that the IRS should file taxes on behalf of Americans with simple financial situations. “Long-term, we should be looking at a solution where everyday people do not necessarily have to spend hours every year preparing tax returns, when the majority of Americans have relatively simple and straight-forward returns," she said.