Toomey Leads Charge Against ESG ratings firms

The Pennsylvania Senator says the firms 'lack complete transparency'

GOP mounts counteroffensive to Wall Street's ESG investing trend

FOX Business senior correspondent Charlie Gasparino details the Republican pushback to Wall Street's environmental, social, and corporate governance strategy on 'Cavuto: Coast to Coast.'

Pennsylvania Senator Pat Toomey is retiring after serving 18 years in Congress. Still, before he leaves, he’s providing a blueprint for how a potential GOP majority can defang the effort to push controversial "ESG" mandates on corporate America.

Toomey, a Republican, has requested information from a dozen firms, including proxy advisors and ratings agencies on how they come up with scores that rank how various corporations adhere to so-called Environmental, Social and Governance edicts, FOX Business has learned. He plans to hand over the information to his GOP colleagues, who are promising to mount investigations into the ESG movement armed with subpoena power if Congress runs red after next week’s midterms, people close to the matter say.

ESG is a broad term to describe an investing technique that has become both popular and controversial in recent years as some investors demanded corporate policies that took into account societal needs, not just maximizing shareholder value. It seeks to force public companies to take steps to protect the environment, create governance mandates that ensure diversity and adhere to principles that better society.

Sen. Pat Toomey, R-Pa., questions Treasury Secretary Steven Mnuchin during a Congressional Oversight Commission hearing on Capitol Hill in Washington, Thursday Dec. 10, 2020. (Sarah Silbiger/The Washington Post via AP, Pool) ((Sarah Silbiger/The Washington Post via AP, Pool) / AP Newsroom)

WHAT IS ESG? INVESTING WITH ENVIRONMENTAL, SOCIAL AND GOVERNANCE IN MIND

The Biden Administration has been pushing ESG through its various corporate regulatory agencies like the Securities and Exchange Commission. Asset managers and exchanges like the Nasdaq, meanwhile, are attempting to direct investment money to those public companies that adhere to ESG mandates.

But economists and GOP lawmakers have criticized the movement for forcing politically progressive standards on boardrooms. Critics, for instance, say that ESG has had a marginal impact on reducing the world’s carbon footprint since foreign companies like those in China are exempt. Critics also contend ESG has had a deleterious impact on American consumers, forcing energy companies to scale back on production, leading to higher gas prices.

A key component of the $2.7 trillion ESG ecosystem are nearly a dozen firms that assign grades to public companies based on how well they comply with ESG standards. The companies include proxy advisers like ISS that recommend how shareholders vote on corporate policies, but also other outfits that grade public companies on their ESG efforts.

Both play a role in how big asset managers allocate investment funds and thus shape corporate policy.

Toomey, and other Republican lawmakers, have been increasingly vocal in their criticism of the ESG movement likening it to corporate blackmail. Companies, bullied by progressive activists, regulators in the White House, and egged on by ESG rating firms seeking a profit from the burgeoning business, cave to ESG demands. If the GOP takes both chambers of Congress, as recent polls suggest, ESG will be the focus of hearings and investigation targeting its top players, and regulatory officials such as those at the SEC that are enacting new rules demanding ESG disclosures from public companies, Fox Business has learned.

Workers arrive at Goldman Sachs headquarters in New York, US, on Wednesday, June 15, 2022. The Securities and Exchange Commission is looking into whether some investments for the funds are in breach of ESG metrics promised in marketing materials, one (Photographer: Michael Nagle/Bloomberg via Getty Images / Getty Images)

ESG INVESTING HAS DAMAGED CREDIBILITY OF ASSET MANAGERS LIKE BLACKROCK

In September, Toomey who serves as a ranking member on the Senate Banking Committee sent letters to twelve companies believed to be key players enforcing ESG edicts requesting information regarding the criteria they use to give public companies ESG scores. They include outfits such as MSCI, ISS, Bloomberg, Sustainalytics, Moody’s, Carbon Disclosure Project, S&P Global, FTSE Russell, RepRisk, FactSet, Refinitiv, and Arabesque S-Ray.

