Plosser: Fed is Not Overtly Political

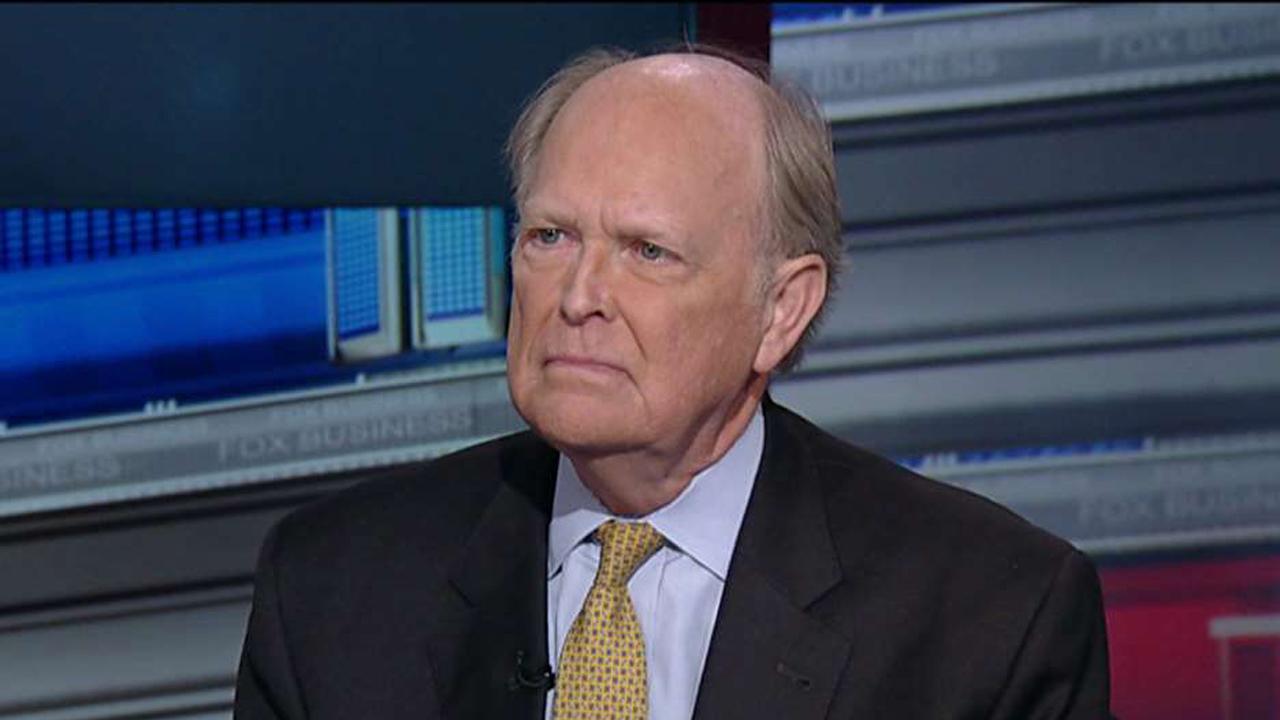

President-elect Donald Trump was a vocal critic of the Federal Reserve during his campaign, but what will a Trump administration mean for the future of the central bank? Former Philadelphia Federal Reserve President Charles Plosser weighed in on the outlook for monetary policy as well as the future of the Fed itself.

“I don’t think the Fed is overtly political, it tries hard not to be, obviously they’re creatures of Congress,” Plosser told the FOX Business Network’s Neil Cavuto.

Plosser responded to concerns that a rise in interest rates could lead to a market drop.

“Well, it’s certainly clear the Fed is nervous about that and worried, and that’s why they keep saying we’re only going to do this gradually.”

On the other hand, according to Plosser, moving too slowly could put the Fed in a difficult situation as well.

“But if market rates as they have done for the last, since the election, gone up 50, 75 basis [points], they’re behind the curve and the Fed will then find itself in a position not where it’s forcing interest rates up, it’s chasing them up and that would be a very bad spot.”

Plosser then weighed in on the potential economic policies from Congress or the Trump administration that would most benefit the U.S. economy.

“What I think the right policy should be would be policies whether it be tax cuts or rollbacks in the regulatory infrastructure that has grown so enormously. Those types of things will help encourage productivity – that’s what we need.”