JPMorgan Chase, BlackRock drop out of massive UN climate alliance in stunning move

JPMorgan Chase says its in-house sustainability efforts are sufficient to fight global warming

ESG is an existential threat to American agriculture: Wilton Simpson

Florida Republican Agriculture Commissioner Wilton Simpson discusses the probe into U.S. banks over ESG initiatives on 'The Big Money Show.'

JPMorgan Chase and institutional investors BlackRock and State Street Global Advisors (SSGA) on Thursday announced that they are quitting or, in the case of BlackRock, substantially scaling back involvement in a massive United Nations climate alliance formed to combat global warming through corporate sustainability agreements.

In a statement, the New York-based JPMorgan Chase explained that it would exit the so-called Climate Action 100+ investor group because of the expansion of its in-house sustainability team and the establishment of its climate risk framework in recent years. BlackRock and State Street, which both manage trillions of dollars in assets, said the alliance's climate initiatives had gone too far, expressing concern about potential legal issues as well.

The stunning announcements come as the largest financial institutions in the U.S. and worldwide face an onslaught of pressure from consumer advocates and Republican states over their environmental, social and governance (ESG) priorities.

"The firm has built a team of 40 dedicated sustainable investing professionals, including investment stewardship specialists who also leverage one of the largest buy side research teams in the industry," the bank said in a statement shared with FOX Business. "Given these strengths and the evolution of its own stewardship capabilities, JPMAM (JP Morgan Asset Management) has determined that it will no longer participate in Climate Action 100+ engagements."

MEET THE LITTLE-KNOWN GROUP FUNDED BY LEFT-WING DARK MONEY THAT IS SHAPING FEDERAL CLIMATE POLICY

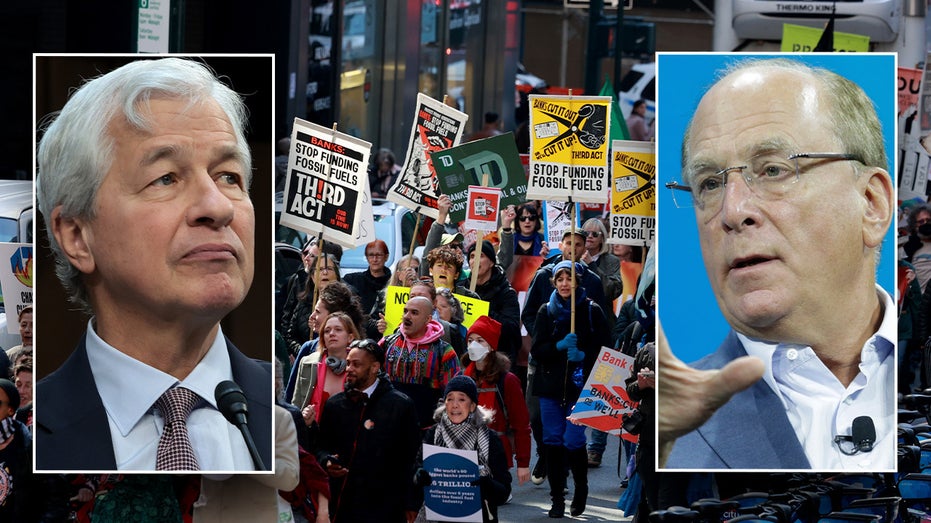

JPMorgan Chase CEO Jamie Dimon, left, and BlackRock CEO Larry Fink. (Getty Images / Getty Images)

BlackRock, meanwhile, withdrew its U.S. business from Climate Action 100+, shifting involvement in the alliance to BlackRock's smaller international entity where a majority of clients are pursuing decarbonization goals, the Financial Times first reported Thursday. A spokesperson for BlackRock confirmed to FOX Business that the move had been made in recent weeks.

And State Street said its exit from the alliance was made because Climate Action 100+'s "phase 2" commitments conflicted with the firm's internal investing policies.

