Inflation timeline: Mapping the Biden admin's response to rapid price growth

How Biden's inflation response has changed over the year amid growing voter outrage

Does the Federal Reserve need to raise rates to tamp down inflation?

Andrew Brenner and Peter Schiff provide insight on the Federal Reserve and inflation on 'The Claman Countdown.'

Confronted with a sharp decline in approval ratings and the relentless increase in consumer prices, President Biden is finally shifting to full inflation-fighting mode, with a month-long campaign intended to contain public outrage over the rising cost of everyday goods.

The White House is taking steps to quell voter unrest over surging inflation by signaling that Biden understands what U.S. households are enduring – and that officials are maximizing efforts to bring prices under control – ahead of the November midterms, in which Democrats risk losing their already razor-thin majorities.

HOW THE FEDERAL RESERVE MISSED THE MARK ON SURGING INFLATION

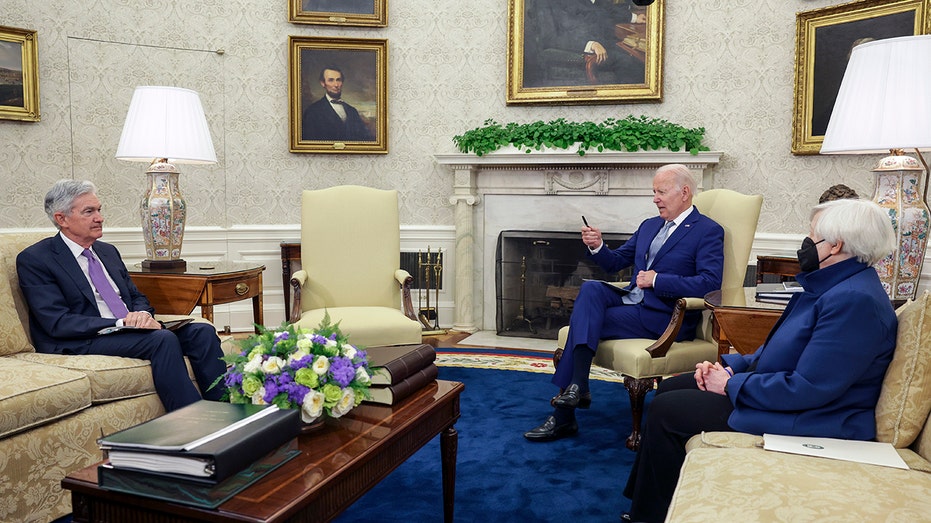

Just last week, Biden held a rare Oval Office meeting with Federal Reserve Chairman Jerome Powell, wrote an op-ed in The Wall Street Journal about his plan to handle higher prices and sent his top lieutenants, including Treasury Secretary Janet Yellen, across cable news to tout his plan. The president has called tackling inflation his "top priority."

But the media blitz comes long after the White House was accused of grossly misjudging the inflation problem, insisting that prices would fall even when it became clear the spike would likely last longer than expected.

Here's a closer look at the Biden administration's response to inflation over the past year:

June 2021

Inflation accelerated at the fastest pace in nearly 13 years, with the consumer price – which measures the cost of everyday goods like cars, rent, health care and gasoline – jumping 5% in May (the government releases economic data reports the following month, meaning May inflation data was not public until June 10). While that marked the fastest pace since 2008, just before the financial crisis triggered a massive downturn, inflation was not a top priority on the White House's radar.

IS THE US ECONOMY ON THE BRINK OF RECESSION? FED GDP TRACKER SAYS YES

White House officials argued that rising inflation was not only temporary – the result of snarled supply chains – but ultimately indicative of a rebounding economy in the wake of the COVID-19 pandemic. At the time, Democrats' $1.9 trillion spending bill was beginning to filter through the economy, COVID-19 cases were falling and more Americans were getting vaccinated.

"As the virus is contained, the economy is improving, step-by-step," White House Council of Economic Advisers member Heather Boushey tweeted. "Today’s data on inflation is the latest indicator that things are both moving in the right direction and that we have supply-chain hiccups."

Treasury Secretary Janet Yellen acknowledged at this point that inflation could end up running hotter than expected. Still, she insisted that the spike was largely due to transitory factors.

July 2021

Inflation continued its uphill climb in June, with prices surging by 5.4% from the year-ago period, according to a government report published on July 13. White House officials maintained that soaring costs stemmed from pandemic-induced disruptions in the economy, including pent-up consumer demand and disruptions in the supply chain.

