Ethics watchdog group seeks probes into oversight of officials’ stock-trading conflicts

Campaign Legal Center files complaints with federal agencies following WSJ series

Charles Payne: This is the essence of insider trading

FOX Business host Charles Payne weighs in on if Congress should be trading the stock market on 'Making Money.'

A nonpartisan group that monitors government ethics filed a series of legal complaints alleging the federal government is failing to adequately enforce conflict-of-interest rules.

The Campaign Legal Center called on the executive-branch agency that oversees ethics rules to investigate what it called deficiencies in enforcement at several agencies. The group also requested that internal investigators at four federal agencies examine whether their ethics programs complied with federal rules.

The legal filings were prompted by a series of articles in The Wall Street Journal revealing that thousands of federal employees at 50 federal agencies held stock in companies that were regulated by the agencies where those employees worked.

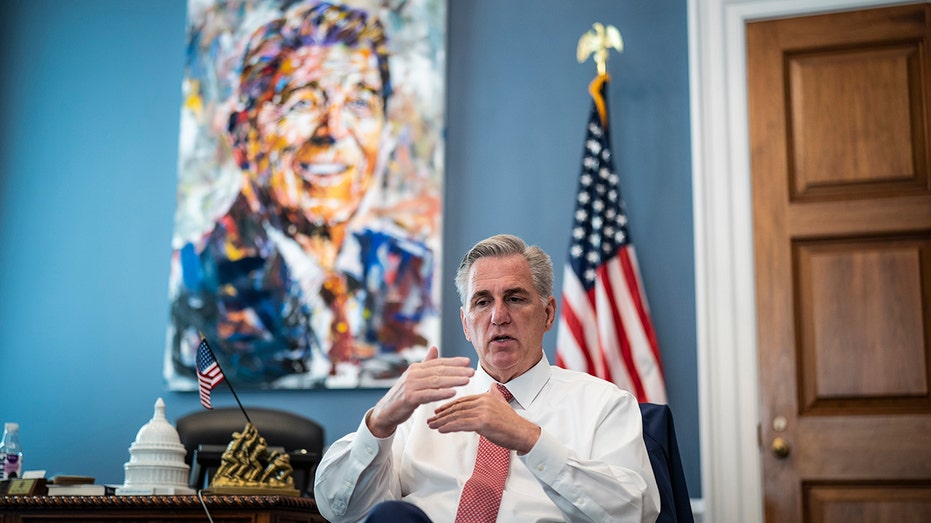

House Minority leader Kevin McCarthy, R-Calif., meets in his office with former House Speaker Newt Gingrich, and Kellyanne Conway, former Trump White House advisor, moments before heading to speak, share experiences and offer advice to members of the ((Photo by Jabin Botsford/The Washington Post via Getty Images) / Getty Images)

The agencies "have repeatedly allowed senior officials to own and trade stock in companies that appear to create conflicts of interest with their official duties," the complaint said. "An investigation can determine whether the scope and severity of deficiencies in the ethics programs’ guidance on financial conflicts of interest is greater than currently publicly known."

GOVERNMENT OFFICIALS INVEST IN COMPANIES THEIR AGENCIES OVERSEE

Separately, some lawmakers on Capitol Hill say that changes in the political landscape in Washington could make it more likely that Congress takes up legislation next year to overhaul the government’s rules regarding stock ownership by federal officials.

Rep. Kevin McCarthy of California, the Republican lawmaker who is the front-runner to serve as House speaker, is considering a sweeping ethics-reform package aimed at restoring public trust in the government, an aide told the Journal.

The Department of the Treasury building is seen in Washington, DC, on August 29, 2022. Efforts to pass a stock-trading ban on lawmakers and federal employees—which has broad public support—briefly gained momentum this fall before stalling out. (Photo ((Photo by DANIEL SLIM/AFP via Getty Images) / Getty Images)

Under consideration is legislation to ban or restrict members of Congress and senior executive branch employees from owning or trading stock, the aide said. Earlier this year, Mr. McCarthy said that if Republicans took control of the House, he would consider prohibiting lawmakers from holding or trading stocks. He didn’t support any Democratic bills proposing such a ban.

The Campaign Legal Center filed complaints with the inspectors general for the Environmental Protection Agency, Defense Department, Federal Trade Commission and Health and Human Services Department, in addition to the Office of Government Ethics.

HOW FTX BOUGHT ITS WAY TO BECOME THE 'MOST REGULATED' CRYPTO EXCHANGE

Among the examples the group cited from the Journal’s reporting was an EPA official who reported owning oil and gas stocks with his husband; a defense official who traded stock in a Chinese company while the agency deliberated over whether to add the company to a blacklist; and an FTC official who traded stock in Facebook, now Meta Platforms Inc., while his office coordinated an investigation involving the company.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| META | META PLATFORMS INC. | 677.22 | +15.76 | +2.38% |

"The public has a right to know that the officials tasked with protecting the security of our country are always acting in the public’s interest, not in their own private financial interest," said the complaint filed with the Defense Department.

