New US tech restrictions on China have investors wary, watching for retaliation

The Biden admin's proposed rule would ban some U.S. investments and require disclosure of others involving sensitive tech like advanced computer chips and AI

Everything China does is in the interest of their national security: Rep. French Hill

Rep. French Hill, R-Ark., joins ‘Mornings with Maria’ to discuss the Inflation Reduction Act, U.S.’s foreign policy, and the GOPs impeachment inquiry.

The Biden administration’s newly-proposed restrictions on U.S. investments in China’s tech sector have investors on the lookout for signs of retaliation by Beijing.

Last week, President Joe Biden signed an executive order that prompted the Treasury Dept. to announce a proposed rulemaking that would restrict new U.S. investments in China involving sensitive tech such as computer chips, artificial intelligence (AI), and quantum information technologies.

The move is intended to inhibit China’s access to capital and knowledge that could bolster its military modernization efforts and economic competitiveness. Some investments would be blocked outright, while others would have to be disclosed to regulators.

"It’s naive to think that there won’t be some type of retaliation from China," Tom Plumb, CEO of mutual fund Plumb Funds, told Reuters. He added that China may retaliate by restricting exports of rare earth minerals used in electronics, electric vehicles, and other high-end technology that American firms source from China while taking further steps to reduce its own dependencies on vital goods from the U.S.

BIDEN BANS NEW INVESTMENTS IN CHINA’S HIGH-TECH INDUSTRIES, CHINA SLAMS US

The newly proposed U.S. restrictions on investment in Chinese firms involved with sensitive technology come amid broader geopolitical and economic tensions between the two countries. (Photo by Milos Bicanski/Getty Images | istock / Getty Images)

"This is obviously going to put China in a position where they’re going to try to reduce their dependency on any U.S. company for higher levels of technology," Plumb added.

China’s Ministry of Commerce blasted the proposed trade restrictions, saying it was "gravely concerned" by the move and pledged to "resolutely safeguard its own rights and interests." For its part, China’s Ministry of Foreign Affairs said the "true purpose" of the U.S. restrictions "is to deprive China of its development rights and maintain its own hegemony."

BIDEN SAYS CHINA IS ‘TICKING TIME BOMB’ DUE TO ECONOMIC WOES

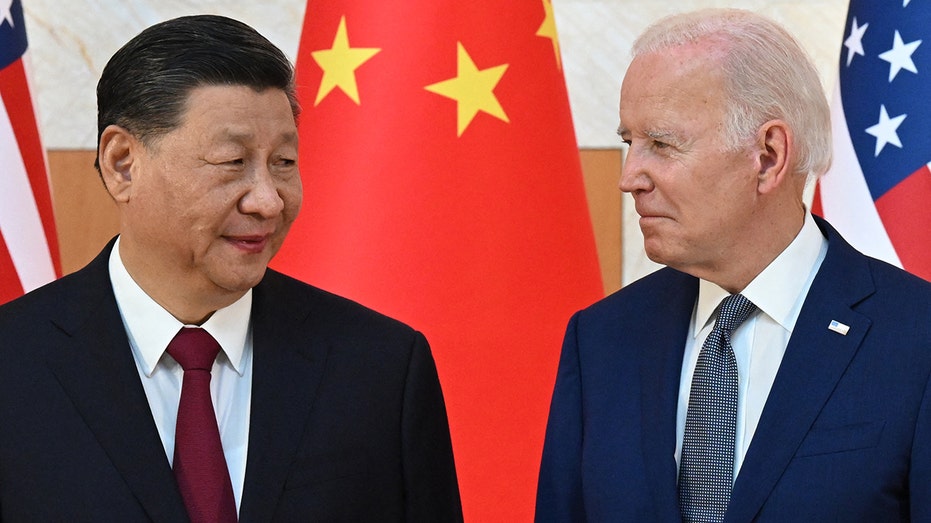

The Treasury Department's announcement of the proposed restrictions on sensitive tech in China come as the Biden administration attempts to lower tensions as an economic decoupling with China occurs. (SAUL LOEB/AFP via Getty Images / Getty Images)

Michael Ashley Schulman, the chief investment officer at Running Point Capital Advisors, told Reuters that some clients had already requested reduced or zero exposure to China via stocks, bonds or ETFs.

"After the government’s announcement, I suspect that we may receive a few more similar requests," he added.

US MANUFACTURING SECTOR REAPING BENEFITS OF RESHORING

President Joe Biden signed an executive order that started a rulemaking process aimed at restricting U.S. investment involving sensitive technologies in China, including advanced computer chips, AI and quantum computing. ((AP Photo/Manuel Balce Ceneta) / AP Newsroom)

The proposed restrictions on high-tech investment in China have been under discussion for months. Ngor Luong, a research analyst with the Center for Security and Emerging Technology (CSET), previously told FOX Business that the trade restrictions are intended to allay national security concerns.

"There are concerns around U.S. technology going to the Chinese military to help it modernize, to support Beijing’s efforts to leverage technology for human rights violations, or to help China gain a first-mover advance in AI writ large," Luong said.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| MCHI | ISHARES MSCI CHINA ETF - USD DIS | 61.97 | +0.30 | +0.49% |

The Biden administration officially proposed the new restrictions on Wednesday. The iShares MSCI China exchange-traded fund (ETF) – one of the largest ETFs featuring China-based companies – lost roughly 4.5% of its share price last week.

Its price started last week at $47.99, fluctuated between $46 and $47 on Wednesday, and was largely flat during Thursday’s trading session before it ended the week at $45.84 at Friday’s close. On a year-to-date basis, the ETF is down a little more than 6.6%.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The Biden administration’s proposed rule is now in a public comment period with comments due by September 28, 2023.

Following the conclusion of the comment period, the Treasury Dept. will review feedback and issue draft regulations at a later date that will undergo a review period before they become final.

FOX Business’ Chris Pandolfo and Reuters contributed to this report.