On the White House lawn, Biden claimed the U.S. was "closer than ever to declaring our independence from a deadly virus," even as the delta variant began picking up steam.

Containers are seen at the port in San Pedro, California, March 22, 2018. (Reuters/Bob Riha, Jr. / Reuters Photos)

"We also know that as our economy has come roaring back, we’ve seen some price increases," Biden said in remarks on July 19. "Some folks have raised worries that this could be a sign of persistent inflation. But that’s not our view. Our experts believe and the data shows that most of the price increases we’ve seen are – were expected and expected to be temporary."

The federal government also began delivering the first in a series of monthly child tax credit payments, worth up to $300 per child.

August 2021

Prices remained above pre-pandemic levels in July, with the consumer price index holding steady at the 13-year high of 5.4%, according to a government release on Aug. 11.

The White House and the Federal Reserve maintained that rising consumer prices were merely a side effect of supply chain glitches that stemmed from the pandemic. Officials tried to assure voters that once life returned to normal, price increases would subside.

YELLEN CALLS ELEVATED INFLATION 'UNACCEPTABLE,' BUT OFFERS FEW SOLUTIONS TO COOL PRICES

"One month does not make a trend (monthly inflation slowed in May before rebounding in June), and we know supply constraints persist in various sectors," the White House Council of Economic Advisers tweeted.

September 2021

Inflation actually cooled off in August, dropping to 5.3% on an annual basis and breaking an eight-month rising streak, a September release from the Labor Department showed. It provided a brief reprieve to policymakers who thought it may have signaled the end of the constant inflation rise.

White House economists welcomed the report as evidence that so-called "team transitory" was right in predicting the price spike would slow down soon.

"We view the report as consistent with the story we, the Federal Reserve and the vast majority of forecasters have been talking about," said Jared Bernstein, a member of the White House Council of Economic Advisers. "It’s one month, and we’re going to continue to vigilantly watch the data."

October 2021

Inflation marched higher in September, dashing hopes that consumer price increases had leveled off for good. The consumer price index jumped 5.4% on an annual basis, with prices rising across the board for things like cars, food and televisions, among other goods.

Billboard on the cruelties of inflation in Coon Rapids, Minnesota. (Universal Images Group via Getty Images / Getty Images)

Although Biden had initially been pitching his massive spending package, the Build Back Better plan, as a solution to fix inflation, he pivoted in October, saying that his administration was doing what it could to fix supply chain issues. That included allowing the Port of Los Angeles to begin operating around the clock to reduce growing backlogs, and encouraging states to license truck drivers more quickly.

"Today’s announcement has the potential to be a game-changer," Biden said of the longer port hours. He also called on private-sector companies to "step up as well."

That same month, Federal Reserve officials began preparing to slow their aggressive bond-buying program, the first step that policymakers will take in dialing back pandemic-era support for the economy.

November 2021

Consumer prices surged again in October, rising at the fastest pace in more than three decades as fuel costs picked up and supply chains remained snarled, a November report showed. Overall prices jumped 6.2% in October from the previous year – the fastest pace since 1990.

US ECONOMY ON CUSP OF STAGFLATION, WORLD'S LARGEST HEDGE FUND WARNS

Biden called reversing the inflation trend a "top priority" and acknowledged that higher prices hurt Americans' pocketbooks in a statement after the report. Still, the president continued to blame supply chain disruptions and rising energy costs for the headline inflation spike, and argued that the bipartisan infrastructure bill – which included $500 billion in new funding – would help alleviate those problems.

