Senate Democrats urge Biden to revive expired child tax credit

Boosted child tax credit should be 'centerpiece' of spending bill, Dems say

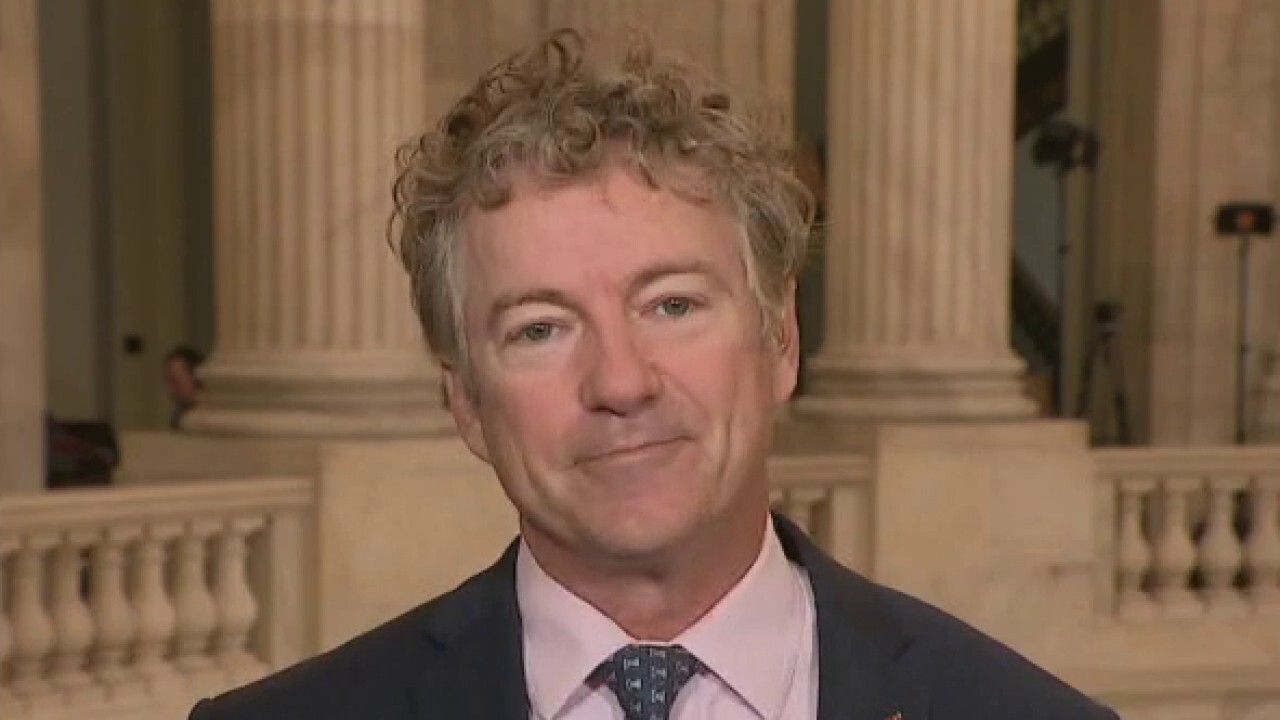

Paul: ‘Let’s not give them money but reduce their taxes

Kentucky Senator Rand Paul discusses on ‘Kudlow’ Putin and Biden’s video call and the electric vehicle incentives in Biden’s spending bill.

Top Senate Democrats on Wednesday urged President Biden to keep the expanded child tax credit payment as the "centerpiece" of a stalled tax and spending package as the White House looks to revive a narrower version of the Build Back Better bill.

In a letter to Biden, the senators – led by Michael Bennet of Colorado – credited the monthly cash bursts to families with reducing child poverty by more than 40% and keeping an estimated 3.7 million children out of poverty. Other signatories included Sens. Ron Wyden of Oregon, Sherrod Brown of Ohio, Raphael Warnock of Georgia and Cory Booker of New Jersey.

BIDEN TO MEET WITH CEOS IN PUSH TO SALVAGE MEGA SPENDING BILL

"Without the expanded credit, nearly 10 million children will be thrown back into or deeper into poverty this winter, increasing the monthly child poverty rate from roughly 12% to at least 17%," the lawmakers wrote. "Raising taxes on working families is the last thing we should do during a pandemic."

President Biden listens to reporter's questions during a meeting on efforts to lower prices for working families, in the East Room of the White House in Washington, Monday, Jan. 24, 2022. (AP Photo/Andrew Harnik / AP Newsroom)

Democrats temporarily expanded the child tax credit in early 2021 as part of a sweeping coronavirus relief package, but the program expired at the end of the year. Under the expansion, low- and middle-income parents could receive up to $3,000 for every child ages 6 to 17 and $3,600 for every child under age 6. The payments were income-based and began to phase out for individuals earning more than $75,000 and married couples earning more than $150,000.

The first half was delivered in monthly payments from July to December with $300 for children under the age of six and $250 for those ages 6 to 17, but the last check was mailed out in December. The second half will be delivered as a lump sum when families file their 2021 tax returns in the spring. The IRS said that 36 million families received the payments each month, or about 60 million children.

Without the enhanced tax credit, an estimated 10 million children are at risk of falling below the poverty line, according to an analysis from the progressive think tank Center on Budget and Policy Priorities.

Although Biden and most congressional Democrats hoped to extend the boosted program for at least another year with the passage of the $1.7 trillion Build Back Better plan, momentum for the massive social spending and climate bill crumbled after moderate Sen. Joe Manchin, D-W.Va., abruptly withdrew his support last month, citing concerns over inflation and the growing federal debt.

This May 4, 2021 image shows teacher Graciela Olague-Barrios working with two infants at Cuidando Los Ninos in Albuquerque, N.M. ((AP Photo/Susan Montoya Bryan) / AP Newsroom)

"I cannot vote to continue with this piece of legislation. I just can't. I tried everything humanly possible. I can't get there," Manchin said during an interview on "Fox News Sunday" in December. "This is a 'no' on this legislation."

One of Manchin's biggest hang-ups over the spending bill was the child tax credit program, which he insisted needed to have work requirements as well as means-testing so that anyone earning more than $200,000 is not eligible for the money. Manchin also expressed concerns that the money could trigger a workforce exodus – an argument that has also been pushed by Republican lawmakers.

A Census Bureau survey of spending patterns among recipients in September and October shows that nearly one-third used the money to pay for school expenses, while about one-quarter of families with young children used the monthly payment to help cover child care. Another 40% said they put the money toward paying off debt.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Republicans on the House Ways and Means Committee in December accused Democrats of turning the child tax credit into the "largest welfare-without-work program in existence" and have cited a University of Chicago research paper that found the expanded credit would trigger a workforce exodus of about 1.5 million employees.

Night falls at the Capitol in Washington, Thursday, Dec. 2, 2021, with the deadline to fund the government approaching. ( (AP Photo/J. Scott Applewhite) / AP Newsroom)

"Paying parents not to work and creating more barriers for the jobless to reconnect to a job harms families and the economy," the GOP lawmakers wrote. "Instead of making the worker shortage worse and driving up inflation, Democrats in Congress should join with Republicans to make the 2017 expansion permanent – including rewarding work by preserving the earnings requirement."