Inflation: Former Philly Fed president reveals the 'big mistake' that led to the current crisis

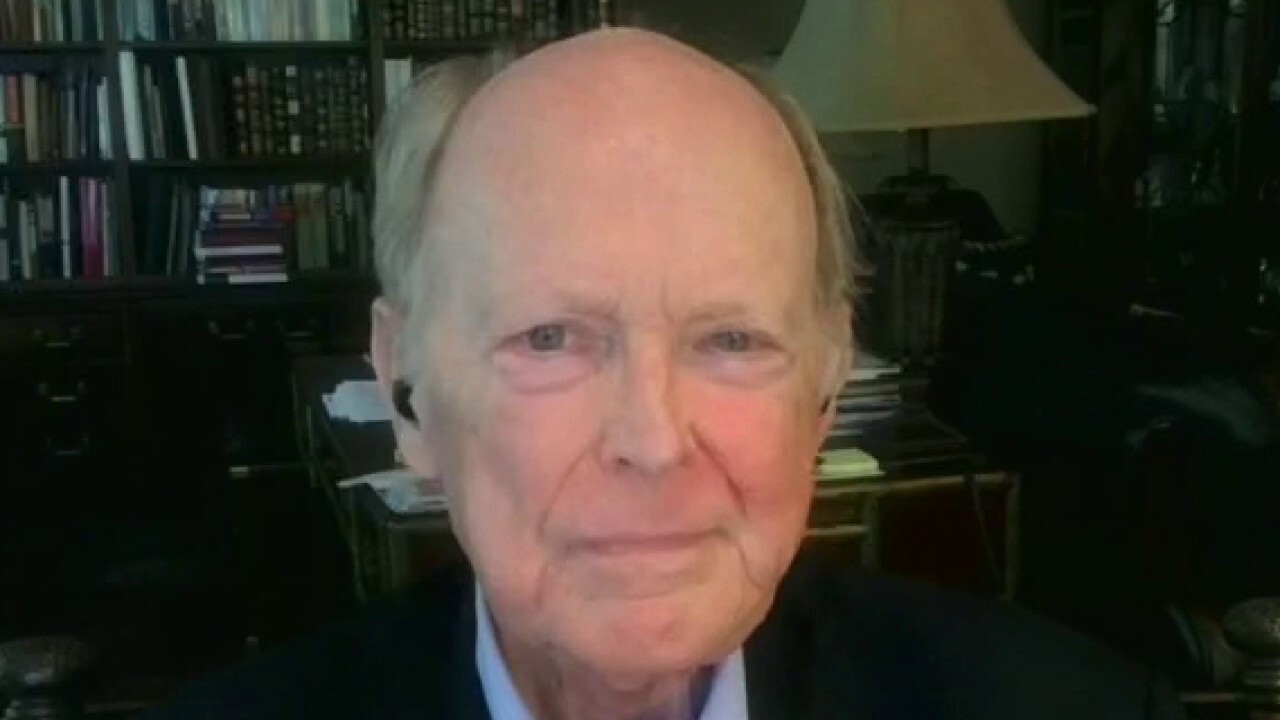

Charles Plosser argues the Fed should have acted sooner to curb inflation

Who should investors blame for economic woes?

Former President and CEO of the Federal Reserve Bank of Philadelphia says he wishes the central bank started to try and curb inflation sooner.

Former President and CEO of the Federal Reserve Bank of Philadelphia Charles Plosser revealed on Thursday who he believes is responsible for the inflation "crisis" as price hikes sit near 40-year highs.

Speaking on "Cavuto: Coast to Coast," Thursday, Plosser argued that "one of the big mistakes right now is that people blame inflation on the pandemic, supply chain bottlenecks, "greedy corporations" and the war in Ukraine, believing "the policy would have been fine if it hadn’t been for all that."

"Monetary and fiscal policy have been extraordinarily aggressive in this episode and they’re the ones to look to as to what went wrong during this and to why the inflation has persisted as it seems to be," he said.

"And I think that by ignoring that and not acknowledging the role that policy has played in creating this crisis is a huge mistake."

EVERYBODY GETTING 'HURT' BY INFLATION: INVESTMENT EXPERT

Plosser stressed that the Fed should "absolutely" accept some of the blame for the current economic landscape.

The Labor Department said earlier this month that the consumer price index, a broad measure of the price for everyday goods including gasoline, groceries and rents, rose 8.3% in April from a year ago, below the 8.5% year-over-year surge recorded in March. Prices jumped 0.3% in the one-month period from March.

Those figures were both higher than the 8.1% headline figure and 0.2% monthly gain forecast by Refinitiv economists.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 50115.67 | +1,206.95 | +2.47% |

| SP500 | S&P 500 | 6932.3 | +133.90 | +1.97% |

| I:COMP | NASDAQ COMPOSITE INDEX | 23031.213218 | +490.63 | +2.18% |

Markets have been experiencing volatility in recent weeks as concerns over Federal Reserve rate hikes and high inflation continued to trouble investors.

The central bank faces the tricky task of cooling demand and prices without inadvertently dragging the economy into a recession.

Federal Reserve Chairman Jerome Powell reiterated his commitment last week to curbing the highest inflation in decades. (REUTERS/Kevin Lamarque)

Last week, Federal Reserve Chairman Jerome Powell reiterated his commitment to curbing the highest inflation in decades, indicating the central bank will raise interest rates as high as necessary in order to tame consumer prices.

Fed policymakers hiked the benchmark federal funds rate by a half-point earlier this month, and Powell has all but promised that two similarly sized increases are on the table at the forthcoming meetings in June and July. He echoed that sentiment on Tuesday as the Fed races to catch up with runaway inflation and bring it back down to the 2% target.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"I think the Fed has waited so long to react to this that it has raised the risk that the ability to achieve a soft landing is getting smaller and smaller," Plosser argued.

"I hope that’s not the case and we may get lucky."

Who is to blame for inflation 'crisis'?

Former President and CEO of the Federal Reserve Bank of Philadelphia Charles Plosser weighs in.

"I think it’s hard for me to imagine that you can cure and bring down 8% inflation down to 2% without some pretty aggressive policy actions," he continued, noting that those moves are "going to be disruptive" and adds risk.

Plosser also noted that it will be determined "how much the economy ends up having to slow" in order to achieve lower inflation.

"That’s why I wish they [the Fed] had started earlier," he continued, stressing that "it might have been easier and more gradual" as well as "more successful."

CLICK HERE TO READ MORE ON FOX BUSINESS