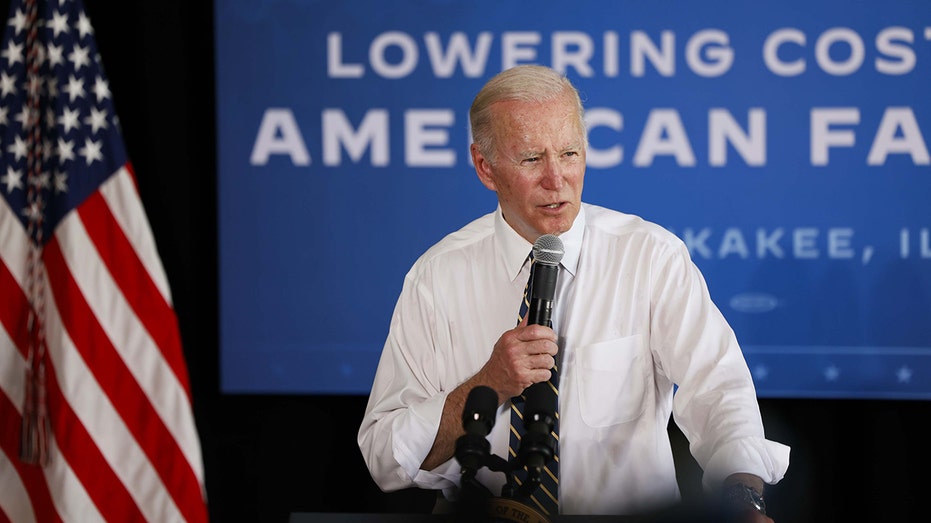

President Joe Biden speaks during a visit to a family farm in Kankakee, Illinois, on May 11, 2022. (Taylor Glascock/Bloomberg via Getty Images / Getty Images)

"Many people remain unsettled about the economy, and we all know why: They see higher prices," Biden said.

The Federal Reserve announced plans to begin slowing its aggressive bond-buying program by $15 billion a month in mid-November. The monthly asset purchases, known as quantitative easing, were intended to stabilize the financial markets and keep credit cheap during the pandemic.

"Inflation is elevated, largely reflecting factors that are expected to be transitory," the FOMC said in its post-meeting statement. "Supply and demand imbalances related to the pandemic and the reopening of the economy have contributed to sizable price increases in some sectors."

December 2021

Inflation ripped higher in November, exacerbating the political headache for Biden. The consumer price index rose 6.8% in November from the previous year, the fastest pace since 1982.

Democrats, including Biden, continued to pitch the Build Back Better spending proposal as the solution to lowering costs – including for child care and health care.

"We’ve never had this kind of growth in 60 years, but inflation is affecting people’s lives," Biden said in December. "The reason why… economists think [Build Back Better] is going to, in fact, diminish the impact on inflation is because it’s reducing costs for ordinary people.".

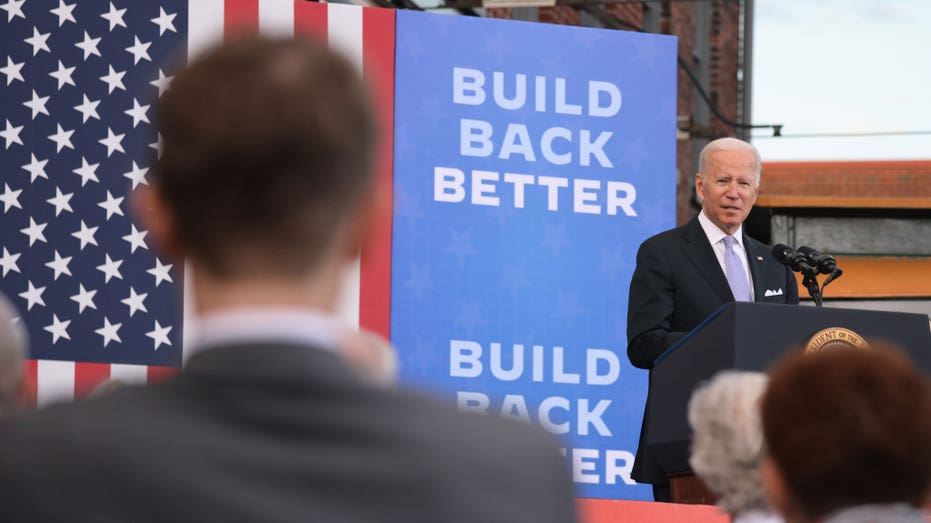

President Joe Biden speaks at an event at the Electric City Trolley Museum in Scranton on Oct. 20, 2021. (Spencer Platt/Getty Images / Getty Images)

But Sen. Joe Manchin, D-W.Va., squashed that legislation later in the month, citing sky-high inflation and leaving Democrats spinning to find another defense against inflation.

In another blow to Biden, Powell admitted that inflation may not be temporary and signaled that interest rate hikes were coming sooner than expected. The central bank also doubled its reduction of bond purchases to $30 billion a month.

"There’s a real risk now, we believe – I believe – that inflation may be more persistent," Powell told reporters. "The risk of higher inflation becoming entrenched has certainly increased. I don’t think it’s high at this moment, but I think it’s increased."

