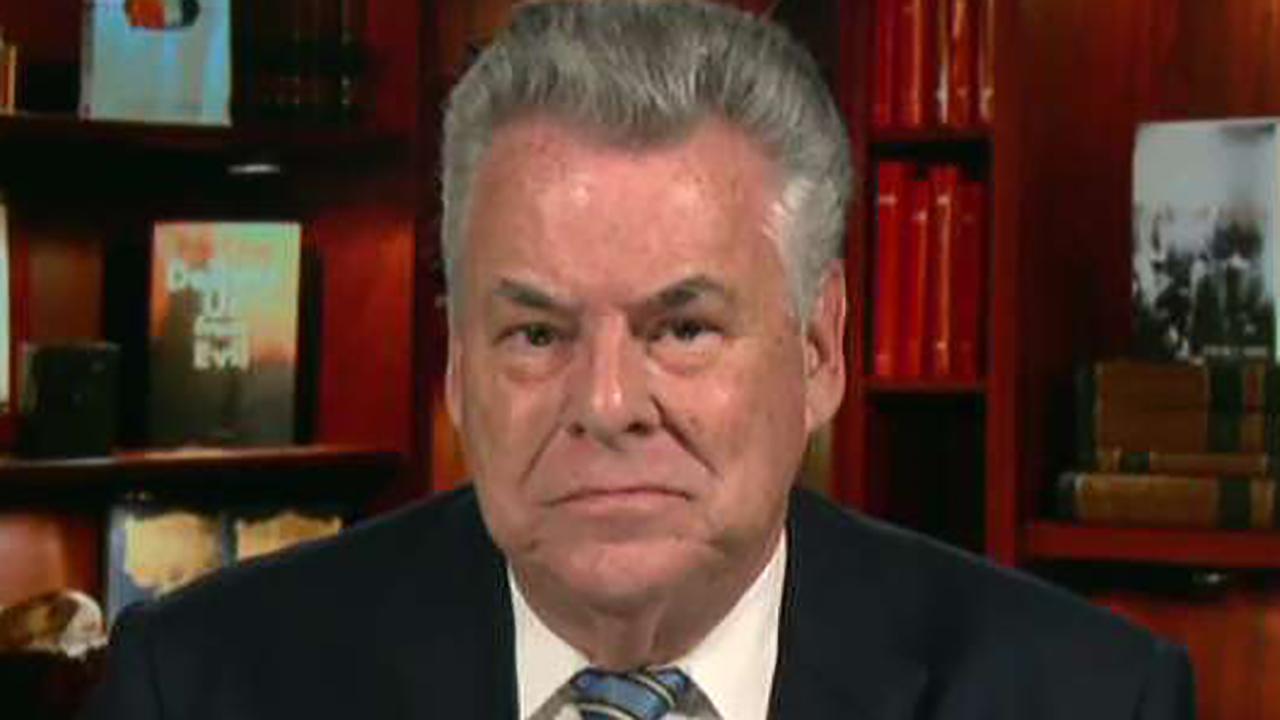

NY homeowners will see taxes increase without SALT: Rep. King

Rep. Peter King, a staunch opponent to the current version of the House Republicans’ tax reform plan, said the elimination of the state and local tax (SALT) deduction could increase the average New York homeowner’s taxes by at least $1,000.

“Maybe more than that -- $2,000 to $3,000,†King, R-N.Y., told Maria Bartiromo on “Sunday Morning Futures.†“It’s difficult to fully compute it right now, but there’s no doubt there will be increases.â€

King and other lawmakers from high-tax states, which include New York, New Jersey and California, argue that getting rid of these deductions will hurt hard-working, middle- to upper middle-class people. The New York Republican has said that the reason why New York is considered “high-tax†is because much of the revenue that goes to the federal government isn’t returned to the state.

“New York gets $48 billion less from the federal government than it pays in revenues,†he said Sunday. “Other states get almost twice as much back as they put in, so we have to make that up somehow. If we can get that $48 billion back in New York, that would make it a lot easier for us to reduce tax rates.â€

King said his region is being treated unfairly since other states will not see such an impact. In nearby New Jersey, Senate President Steve Sweeney said last week that his state, as well as New York and California, are “under attack†by conservative lawmakers in the nation’s capital.

“If we lose the millions of dollars that they’re talking about and taxes are going to be raised on average families by $2,500 when they lose the deductions they’re going to get, how can you do anything? Right now we have to re-evaluate where we’re going to go,†Sweeney said during an interview on FOX Business.

Much like Sweeney, the New York congressman said he could see a mass exodus happening in his state if tax rates go up on residents, which he also explained includes parts of the state’s business community.

“Big people in the business community who feel this is going to terribly impact them … they are talking about moving their address to North Carolina, Florida, wherever … and that then will have a compounding effect because there’ll be less state revenues available. That means local governments will have to raise property taxes—it’s really a vicious cycle,†King said.