How Elizabeth Warren's 'ultra-millionaire tax' would affect the wealthy

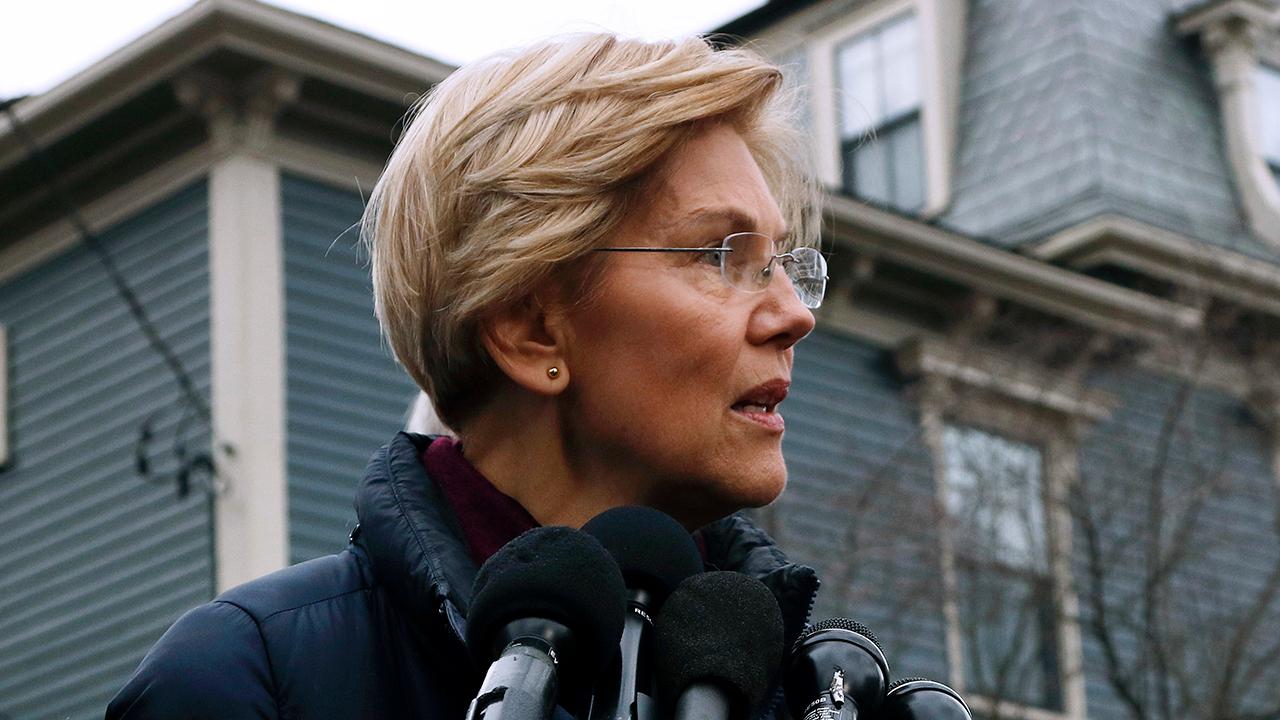

Massachusetts Democratic Sen. Elizabeth Warren, and potential 2020 contender, announced a plan to raise taxes on the country’s wealthiest residents – with a goal of curbing “the growing concentration of wealth,” according to economists.

The wealth tax would apply to "ultra-millionaires," or those with more than $50 million in assets. The tax would be equal to 2 percent, but would rise to 3 percent for those who have assets valued at more than $1 billion.

Economists from the University of California, Berkeley, who advised Warren on the proposal, gave some insight into the reasoning behind those figures. The economists cited 2016 data showing that the share of wealth among the country’s top 0.1 percent has grown to around 20 percent today from about 7 percent in the late 1970s. That contrasts with the share of wealth held by the bottom 90 percent of Americans, which has declined about 10 percentage points to 25 percent today, from about 35 percent in the late 1970s. As a result, the top 0.1 percent currently owns almost as much wealth as the bottom 90 percent of U.S. families.

Economists attributed the decrease in wealth among the majority of American households to increasing debt levels.

Despite the disparity in wealth, when it comes to tax burdens, researchers found that the relative burden on the average U.S. household is actually higher than the ultra-wealthy. For the top 0.1 percent, taxes are equal to an estimated 3.2 percent of their wealth, compared to about 7.2 percent for the bottom 99 percent of families.

Warren’s wealth tax would raise the tax burden on the rich by 1.1 percent, or $1.27 million, to 4.3 percent.

Last week, Warren – who formed an exploratory committee ahead of a potential 2020 bid – detailed her wealth tax, which she is calling an “Ultra-Millionaire Tax.”

The tax would raise $2.75 trillion over the course of a decade. It would only apply to less than 0.1 percent of the population – about 75,000 families.

CLICK HERE TO GET THE FOX BUSINESS APP

A recent Fox News Poll showed a majority – 51 percent – of respondents said they favored spending more on domestic programs over cutting taxes and reducing spending. Their preferred method of financing those projects is through taxing the wealthy. About 70 percent of voters favored raising taxes on those making more than $10 million each year.

Other progressive Democrats have shown a propensity toward imposing higher taxes on the country’s wealthier residents. Freshman New York Democrat Alexandria Ocasio-Cortez, for example, recently proposed raising taxes on incomes above $10 million to 70 percent – the proceeds of which would be used to help fund a new green energy plan.