January 2022

Inflation rose at the fastest pace in nearly four decades in December, as rapid price gains fueled consumer fears about the economy and sent Biden's approval rating tumbling. The consumer price index rose 7% in December from a year ago, the Labor Department said, marking the fastest increase since June 1982.

In a statement following the data release, Biden touted the decline in month-over-month inflation – at 0.5%, it was down slightly from the 0.8% increase in November – as evidence of a "meaningful reduction in headline inflation" and demonstrative of falling food and gas prices.

"At the same time, this report underscores that we still have more work to do, with price increases still too high and squeezing family budgets," the president said. "Inflation is a global challenge, appearing in virtually every developed nation as it emerges from the pandemic economic slump. America is fortunate that we have one of the fastest-growing economies."

February 2022

Prices accelerated more than expected in January, notching another four-decade high of 7.5%, the Labor Department reported in February.

High gas prices are seen in front of a medical billboard on May 11, 2022, in Milwaukee. (AP Photo/Morry Gash / AP Newsroom)

"While today is a reminder that Americans’ budgets are being stretched in ways that create real stress at the kitchen table, there are also signs that we will make it through this challenge," Biden said in a statement. He stressed that wages were also on the rise, though in general they have not kept pace with the rate of inflation.

Making matters worse for Biden, Russia attacked Ukraine on Feb. 24 after a months-long buildup. The invasion resulted in punishing sanctions on Russian President Vladimir Putin, many of which targeted Moscow's energy industry. The fallout from the war sent energy and food prices spiking globally.

March 2022

Prices climbed again in February as the Ukraine war pushed inflation even higher. Biden once again acknowledged the pain that higher costs were imposing on U.S. households, but found a new scapegoat in Putin, blaming his invasion of Ukraine for fueling higher gas prices.

Democrats began using the hashtag #PutinPriceHike to pin soaring inflation on the Russian leader. As a result, Biden announced an unprecedented release of 180 million barrels of oil from the U.S. Strategic Petroleum Reserve over the next six months.

"Today’s inflation report is a reminder that Americans’ budgets are being stretched by price increases and families are starting to feel the impacts of Putin’s price hike," Biden said in a statement.

The Federal Reserve also voted to hike the short-term interest rate by 25-basis points in March for the first time in three years. Policymakers signaled that it would be the start of a series of rate hikes.

April 2022

The March inflation data – the first to capture the full effect of the European war – showed that inflation accelerated to another four-decade high in March. Biden announced a plan to allow higher-ethanol gasoline blends in an effort to reduce prices at the pump.

WHAT THE NEXT ECONOMIC RECESSION COULD LOOK LIKE

"I’m doing everything within my powers, by executive order, to bring down the prices and address the Putin price hike," Biden.

May 2022

Central bank officials hiked interest rates again on May 4, lifting them by 50-basis points for the first time in two decades.

"Inflation is much too high," Powell said. The Fed also announced plans to begin running down its massive $8.9 trillion balance sheet.

The inflation report in April showed that prices cooled off just slightly, but remained near a 40-year high. Core prices – which exclude gasoline and food – also accelerated more than expected, underscoring how strong inflationary pressures in the economy still are.

President Joe Biden meets with Federal Reserve Chairman Jerome Powell and Treasury Secretary Janet Yellen at the White House on May 31, 2022. (Kevin Dietsch/Getty Images / Getty Images)

With Biden's approval rating sinking to the lowest level yet, the White House had no choice but to confront growing voter anger over rising prices. The president calls tackling inflation his "top domestic priority," but insists that fiscal stimulus is not to blame for runaway prices.

"There are two leading causes of inflation we’re seeing today. The first cause of inflation is a once-in-a-century pandemic," Biden said on May 10. "This year we have a second cause – Mr. Putin’s war in Ukraine."

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Administration officials have since conceded they did not expect last year to unfold as it did.

"I think I was wrong then about the path that inflation would take," Treasury Secretary Janet Yellen said last week during an interview on CNN. "There have been unanticipated and large shocks that have boosted energy and food prices, and supply bottlenecks that have affected our economy badly that I... at the time, didn’t fully understand."

It remains to be seen whether Biden's new strategy on the economy will prove effective with voters. It comes at an increasingly precarious time for the U.S. economy, as the Fed moves at the fastest pace in decades to raise rates and crush inflation.