FTX collapse where people lost billions has 'silver lining,' O'Leary says: Industry is 'culling its herd'

O'Leary remains a defended of cryptocurrency

FTX collapse where people lost billions has 'silver lining,' O'Leary says: Industry is 'culling its herd'

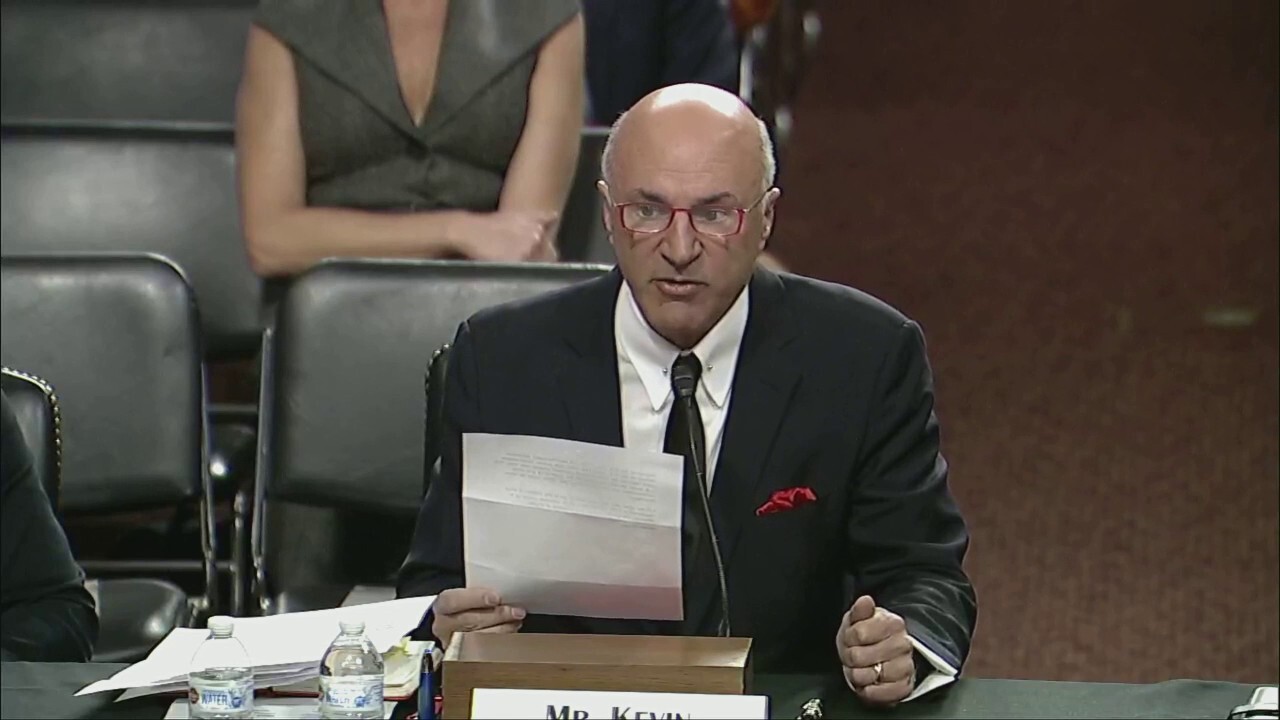

Media personality Kevin O'Leary testified Wednesday that the collapse of cryptocurrency firm FTX has a "silver lining," that the industry is "culling its herd.

FTX paid spokesman Kevin O’Leary did not defend the company in the wake of its collapse, but at a Senate Banking Committee hearing on Wednesday, he claimed that the fate of the firm and co-founder Samuel Bankman-Fried is ultimately a positive for the industry.

O’Leary, who is also a private equity and venture investor, argued that even though he lost millions, the FTX scandal has no bearing on the future of cryptocurrency.

"In fact, the recent collapse of crypto companies has a silver lining," O’Leary claimed. "This nascent industry is culling its herd. Going or gone are the inexperienced or incompetent managers, weak business models and rogue unregulated operators. Hopefully, these highly publicized events will put renewed focus on implementing domestic regulation that has been stalled for years."

O’Leary said that Congress needs to act and put such regulations in place. He lamented that the U.S. is "falling behind and losing our leadership position" in the world when it comes to crypto, while other places have adopted regulations "and are now attracting both investment capital and highly skilled talent."

FTX collapse has 'reverberated throughout crypto': Pete Hegseth

'Fox & Friends Weekend' co-host Pete Hegseth explains how FTX's bankruptcy has impacted his cryptocurrency investments, and previews Fox Nation's fourth annual Patriot Awards.

The former spokesperson said that in $18 million of compensation, $10 million was in "tokens held in FTX wallets," and another $1 million was FTX equity. Now, he says the equity is "most likely worthless" and as for the accounts containing the tokens, he says he has "written them off to zero." Despite this, he said that the company’s fall "is nothing new" and does not reflect on cryptocurrency itself.

The crypto word is about decentralization: SEC commissioner Hester Peirce

SEC commissioner Hester Peirce reacts to the collapse of FTX on 'Kudlow.'

"While this situation is painful for shareholders, employees and account holders, in the long run, it does not change this industry’s promise," he said. "Enron came and went and had no impact on the energy markets. Bear Stearns' and Lehman Brothers' demise had no impact on the long-term potential of American debt and equity markets."

WHERE DID THE MONEY GO IN FTX CRYPTO COLLAPSE?

Sam Bankman-Fried, founder and chief executive officer of FTX Cryptocurrency Derivatives Exchange, during an interview on an episode of Bloomberg Wealth with David Rubenstein in New York, US, on Wednesday, Aug 17, 2022. (Jeenah Moon/Bloomberg via Get (Jeenah Moon/Bloomberg via Getty Images / Getty Images)

O’Leary said he understands why some are skeptical about cryptocurrency technology and would like to see it banned, but he insisted that it is "absolutely necessary" for economic advancement.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"[W]e need to get to the bottom of what happened at FTX, but we can’t let its collapse cause us to abandon the great promise and potential of crypto," he said.