According to Toomey, only half of those companies complied with requests for information on condition of confidentiality, while the other half gave incomplete information or did not respond at all. As a result, the Republican Senator has sent follow-up letters to those six firms: ISS, Carbon Disclosure Project, RepRisk, Arabesque S-Ray, FactSet and Sustainalytics (an arm of investment management firm Morningstar) urging them to respond to his request for transparency.

HERITAGE FOUNDATION UNVEILS INITIATIVE OPPOSING ESG POLICIES PUSHED BY 'WOKE' CORPORATIONS

"What’s ironic is that these firms’ entire business model is forcing companies to be transparent," a Toomey aide tells FOX Business. "But the firms themselves lack complete transparency when it comes to disclosing how they go about scoring these companies."

Press officials from the companies did not respond to requests for comment.

Toomey’s letters to the companies also stated that there is "bi-partisan concerns" over the opacity of rating methodologies and the veracity of third-party data used to provide the criteria that companies must meet in order to receive a good rating. Some Democrats, worried about ESG stoking inflation on blue collar workers, have begun to question the investment theory despite its widespread support among progressives and environmentalists that are also key constituencies.

One problem Toomey is concerned with is how ESG ratings are derived. According to Toomey’s office, ESG ratings often rely on publicly-sourced data collected by external analysts, or data that is self-reported by the company being rated. That data can sometimes be skewed depending on the source of the information.

CLICK HERE TO GET THE FOX BUSINESS APP

The sourcing data can also come from politically suspect sources, Toomey’s office says. For example, the Senate Banking Committee’s review of Sustainalytics’ sourcing found multiple data points from state-controlled media organizations including Russian state media, and Palestinian Rights Groups. In Sustainalytics’ response to Toomey’s original letter, the firm refused to answer whether they had ever used state-controlled foreign media as a data source.

Sustainalytics did not immediately respond to requests for comment.

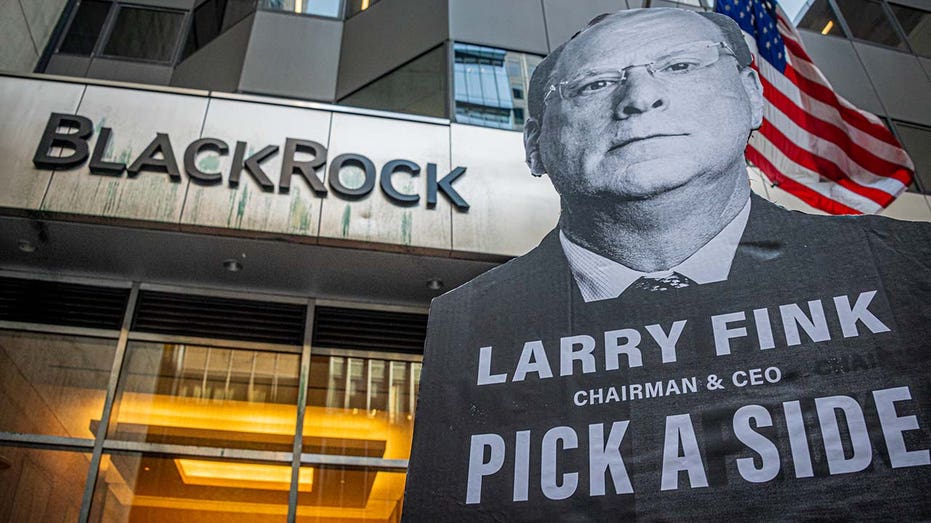

MANHATTAN, NEW YORK, UNITED STATES - 2022/05/25: Participant seen holding a sign at the protest. More than 100 New Yorkers held a protest outside BlackRock Headquarters in Manhattan. BlackRock has been at the forefront of the ESG debate. (Photo by Erik McGregor/LightRocket via Getty Images / Getty Images)

As next week’s midterms approach and Republican lawmakers eye control of both the House and the Senate, members are laying the groundwork to begin overhauling progressive corporate policies on a scale larger than just the ESG rating firms and proxy advisers.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BLK | BLACKROCK INC. | 1,079.90 | +23.52 | +2.23% |

Part of this includes GOP plans to scale back ESG efforts by regulatory agencies, asset managers like BlackRock, and exchanges like the Nasdaq, which has its own ESG listing requirements, Fox Business has learned.