House panel on China economy: 'Single greatest threat to America's global standing'

Lawmakers emphasized the existential threat the Chinese government poses to America's economic leadership

Biden unlikely to condemn China during State of the Union: Martha MacCallum

'The Story' host Martha MacCallum discusses the US-China relationship and whether Biden will reference the Chinese spy flight during his State of the Union speech on 'The Big Money Show.'

The House Financial Services Committee held its first full hearing of the 118th Congress Tuesday, focusing on the threat posed by the People's Republic of China (PRC) to U.S. economic interests.

Tensions have risen between the U.S. and China in recent years amid the PRC's threats against neighboring countries like India and Taiwan, its takeover of Hong Kong and human rights abuses against Uyghurs and other minorities. China has also engaged in a number of unfair trade practices, such as currency manipulation, along with a campaign of intellectual property theft and economic espionage targeting U.S. companies.

"We must double down on our commitment to free people and free markets," Chairman Patrick McHenry, R-N.C., said in his opening remarks. "The juxtaposition between the U.S. and China could not be more clear. They are centralized. We are decentralized. They are closed. We are open. They suppress free speech and human dignity. We embrace it. These are the American values that produce the economic strength that has led to the highest living standard and greatest military power in human history."

BLOCKADE OF TAIWAN BY CHINA COULD COST WORLD ECONOMY OVER $2 TRILLION, REPORT FINDS

A worker walks past cranes at the container port in Qingdao in eastern China's Shandong province Jan. 14, 2020. (Chinatopix Via AP / Fox News)

McHenry mentioned the Chinese surveillance balloon that traveled U.S. airspace before it was shot down over the weekend, calling it a "clarifying moment" about the intentions of the Chinese Communist Party (CCP).

"China is not an ally or strategic partner," McHenry said. "They are our competitor and pose the single greatest threat to America's global standing."

Several Democratic lawmakers, including ranking member Maxine Waters, D-Calif., tied the looming debate in Congress about raising the U.S. debt ceiling to the economic competition with China.

"I'd like to start by saying that if House Republicans continue their brinkmanship over debt ceiling it will result in even more severe interest rate hikes, a plunging stock market, major job losses and a recession of epic proportions," Waters said. "Such a global financial crisis would hand the Chinese Communist Party a massive win by bolstering the Chinese government's standing in the world."

CHINA CONTINUES TO LEAD WORLD IN COUNTERFEIT AND PIRATED PRODUCTS: USTR REPORT

China immigration inspection officers in protective overalls march near a container ship at a port in Qingdao in eastern China's Shandong province Nov. 7, 2021. (Chinatopix via AP / AP Images)

Clete Willems, who worked on economic policy toward China at the National Economic Council and National Security Council during the Trump administration, noted that the threat posed by China has been "on full display in recent days with the PRC's brazen decision to fly a spy balloon over the United States.

"China also seeks to challenge U.S. economic and geopolitical leadership and to remake the international order with priorities and values that differ significantly from our own," Willems added. "Accordingly, the outcome of this competition will affect the future of our country and the world we live in. And Congress is right to make it a top priority."

Willems testified alongside Tom Feddo, who previously oversaw the Treasury's Committee on Foreign Investment in the United States (CFIUS); Eric Lober, a specialist in sanctions at the Treasury Dept. and private sector; Richard Ashooh, who worked at the Dept. of Commerce's Bureau of Industry and Security (BIS); and Peter Harrell, who served as the National Security Council's director of international economics and competitiveness.

In this photo released by Xinhua News Agency, Chinese President Xi Jinping speaks during the fifth plenary session of the 19th CPC Central Committee in Beijing Oct 29, 2020. (Ju Peng/Xinhua via AP / AP Newsroom)

At one point during the hearing, Rep. Al Green, D-Texas, asked the witnesses if they agree the debt ceiling should be raised, and all five panelists raised their hands. Green then asked if they agree the budget should be cut to raise the debt ceiling, and three of the five did so.

In response to a question posed by Rep. Bryan Steil, R-Wis., about how the U.S. can "go on offense" by improving its trade relationships to counter China's growing influence, Willems called for the U.S. to compete economically by securing more market access trade agreements. He urged a continuation of ongoing trade talks with Taiwan and a renegotiation of the Trans-Pacific Partnership and called on the Biden administration to resume trade negotiations with Kenya and the United Kingdom that have been put on pause.

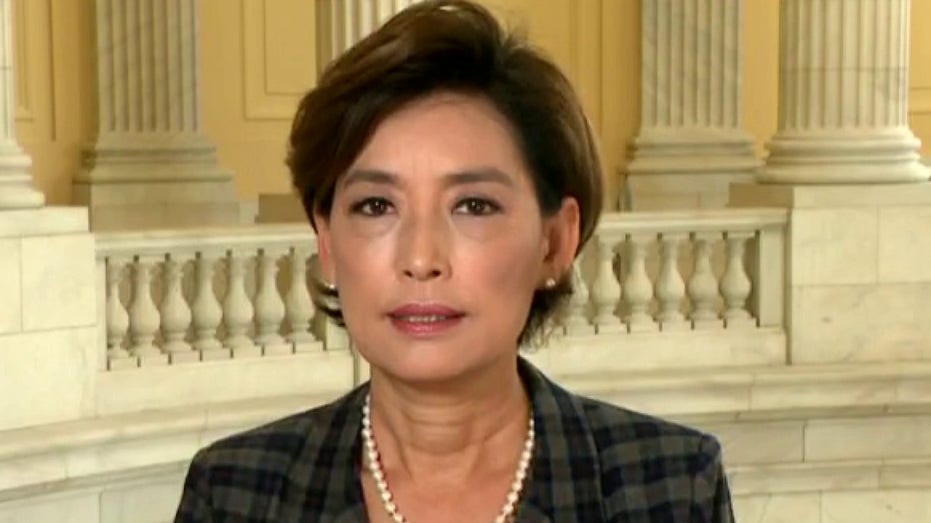

Rep. Young Kim, R-Calif., noted how the COVID-19 pandemic exposed that critical supply chains were linked to China, which exposed the danger of having an authoritarian regime exercise a great degree of control over essential goods. Willems said the Biden administration hasn't done enough to encourage those supply chains to leave China for countries like Taiwan, which he said could be achieved through trade agreements.

Rep. Young Kim (Fox News)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Lawmakers from both sides of the aisle discussed ways to scrutinize investments in China made by U.S. companies and individuals to prevent funds from flowing to initiatives that bolster the Chinese military's capabilities or enhance the Chinese Communist Party's access to cutting-edge technologies. Measures to counteract the shipment of precursor chemicals from China that are used to manufacture illicit fentanyl, which has caused a surge of overdose deaths in recent years, were also discussed.

The House Financial Services Committee is expected to consider more than a dozen bills aimed at countering the Chinese government's economic practices, securing U.S. supply chains and enhancing the dollar's position as the world's reserve currency. Once those bills are advanced from the committee, they may be considered on the House floor in the near future.