Republicans eye possible extension of Trump tax cuts after midterm elections

McCarthy confirms GOP wants to 'lock in' the 2017 Tax Cuts and Jobs Act

Republican lawmakers are gearing up to extend key parts of former President Trump's tax overhaul if they win control of Congress during the pivotal midterm elections.

With inflation running near the highest level in 40 years, Democrats are widely expected to lose their razor-thin majority in the House and possibly the Senate too in November.

Should the GOP regain control of both chambers of Congress, they have indicated that a top economic priority would be enshrining key parts of the 2017 Tax Cuts and Jobs Act into law. That $1.2 trillion tax overhaul – the largest since Ronald Reagan occupied the Oval Office – slashed the top individual tax rate to 37% until 2025 and permanently cut the corporate tax rate from 35% to 21%.

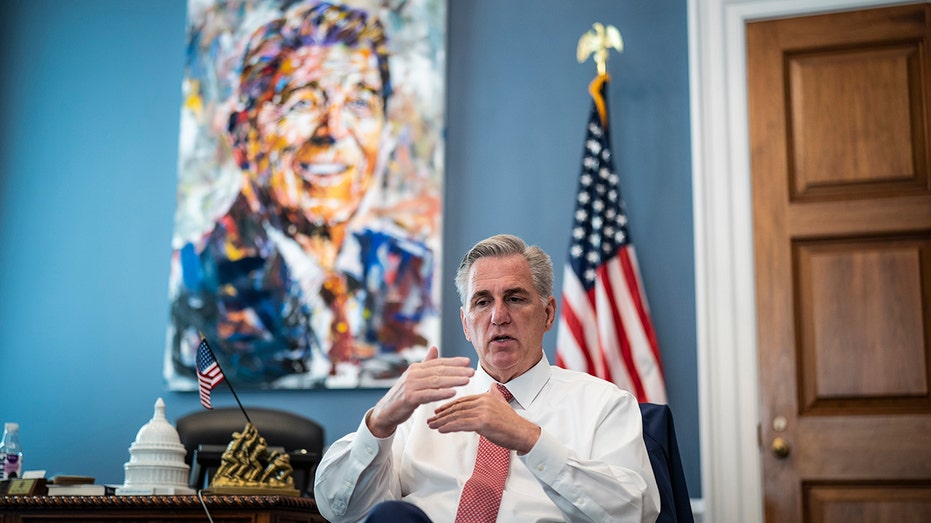

House Minority Leader Kevin McCarthy confirmed during an interview with FOX Business' Larry Kudlow on Tuesday that Republicans want to "lock in those tax cuts that we got, that we've got to pass in the next couple of years to make that happen as well."

THESE BUSINESS TITANS ARE SOUNDING THE ALARM OVER THE US ECONOMY

House Minority leader Kevin McCarthy, R-Calif., meets in his office with former House Speaker Newt Gingrich, and Kellyanne Conway, former Trump White House adviser, moments before heading to speak, share experiences and offer advice to members of the ((Photo by Jabin Botsford/The Washington Post via Getty Images) / Getty Images)

The Washington Post first reported the news.

Although President Biden campaigned on reversing the bulk of Trump's tax policies, including raising the corporate minimum tax to 28%, Democrats have repeatedly failed to do so amid resistance from Sen. Kyrsten Sinema in the 50-50 Senate.

Republicans hope that by pushing hard to advance the tax cuts for wealthy earners if they control the House and the Senate, they could put Biden into a bind by forcing him to choose between handing them a major legislative victory ahead of the 2024 presidential election, or vetoing the tax cuts and committing to higher taxes for millions of Americans in a time of economic uncertainty.

"The trick is to put the president in a position of either getting defeated in 2024 or signing your stuff into law," Newt Gingrich, who served as House speaker in the 1990s and is in communication with senior Republican leaders, told the Post. "Republicans will make it a priority to continue the Trump tax cuts, because it puts the Democrats in a position of being for tax increases and against economic growth."

US RECESSION ODDS RISE TO 100% AS INFLATION SQUEEZES THE ECONOMY

US President Joe Biden speaks during a visit to a family farm in Kankakee, Illinois, US, on Wednesday, May 11, 2022. (Photographer: Taylor Glascock/Bloomberg via Getty Images / Getty Images)

Rep. Adrian Smith, R-Neb., who could become the leader of the Ways and Means Committee in a Republican-controlled House, told C-SPAN last month that the first legislation he plans to prioritize is continuing the 2017 Tax Cuts for individual taxpayers.

Still, unless Republicans win a 60-plus seat majority – an unlikely occurrence – they would need to recruit several Democrats in order to avoid a filibuster and pass the measure in order to force Biden's hand.

"We have temporary tax policies that have been good for the middle class – we need to make those permanent," Smith said.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Critics of the 2017 tax law say that it disproportionately benefited wealthy Americans and well-off corporations. There are also concerns now that extending the tax law could exacerbate the worst inflation spike in a generation; that's because reducing taxes essentially puts more money into people's pockets, likely driving demand higher.

The U.S. House of Representatives and the U.S. Capitol Dome is seen as Speaker of the House Nancy Pelosi (D-CA) prepares to speak during a press conference on September 21, 2022 in Washington, DC. ((Photo by Samuel Corum/Getty Images) / Getty Images)

"Putting more money in people's pockets will increase demand for goods at a time of supply shortages," Howard Gleckman, a senior fellow at the Tax Policy Center, wrote earlier this year about plans from Republican governors to cut taxes. "That will drive up prices and worsen the inflation that the governors claim to be so worried about. And it will increase pressure on the Federal Reserve to raise interest rates even more than it planned."