GOP tax plan gets reworked, SALT on front lines as deadline looms

GOP leaders are signaling they’re ready to negotiate in order to pass tax reform as it comes down to the wire.

The House Ways and Means Committee said it plans on “restoring an itemized property tax deduction to help taxpayers with local tax burdens,” according to a statement on Saturday. This concession is aimed at appeasing lawmakers in high-tax states such as New York and New Jersey who oppose eliminating deductions for state and local taxes (SALT).

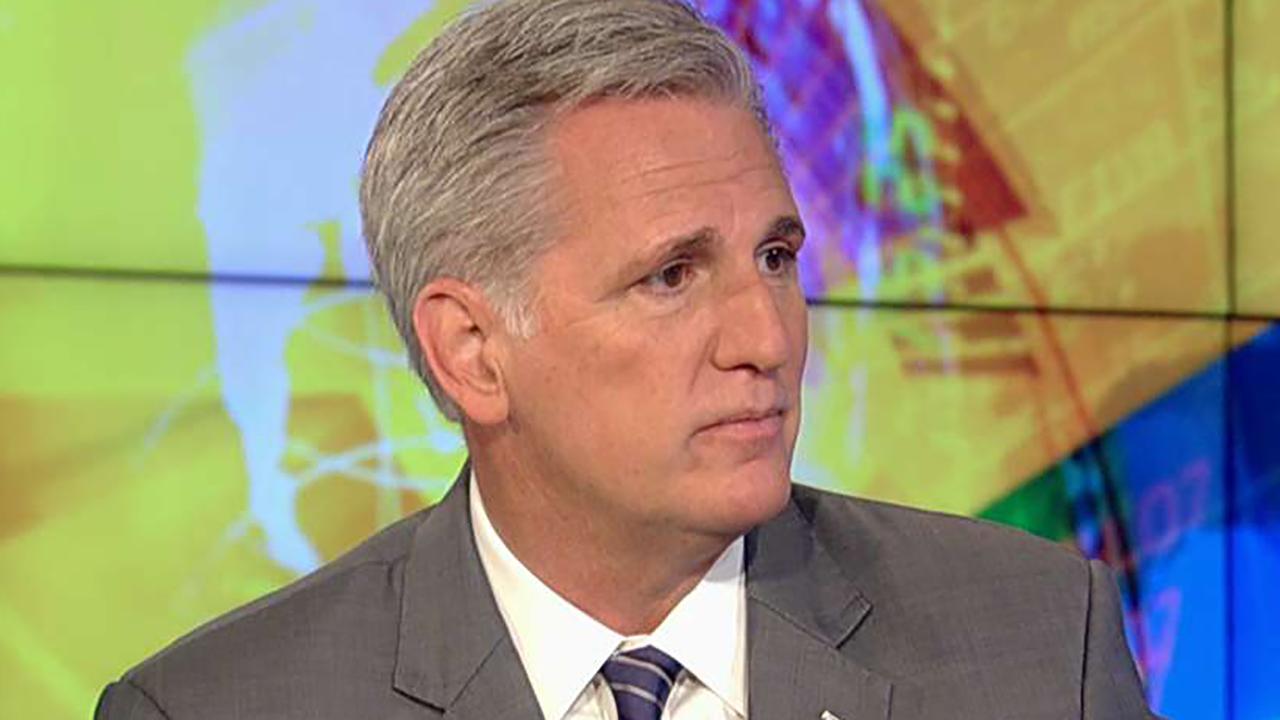

“If you double the standard deduction, if you lower the rates and you eliminate AMT [alternative minimum tax], if people look at the overall tax plan and they live in those [high-tax] states, they’re going to like the final outcome of what it deals with,” said House Majority Leader Kevin McCarthy, R-Calif., during an interview on Fox’s “Sunday Morning Futures”. “If you eliminate the AMT that really offsets what people are doing when it comes to SALT,” he added.

It is unclear if this will be enough for lawmakers such as Rep. Peter King, R-NY,. fighting to keep SALT intact with the threat of opposing the final plan.

“I would say the entire package right now, I am certaintly not on board, this involves the future of my district for years to come”, Rep. Peter King, R-N.Y., told Maria Bartiromo on “Sunday Morning Futures”.

King also blasted the GOP for last minute changes to the plan.

“The fact they we’re getting it at the 11th hour raises real issues with me,” said King, noting that he plans to have the final plan analyzed to ensure it benefits his district.

The House Ways and Means Committee is expected to release its tax reform plan on Wednesday. This comes after the budget bill passed through the House in a 216-212 vote last Thursday, paving way for the GOP to pass its tax plan without help from Democrats. However, 20 Republican lawmakers, including King, were part of the “no” vote, many from high-tax states such as New York and New Jersey whose residents would be severely impacted if the deduction for state and local taxes (SALT) were to be eliminated.

Under the GOP’s plan, married couples filing jointly would be able to receive their first $24,000 tax-free, up from the current $12,700 by using the standard deduction.

“If I go from giving the first $12,000 tax-free to $24,000, that helps me save to buy a new home. That helps me determine whether I want to send my kids to private schools and others,” McCarthy said. “And then I’d lower the rate you’re paying from 10% to zero, from 15 to 12 so I’m keeping more of my own money. So it offsets any difference when it comes in SALT and actually lets me keep more and grow the economy.”