FTX House hearing: What to expect

Disgraced founder Sam Bankman-Fried has been arrested, and current CEO John Ray III is slated to testify

Is Sam Bankman-Fried going to jail for FTX meltdown?

Former U.S. Justice Department fraud section federal prosecutor David Maria discusses the legal consequences of Sam Bankman-Fried's alleged fraud on 'Cavuto: Coast to Coast.'

New details in the collapse of cryptocurrency exchange FTX are expected to be revealed Tuesday on Capitol Hill, with lawmakers on the warpath to hold founder Sam Bankman-Fried and others accountable after the firm lost billions of dollars of customers' funds.

Bankman-Fried had agreed to testify remotely before the House Financial Services Committee led by Chairwoman Maxine Waters, but was arrested in the Bahamas on Monday evening. Authorities there released a statement saying the U.S. filed charges against the disgraced founder and is likely to request extradition.

Representative Maxine Waters, a Democrat from California and chairwoman of the House Financial Services Committee, during a hearing in Washington, D.C., US, on Wednesday, Sept. 21, 2022. (Al Drago/Bloomberg via Getty Images / Getty Images)

The U.S. Attorney for the Southern District of New York, Damian Williams, followed up with a statement saying his office expects "to move to unseal the indictment in the morning and will have more to say at that time."

While Bankman-Fried is unlikely to be present at the House hearing given his arrest, the committee pre-released the written testimony of current FTX CEO John Ray III, which provides insight into what will likely be discussed.

Ray – who took over following Bankman-Fried's resignation and has handled several major corporate collapses including Enron – said in his testimony to the committee that nearly all the cases he has handled alleging criminal activity "share common characteristics," but "never in my career have I seen such an utter failure of corporate controls at every level of an organization, from the lack of financial statements to a complete failure of any internal controls or governance whatsoever."

John Ray, chief executive officer of FTX cryptocurrency exchange, arrives at bankruptcy court in Wilmington, Delaware, US, on Tuesday, Nov. 22, 2022. (Photographer: Eric Lee/Bloomberg via Getty Images / Getty Images)

The new FTX CEO said his investigation is still ongoing but has found several "unacceptable management practices" so far that the "very small group of grossly inexperienced and unsophisticated individuals" running the exchange engaged in.

The seasoned restructuring officer wrote that senior FTX management had access to customer assets they were able to redirect, held hundreds of millions of dollars of crypto access absent of security controls or encryption, and pointed to "[the] absence of audited or reliable financial statements."

ACCOUNTING RED FLAGS ARE COMMON AMONG PUBLIC CRYPTO COMPANIES

Ray acknowledged that his new leadership team has been in close contact with U.S. authorities and lawmakers and that questions remain regarding what happened with FTX and its crypto hedge fund, Alameda. However, he said that what they know already is that FTX was gambling with customer assets by commingling them with Alameda's and engaging in margin trading.

Further, Ray revealed, the FTX group went on what he called "a spending binge" in late 2021 through this year shelling out roughly $5 billion on an array of business and investments that "may be worth only a fraction of what was paid for them." He also wrote that "loans and other payments were made to insiders in excess of $1 billion."

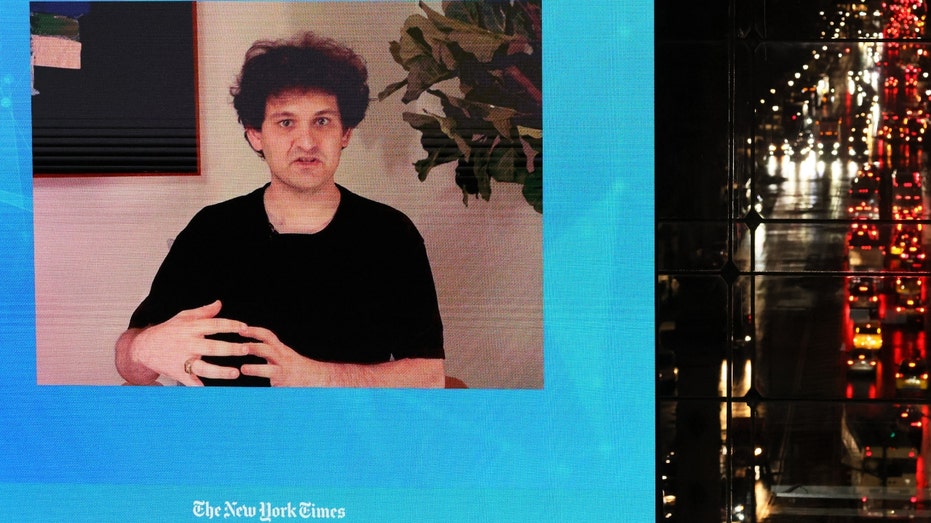

NEW YORK, NEW YORK - NOVEMBER 30: FTX founder Sam Bankman-Fried speaks during the New York Times DealBook Summit in the Appel Room at the Jazz At Lincoln Center on November 30, 2022, in New York City. ((Photo by Michael M. Santiago/Getty Images) / Getty Images)

Bankman-Fried has been on a media blitz for weeks seeking favorable coverage since his company's downfall, angering investors who are demanding accountability not only from the former FTX CEO – but members of Congress and celebrities who accepted money from his apparent house of cards.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

For the time being, he will likely be speaking through his attorneys, who purportedly refused to cooperate when the Senate Banking Committee requested his appearance this week, too.