GPD will grow under the Senate tax reform plan: Rep. David Schweikert

Rep. David Schweikert (R-Ariz.) on Wednesday said that the Senate tax reform plan is needed in order to help grow the economy and support future retirees.

“If we get what the modelling tells us, the additional economic expansion that this tax plan does, it’s great for everyone. It’s great for the workers, it’s great for the businesses but also great for our future retirees and people who are going to receive the benefits that they’ve earned, there is just no money in the bank to pay,” he told FOX Business’ Charles Payne on “Making Money with Charles Payne.”

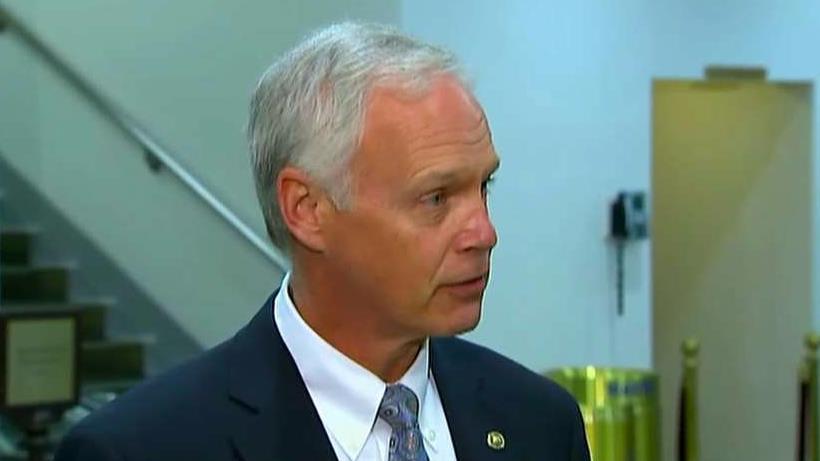

Sen. Ron Johnson (R-Wis.) has become the first Republican Senator to publicly declare that he will not support the tax legislation, claiming that the plan in its current form will benefit corporations more than any other types of businesses.

“If they (Senators) were to take one step backward and understand that supporting the status quo, the path we’re on right now in little over a decade, we hit the wall as a country. The number of entitlements that we have to finance, the lack of economic growth, the math just hits a crisis. Our only solution is a tax policy and series of other things that grow the GDP,” Schweikert said.

Schweikert also discussed how much revenue the tax plan is estimated to bring into the government.

“The Tax Foundation says this plan brings in another trillion dollars of revenue and almost another $300 billion in additional FICA tax and that growth of the GDP and the economy is the trajectory we need if we are just going to even keep our promises to those seniors who are moving into retirement years,” he said.

One criticism of both the House and Senate tax plans is the proposed elimination of the state and local tax deductions, which lawmakers from many high-tax states like New York, California and Illinois believe it will force their residents to actually be taxed more, despite lowering the federal tax rates.

Schweikert said that high taxed states should reevaluate their spending habits.

“When you actually take a look at spending in a tax code and that’s what some of this is. They are spending that is great politics that gets you reelected and then there is spending that grows the economy, that ends up being good for all of society. I want to focus on those things that are actually great for everyone instead of just financing out areas that have functionally spent themselves into oblivion,” he said.