Tax reform implementation is path to 5% US economic growth: Tony Sayegh

House Republicans unveiled details of their tax reform plan Thursday, but there are concerns that potential increases for the 1% means it will not stimulate the U.S. economy as much as the GOP had hoped.

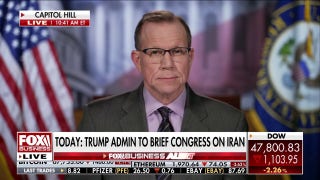

Tony Sayegh, assistant Treasury secretary for public affairs, took a broader view of the tax reform package’s economic impact. “We are dramatically cutting rates across the board, we’re broadening the base, this is very Reaganesque in that regard,” he told the FOX Business Network’s Stuart Varney on “Varney & Co.”

And in conjunction with the corporate tax cuts in the plan, Sayegh says all Americans will benefit from an economic boost.

“Reducing the [corporate] rate from 35% to 20%, taking the small business tax rate, making it the lowest it’s been at the top side in 80 years, stimulating capital spending, stimulating productivity, wage growth and economic growth, that’s where everybody wins.”

Sayegh then responded to concerns about the tax reform plan’s potential to hurt the housing industry by reducing the cap on the mortgage interest deduction to $500,000 for new home purchases.

“Do you know how many mortgages are above $500,000? Six percent – so this whole kind of ‘sky is falling’ idea I think is incorrect and it’s not necessarily something that the American people should worry about,” Sayegh said.

According to Sayegh, the business side of the Republican plan will create a pro-growth environment the White House is hoping will lead to a sustained level of well beyond 3%.

“When Ronald Reagan had his reforms, it reached 4.2% [economic growth]. We feel we could achieve that. Our own Council of Economic Advisors has shown we could reach up to 5% with the tax reform fully implemented.”