Jamie Dimon, CEO of JPMorgan Chase, testifies during a Senate Banking, Housing, and Urban Affairs Committee hearing in Washington, D.C., on Dec. 6, 2023. (Tom Williams/CQ-Roll Call, Inc via Getty Images / Getty Images)

"SSGA has concluded the enhanced Climate Action 100+ phase 2 requirements for signatories are not consistent with our independent approach to proxy voting and portfolio company engagement," State Street said in a statement, according to the Financial Times.

Climate Action 100+ was formally established in December 2017 at the U.N. as a way of aligning the world's largest private sector financiers of greenhouse gas producers. Since the association was created, it has grown to include more than 700 financial institutions that are collectively responsible for a staggering $68 trillion in assets under management.

Activists hold a protest outside BlackRock headquarters in New York City on May 25, 2022. (Erik McGregor/LightRocket via Getty Images / Getty Images)

The group — which is overseen by a nongovernmental steering committee comprised of ESG activists — calls for members to engage companies on "improving climate change governance," curbing carbon emissions and strengthening climate-related financial disclosure policies. Its actions have largely taken aim at investments benefiting the oil and gas industry, while boosting green energy investment strategies.

The Climate Action 100+ "phase 2" strategy, which was set to be implemented later this year, calls for member investors to actively engage with companies to reduce their carbon footprint.

CONSUMER GROUP REVEALS LEFT-WING GROUPS INCREASINGLY USING COURTS TO PUSH GREEN NEW DEAL

"More than 700 investors are committed to managing climate risk and preserving shareholder value through their participation in the initiative," a spokesperson for Climate Action 100+ told FOX Business on Thursday. "Since its inception, Climate Action 100+ has experienced remarkable growth — and that has only continued."

"The initiative has recently entered its second phase, which offers more ways investor signatories can participate," the spokesperson continued. "Last autumn alone, more than 60 new signatories joined, and we expect interest to continue growing."

Delegates applaud after the conclusion of the most recent United Nations climate summit in Dubai, United Arab Emirates, on Dec. 13, 2023. The conference included various agreements from financial institutions to curb investments in the fossil fuel se (Fadel Dawod/Getty Images / Getty Images)

Climate Action 100+, in addition to other global climate alliances and investor networks, has drawn the ire of Republican states and lawmakers who have argued their activities may infringe on government policymaking. They have also warned such associations are harming domestic energy companies which employ thousands of Americans and ensure low consumer prices.

MAJOR 'CLIMATE DECEPTION' LAWSUIT AGAINST BIG OIL VOLUNTARILY DISMISSED

In June, House Judiciary Chairman Jim Jordan, R-Ohio, issued a subpoena to Ceres, a nonprofit advocacy organization that helps to oversee Climate Action 100+, alleging the group may be facilitating collusion through its climate-focused initiatives in violation of U.S. antitrust law.

House Judiciary Committee Chairman Jim Jordan, R-Ohio, is seen during a hearing in Washington, D.C., on March 9, 2023. (Tom Williams/CQ-Roll Call, Inc via Getty Images / Getty Images)

"Today’s decisions by JPMorgan and State Street are big wins for freedom and the American economy, and we hope more financial institutions follow suit in abandoning collusive ESG actions," Jordan wrote Thursday in a social media post on X.

CLICK HERE TO GET THE FOX NEWS APP

Additionally, state attorneys general, financial officers and agriculture commissioners have banded together in recent months to threaten legal action related to banks' involvement in climate alliances.

"JPMorgan, State Street, and BlackRock's departure is a necessary step in the right direction, but consumers should wait to trust these companies again," said Consumers Research executive director Will Hild. "By leaving the Climate Action 100+ climate cartel, they are signaling that the actions of millions of consumers and dozens of elected officials are having an effect."

"These asset management firms are clearly afraid of the bad press and legal actions taken against their destructive net zero push," Hild added.