CAMPAIGN LEGAL CENTER’S COMPLAINTS

- Letter to U.S. Office of Government Ethics

- Letter Regarding the Department of Health and Human Services

- Letter Regarding the Federal Trade Commission

- Letter Regarding the Environmental Protection Agency

- Letter Regarding the Defense Department

The EPA official said he and his husband didn’t know about or direct trades in oil-and-gas companies, which were made by a financial adviser. The defense official said he wasn’t involved in blacklist discussions at the time his trades were made. The FTC official said a financial adviser handled his trading.

Some agencies defended their ethics programs. The Defense Department said it has "extensive guidance" on implementing ethics laws and regulations and said the Office of Government Ethics conducts detailed reviews each year of its ethics program.

An FTC spokesman said the agency refers possible ethics violations to the inspector general for investigation. The EPA has said officials are allowed to invest in energy companies so long as they aren’t working on policies that could affect their investments. HHS didn’t respond to questions about its ethics programs.

Efforts to pass a stock-trading ban—which has broad public support—briefly gained momentum this fall before stalling out.

House Democratic Caucus Chair Rep. Hakeem Jeffries (D-NY) talks to reporters following the weekly Democratic Caucus meeting in the U.S. Capitol Visitors Center on June 29, 2021 in Washington, DC. (Photo by Chip Somodevilla/Getty Images) (Chip Somodevilla/Getty Images / Getty Images)

Rep. Hakeem Jeffries (D., N.Y.), the top contender to succeed California Rep. Nancy Pelosi as the top Democrat in the House, in September said he supported efforts to restrict stock trading, although he pushed back on criticism that Democrats were moving too slowly on the measure.

Now, some on Capitol Hill believe the Republican takeover of the House could breathe new life into those efforts, although they also will face steep odds in the Senate.

Any effort aimed at strengthening executive-branch ethics rules could gain support among Republicans because President Biden oversees much of the executive branch. The Journal found that conflicts pervaded across three administrations, both Democrat and Republican.

Republican control of the House "creates an opportunity" for approving a stock ban, because the GOP’s slim majority will necessitate bipartisan cooperation, said Nick Zeller, a spokesman for Rep. Jared Golden (D., Maine), an author of such a bill.

Mr. Golden and Rep. Michael Cloud (R., Texas) hope to advance a bipartisan bill they introduced in August that would prohibit senior executive branch officials from owning and trading stock and encourage lawmakers to hold their investments in blind trusts.

RETIRING LAWMAKERS LINING UP LOBBYING GIGS IN WASHINGTON: 'IT'S THAT TIME OF YEAR'

Mr. Cloud said he plans to make the bill a priority next year. "As a senior member of the House Oversight Committee, a key focus of mine will be to work with both sides of the aisle to advocate for my bipartisan DIVEST Act to put an end to the decadeslong abuse senior level bureaucrats have gotten used to," he said Monday in a statement to the Journal.

In October, in response to the Journal’s reporting, Rep. David Schweikert (R., Ariz.) introduced a similar bill banning lawmakers and federal employees from individual stock-trading. He said he has had running conversations with GOP leadership on ethics issues and expects them to gain greater traction next year.

Mr. Schweikert said in an interview that he has long supported a ban on lawmaker stock trading but that he hadn’t "given deep thought to the scale at which this sort of thing could be going on in the regulatory state." After reading the Journal’s stories, he said he realized, "This is a big problem."

Senator Elizabeth Warren, D-MA, speaks during a Senate Finance Committee hearing in the Dirksen Senate Office Building on Capitol Hill October 19, 2021 in Washington, DC. (Photo by Mandel Ngan-Pool/Getty Images) (Photo by Mandel Ngan-Pool/Getty Images / Getty Images)

In the Senate, Sen. Elizabeth Warren (D., Mass.) has introduced a set of government reform measures, including one that has won support from Republican Sen. Marsha Blackburn of Tennessee.

"I am committed to working with Republicans and Democrats to finally ban this alarming practice, end the stock trading, and start restoring trust," Ms. Warren said in a statement to The Journal.

In a separate statement, Ms. Blackburn said: "It is extremely concerning that federal employees are trading stocks in the same sectors they are involved in regulating."

Ms. Blackburn added that "Congress would be well suited to closely examine any potential conflicts of interest in the executive branch."

CLICK HERE TO GET THE FOX BUSINESS APP

A White House official declined to say whether Mr. Biden would support restrictions on lawmakers’ and executive-branch officials’ stock investments.

Joe Palazzolo and James V. Grimaldi contributed to this article.