Home Ownership: The American Dream Taking a Hit

The American Dream is becoming a nightmare for many current house hunters across the country, especially those ready to take the plunge for the first time.

“Housing affordability is worsening,” Lawrence Yun, chief economist at the National Association of Realtors, tells FOX Business. “Home values are rising twice as fast as wage growth.”

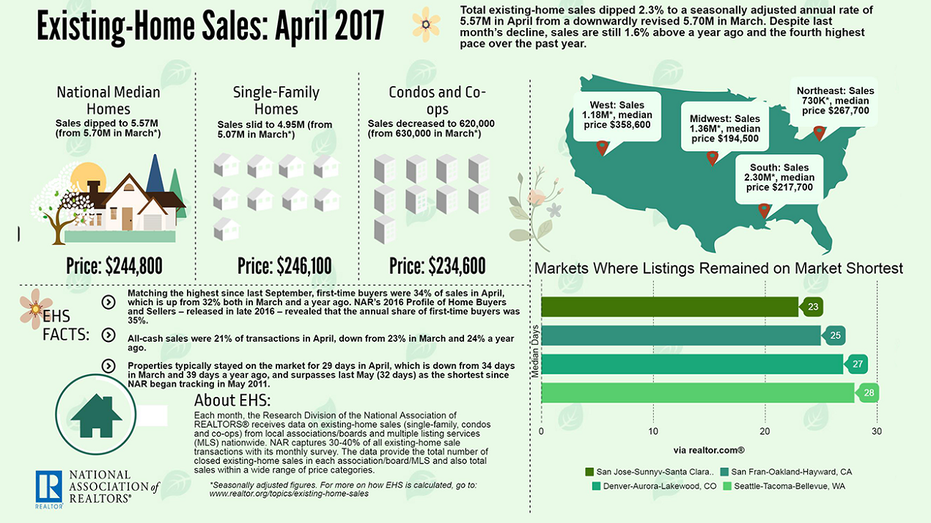

It’s called a seller’s market, ie prices are spiking because there are more buyers than homes on the market. Inventories are 9% lower than a year-ago, despite seeing a 7.2% rise in April, according to NAR. This as prices ticked up for the 62nd straight month. The average-median home price - $244,800 – costs 6% more than a year-ago.

While this is good news for home owners, many would-be home buyers are getting shut out. Home affordability, as tracked by NAR, has declined across the nation with housing in the south and west regions the hardest hit at 10% less affordable than a year-ago. A deeper dive shows Kankakee, IL among the least affordable metro markets, while Atlantic City, NJ is among the most affordable.

Fewer choices dented home sales in April. Sales of existing homes fell by 2.3 percent to a seasonally adjusted annual rate of 5.57 million, as tracked by NAR. At the same time sales of new homes also took a beating, falling more than 11% at a seasonally adjusted annual rate of 569,000, according to the Commerce Department.

Along with fewer choices, the pressure is on for many home buyers racing to lock historically low mortgage rates, ahead of the Federal Reserve’s mandate to gradually raise interest rates this year. The average rate for a 30-year fixed mortgage fell to 3.95% this week as reported by Freddie Mac.

While certain home buyers are taking a hit, the environment is gold for select home builders. Earlier this week Toll Brothers (NYSE:TOL), which specializes in luxury homes, reported a 40% jump in profits, its best spring in a decade.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| XLB | MATERIALS SELECT SECTOR SPDR ETF | 52.84 | -0.18 | -0.34% |

| TOL | TOLL BROTHERS INC. | 160.22 | +0.21 | +0.13% |

| KBH | KB HOME | 64.82 | -0.97 | -1.47% |

| MTH | MERITAGE HOMES CORP. | 77.78 | -1.23 | -1.55% |

| LEN | LENNAR CORP. | 116.15 | -5.11 | -4.21% |

“Many factors are bringing buyers off the fence right now. These include low interest rates, urgency created by the limited supply of resale and new homes and improving personal balance sheets and credit profiles,” said Bob Toll during a conference call with investors.

KB Home (NYSE:KBH) recently boosted its revenue forecast for the year. CEO Jeff Mezger cited pricing power and tight supplies, among other factors, for the favorable outlook.

“The overall economy appears to be gaining momentum with insufficient levels of inventory available to meet this growing demand,” he said in March.