President Biden argues about inflation in '60 Minutes' interview: 'It hasn't spiked'

As Americans struggle to pay for basic necessities, President Biden told Scott Pelley the inflation rate needs to be put 'in perspective' and 'it's been basically even'

President Biden claims that inflation rate has 'hardly risen'

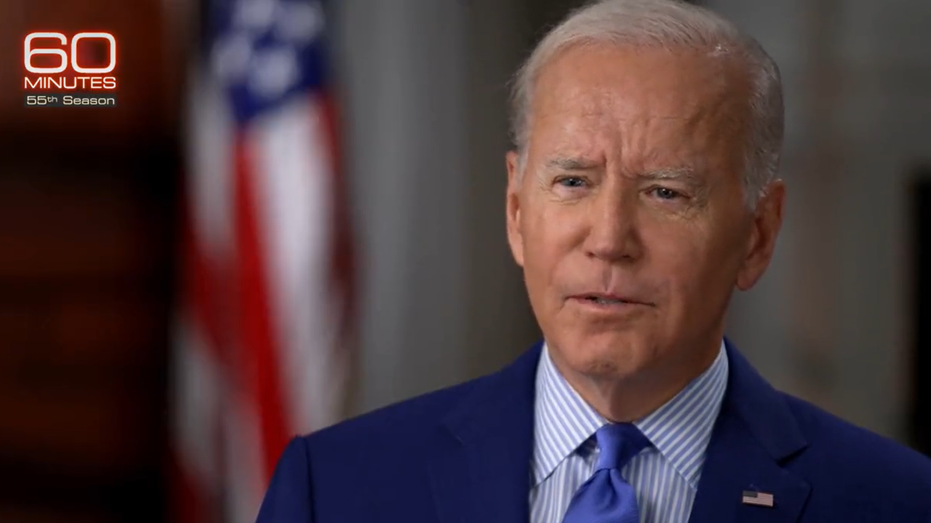

President Joe Biden defended his economic policy during a "60 Minutes" interview with CBS's Scott Pelley, claiming that critics are not putting soaring high inflation in perspective.

President Biden attempted to downplay the U.S. inflation crisis during a "60 Minutes" interview, claiming that the month-to-month rate has "hardly" risen – which prompted his CBS interviewer to dispute his response.

CBS correspondent Scott Pelley asked: "Mr. President, as you know, last Tuesday, the annual inflation rate came in at 8.3%. The stock market nosedived. People are shocked by their grocery bills. What can you do better and faster?"

Biden quickly told Pelley he needed to "put this in perspective" and that the inflation rate month-to-month was "up just an inch, hardly at all."

Pelley quickly interjected: "You're not arguing that 8.3 [percent] is good news?"

SOARING INFLATION DRIVES MORE AMERICANS TO LIVE PAYCHECK TO PAYCHECK DESPITE 5.1% INCREASE IN WAGES

President Joe Biden defended his economic policy during a "60 Minutes" interview with CBS's Scott Pelley, claiming that critics are not putting inflation spikes in perspective. (CBS News)

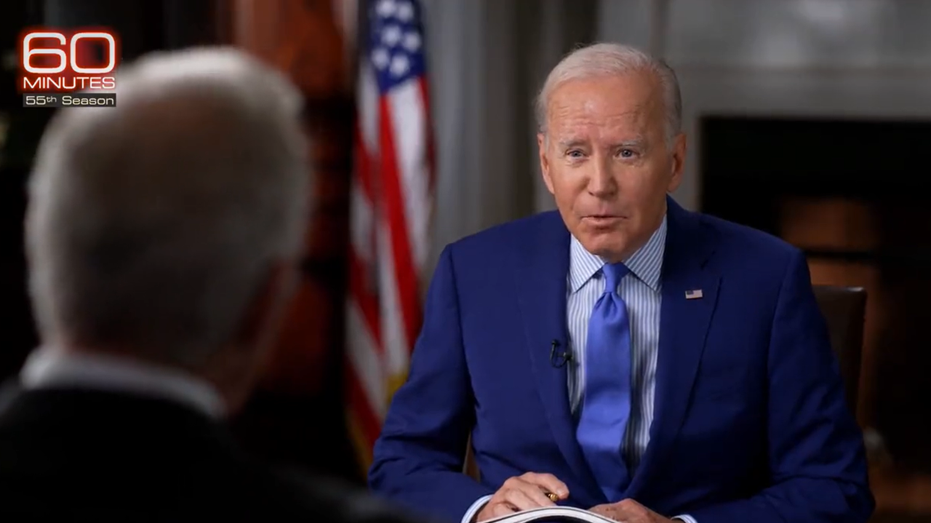

"No, I'm not saying it is good news, but it was 8.2 or 8.2 [percent] before," Biden responded. "I mean… you're making, make it sound like, all of a sudden, my God, it went to 8.2%."

"It's the highest inflation rate, Mr. President, in 40 years," Pelley fired back.

BANK OF AMERICAN WARNS OF NEW LOWS FOR S&P 500 AS ‘INFLATION SHOCK AIN’T OVER'

"I got that. But guess what we are? We're in a position where for the last several months, it hasn't spiked, it is just barely, it's been basically even. And in the meantime, we created all these jobs," Biden argued, while acknowledging that prices "have gone up."

The interview is the latest of Biden's attempts to aggressively defend his economic policy. The White House celebrated the passage of the Inflation Reduction Act last week – despite the Dow Jones Industrial Average tumbling more than 1200 points that same day.

GOLDMAN SACHS CUTS 2023 OUTLOOK FOR US GROWTH

President Biden said he "got" that the current 8.3% inflation rate is the highest its been in 40 years, but also said it was "basically even." (CBS News)

The Inflation Reduction Act is intended to lower prices for consumers, as the current economic crisis is forcing some Americans to rely on credit to pay for basic necessities.

"When it comes to credit card spending over the past couple of years, we have seen categories shift on where people are spending their money," Wells Fargo executive vice president Krista Phillips said. "Right now, our top categories are grocery and gas."

President Joe Biden, riding high on the passage of the Inflation Reduction Act, claimed that the inflation rate has hardly changed. (AP Photo/Evan Vucci, Pool, File / AP Newsroom)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Recent data from the Cox Automotive/Moody's Analytics Vehicle Affordability Index reported that the average cost of a monthly car payment in the U.S. has jumped to $743.

In addition, a University of Pennsylvania Penn Wharton analysis revealed the Inflation Reduction Act would do little to reduce the annual rate of inflation in the midst of the economic recession. The bill would only reduce annual inflation by 0.1 percentage point over the next five years.