Senate Republicans shove tax bill ahead as Democrats fume

U.S. Senate Republicans rammed forward President Donald Trump's tax-cut bill on Tuesday in an abrupt, partisan committee vote that set up a full vote by the Senate as soon as Thursday, although some details of the measure remained unsettled.

As disabled protesters shouted: "Kill the bill, don't kill us," in a Capitol Hill hearing room, the Senate Budget Committee, with no discussion, quickly approved the legislation on a 12-11 party-line vote that left Democrats fuming.

Republican committee members quickly left the room after the vote as Democrats complained about a lack of discussion on a bill that would overhaul the U.S. tax code and add an estimated

$1.4 trillion to the $20 trillion national debt over 10 years.

After the vote, Trump told reporters: "I think we're going to get it passed," adding that it would have some adjustments.

Republicans are hurrying to move their complex tax legislation forward, hoping to avoid the protracted infighting that doomed their effort to repeal Obamacare four months ago.

Since Trump took office in January, he and fellow Republicans in command of both chambers of Congress have approved no major legislation, a fact they want to change before facing voters in the 2018 congressional elections.

If the Senate approves its tax measure later this week, it would need to be reconciled with a version already approved by the House of Representatives before anything could be sent to the White House for Trump to sign into law.

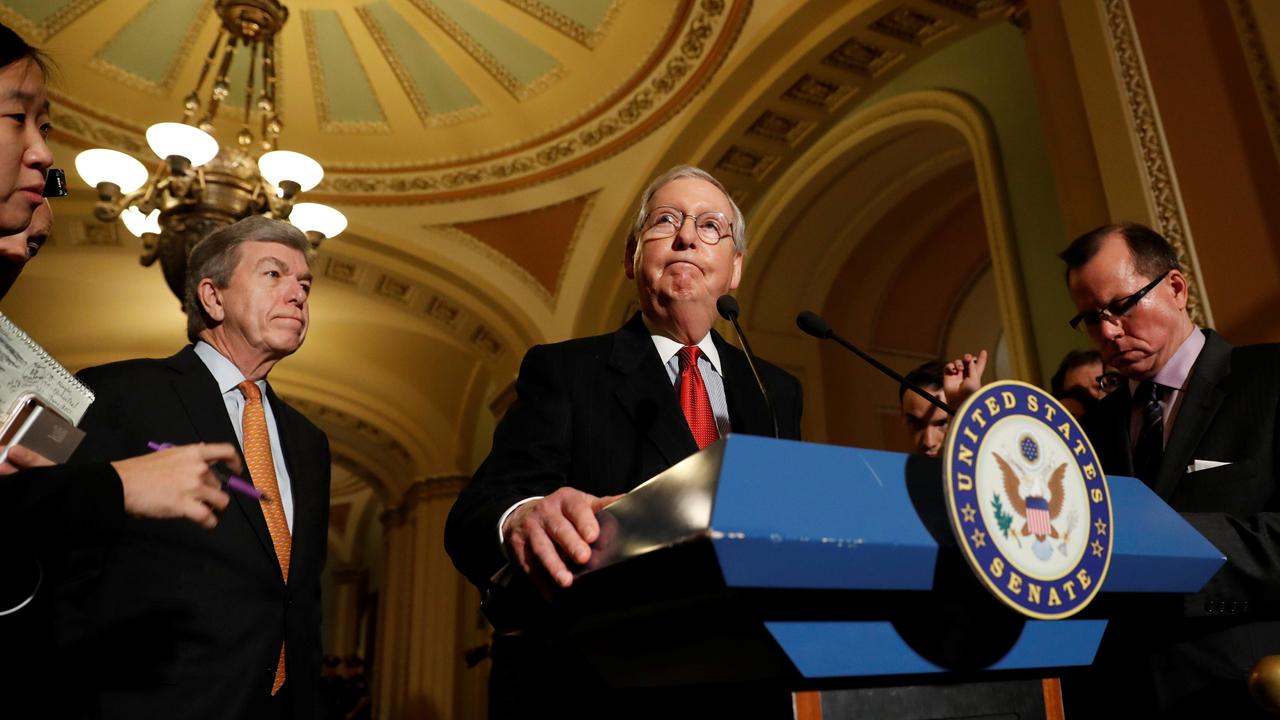

Republican leaders conceded that they had yet to round up the votes needed for passage in the Senate, where they hold a narrow 52-48 majority. "It's a challenging exercise," Senate Republican leader Mitch McConnell said at a news conference.

Democrats have called the Republican tax plan a giveaway to corporations and the rich.

The Senate bill would slash the corporate tax rate to 20 percent from 35 percent after a one-year delay. It would impose a onetime, cut-rate tax on corporations' foreign profits, while exempting future foreign profits from U.S. taxation.

Tax rates for many individuals and families would also be cut temporarily before rising back to their previous levels in 2025. Key tax breaks would also be curbed or eliminated, making the bill a mixed bag for some middle-class families. Some taxes paid by wealthy Americans would be repealed.

Wall Street moved higher on the news that the bill would move to a full Senate vote, with the benchmark S&P 500 <.SPX> index closing up a little over 1 percent.

THE CORKER CONCESSION

As written, the bill would widen the U.S. budget deficit by an estimated $1.4 trillion over 10 years. Republicans maintain that gap would be narrowed by additional economic growth.

Senator Bob Corker, one of few remaining Republican fiscal hawks in Congress, said he worked out a deal satisfying his concerns that the tax cuts add too much to the national debt.

He said the bill would be modified to automatically raise tax revenues if growth targets were not reached. "We got a commitment that puts us in a pretty good place," he said.

Although details were not immediately available, Corker said he expected more information to come out on Thursday as part of the bill.

The concession immediately drew a detractor as Republican Senator John Kennedy told reporters he "would rather drink weed killer than vote for the thing," adding: "I don’t like voting for automatic tax increases."

The Corker concession was one of several lingering uncertainties in the bill that Senate aides said would be nailed down as the measure neared a floor vote.

Republican Senator Susan Collins, who remains undecided on how she will vote on the bill, said "productive discussions" continued and that she would offer an amendment preserving the $10,000 deduction for property tax payments. The deduction is in the House bill, but not the Senate version.

Republican Senator Ron Johnson voted for the bill in the Budget Committee, even though he had said it did not cut taxes deeply enough for some non-corporate businesses.

The final version could address his concerns. Aides said tax writers were working to change the tax rate for non-corporate businesses, preserve an individual deduction for property tax payments, and incorporate Corker's tax revenue idea.

Democratic Senator Jeff Merkley told MSNBC that the Corker concession was "an absolute gimmick" that could be undermined later. "It's just a justification to let those who have argued that they don't believe in increasing the deficit actually vote for a bill which does exactly that," Merkley said.

As the tax fight played out, a new battle opened on another front as Democratic congressional leaders Chuck Schumer and Nancy Pelosi skipped a White House meeting with Trump to discuss spending, immigration and other issues after Trump criticized them on Twitter.

Lawmakers must renew government funding before it expires on Dec. 8 or risk a shutdown. Democrats hope to use their leverage on the budget issue to renew protections for young immigrants who entered the country illegally as children.

(Reporting by David Morgan and Susan Cornwell; Additional reporting by Makini Brice and Amanda Becker in Washington and Lewis Krauskopf in New York; Writing by Andy Sullivan; Editing by Frances Kerry and Peter Cooney)