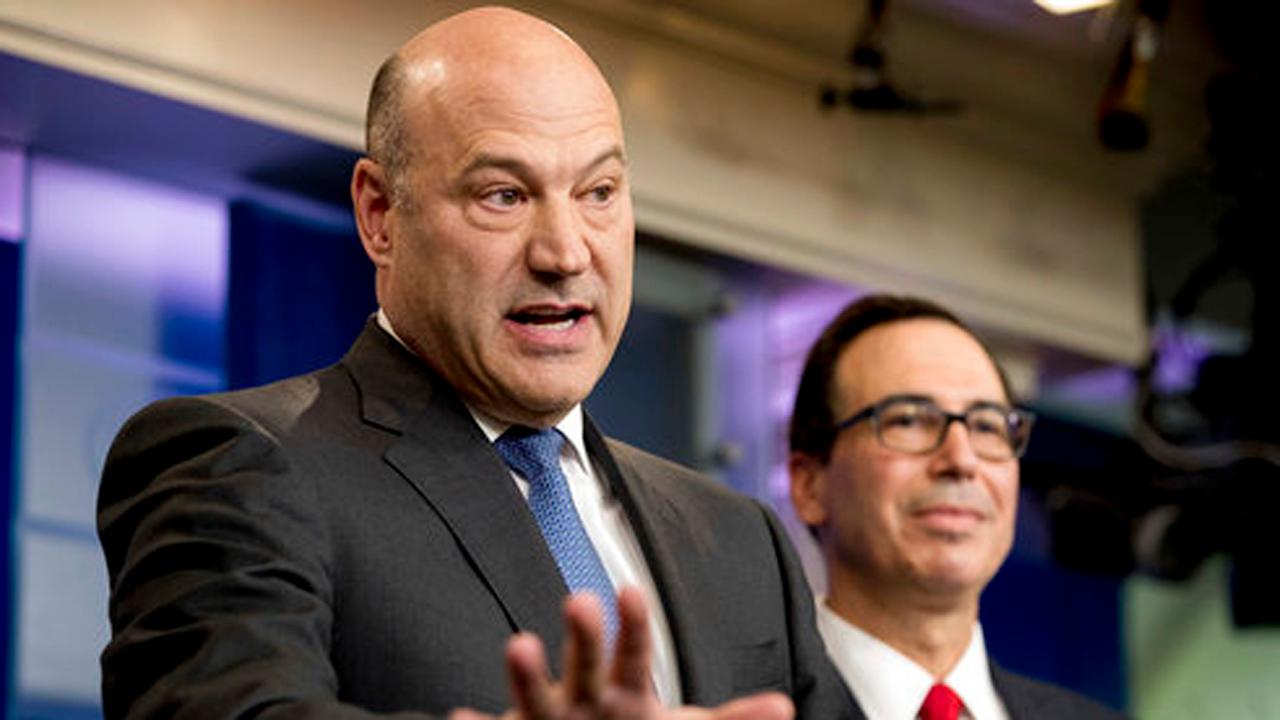

Gary Cohn: Tax Plan Will Offer CEOs One Time Incentive to Bring Cash Back to U.S.A.

The Trump administration is ready to dangle a carrot in front of America’s most powerful CEOs who are holding mounds of cash in offshore accounts.

“We’re going to have a big, one-time incentive rate to get a lot of the money offshore, you know, we know there’s trillions of dollars offshore, we want to get that back into America.”

Otherwise, Cohn, says, that money will get invested elsewhere, telling Payne, “We know if we don’t incentivize people to bring that money back it will get invested overseas, we’ve seen it. The history tells us exactly what’s going to happen.”

As it stands now, CEOs are fed up with too much red tape.

“Industry wants to do things in this country, they want to invest, they want to invest capital, they want to hire people as you see in the jobs report, but they can’t because the regulatory process is just too difficult, so they go to other countries where the regulatory process is easier and the tax rate is lower. We need to fix both of those” said Cohn.

Cohn explained that along with that one-time offer, the administration is also working on a long-term solution to make it easier for companies to shift their funds around.

“Over time we are going to a territorial system that will deal with a lot of these issues and will allow companies to move their capital around as they want to.”

When Payne asked if there were any strings attached for companies to take advantage of the one-time tax incentive, Cohn said they haven’t figured out the details yet, “but my initial thought is they’re going to pay tax on that, we may turn around and take that tax and put it in the infrastructure.”

According to Cohn the goal is to get money funneled directly into the hands of corporate decision makers.

“We want the companies to bring the money back and put it back into the economy, we want them to create jobs, we want them to make the lives of every hard-working American better by creating higher-paying jobs in America.”