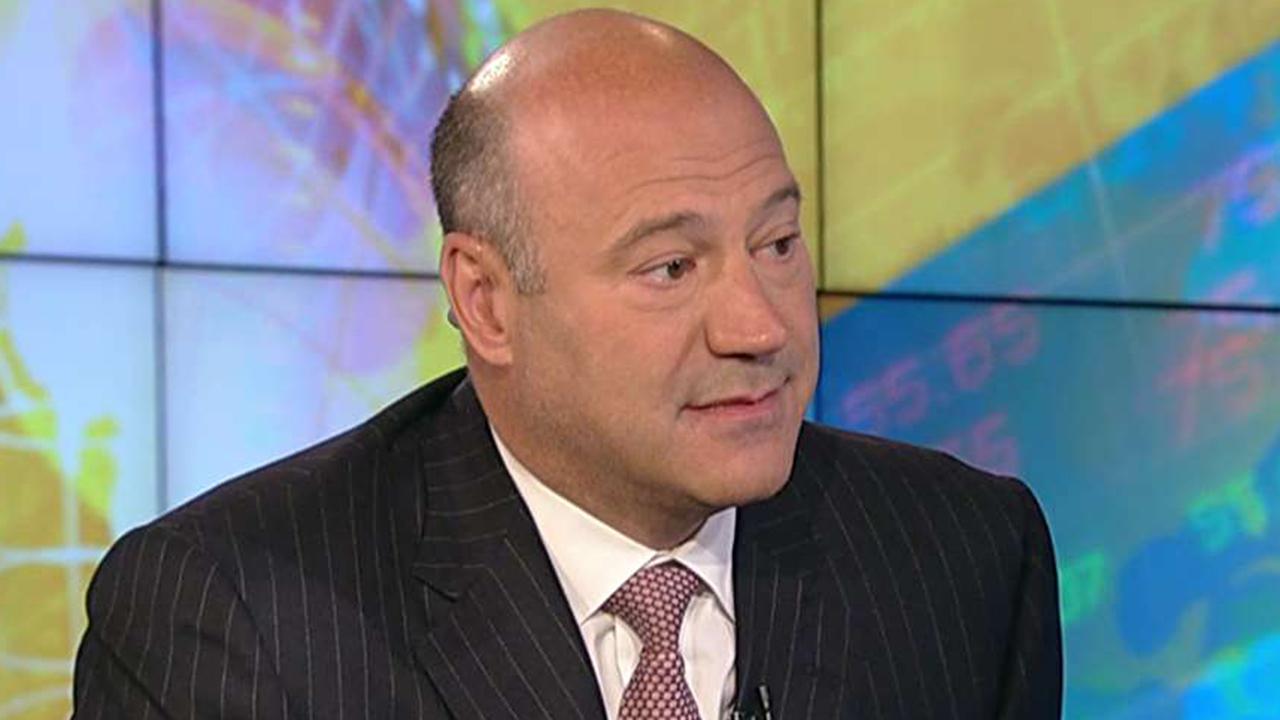

Gary Cohn breaks down the details of Trump's tax reform framework

Chief White House economic adviser Gary Cohn discussed details of the recently-announced Republican tax reform framework Sunday during an exclusive interview on “Sunday Morning Futures.”

Cohn, who serves as the director of the National Economic Council, explained the repatriation tax rate and how it will impact companies and the U.S. economy.

“They’re going to pay the rate if they have money overseas. That’s how we catch up from the ‘worldwide system’ to the ‘territorial system,’” Cohn told Maria Bartiromo on “Sunday Morning Futures.”

Currently, under the worldwide system companies are taxed 35 percent on all income, whether it is earned in the U.S. or overseas. Moving to a territorial system would then encourage some of the profits overseas—which could be as much as $3 trillion, according to Cohn—to return to the U.S.

“We will end up with a bifurcated rate,” he explained. “We will charge you one rate if you have liquid assets offshore. We will charge you a different rate if you’ve got bricks-and-mortar and you’ve turned those earnings into bricks-and-mortar or investments offshore. We will give you some period of time to pay it, but you will incur the tax liability the minute the tax referendum goes through.”

President Donald Trump pushed for a 15 percent corporate tax rate, though settled for 20 percent, still significantly lower than the present rate. Trump’s tax plan calls for reducing the number of tax brackets for individuals from seven to three.

“What people are forgetting is we really enlarged the zero rate. We doubled the zero rate so if you're a family today, you now get the first $24,000 of your income at a zero rate. You then kick into the 12 percent rate, then you go to the 25 percent rate, then you go to the 35 percent rate,” Cohn said.

In addition to lessening the amount of tax brackets on the individual side, the tax plan would also eliminate the estate tax—also known as the “death tax”—which Cohn said has been most burdensome on farmers and small businesses.

“Death should not become a taxable event if you’re in a small business. Death should not become a taxable event if you’re a farmer. If you’re a farmer you should be able to pass it on to your families,” he said.

As for the timing of the GOP’s plan for a business and middle-class friendly tax overhaul, Cohn said it is now in the hands of tax writers in the House and Senate and hopes to have a bill done “in this calendar year.”

“To do that we’ve got to get out of the House relatively soon,” he said. “To get out of the House we’re going to have to have real details. This bill is going to be in markup hopefully in October.”