Trump’s coronavirus economic recovery playbook includes payroll tax cut, he says

Payroll tax cut has become increasingly popular among Republicans wary of further stimulus spending

Get all the latest news on coronavirus and more delivered daily to your inbox. Sign up here.

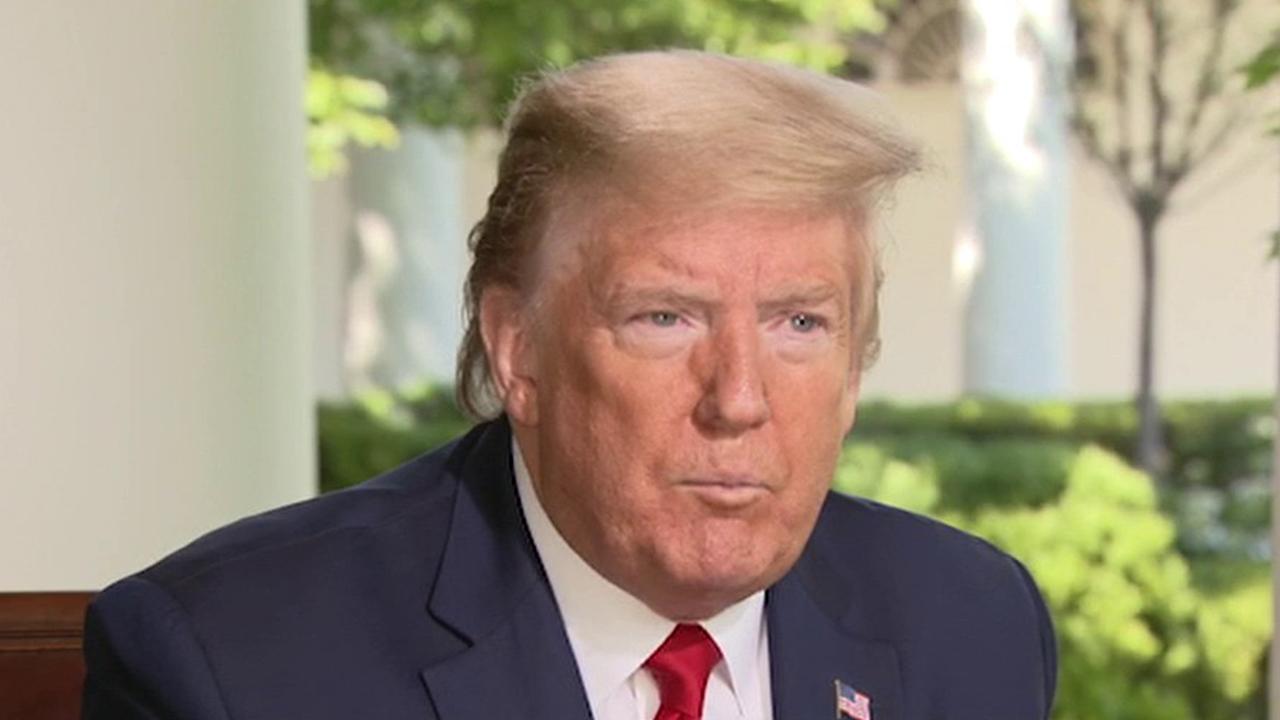

As the U.S. works to recover from the financial fallout of the coronavirus pandemic, President Trump is preparing a “stronger” playbook than his 2017 policy platform to return the U.S. economy to its former strength, he says, which could include a payroll tax cut.

During an interview with FOX Business’ Maria Bartiromo on Thursday, Trump said he liked the idea of a payroll tax cut because it provides a benefit to both businesses and workers.

“That’s one of the taxes that I want to see cut,” Trump said. “And by the way, we’ve already given – we’ve given the largest tax cut in history. If we weren’t so strong as a country, we wouldn’t even exist right now.”

TRUMP 'TOTALLY' DISAGREES WITH FAUCI ON SCHOOL REOPENINGS

A payroll tax cut has become increasingly popular among Republicans who are wary of further stimulus spending – the federal government has already doled out more than $2 trillion on pandemic-related relief measures.

The payroll tax is paid separately from federal income taxes and funds Social Security and Medicare. Employers and employees each pay 6.2 percent for Social Security and 1.45 percent for Medicare, and an additional 0.9 percent is levied on the highest earners.

Cutting or suspending the payroll tax would ideally incentivize employers to hire more workers by reducing their payroll costs while giving employees a boost in their paychecks.

There are concerns, however, that Social Security and Medicare funding would be harmed in the process.

It has been previously suggested that companies would eventually be responsible for repaying the money to Social Security and Medicare, just at a later date.

TRUMP DOUBLES DOWN ON CAPITAL GAINS, PAYROLL TAX CUTS TO STIMULATE ECONOMY

As previously reported by FOX Business, a payroll tax cut is just one of a few measures members of the Trump administration have proposed as a possible means to accelerate U.S. economic growth. Other policies include expanding full, immediate expensing, cutting the capital gains tax rate and reinstating the full deduction for business meals and entertainment.

On Thursday, the president also mentioned taxing imported products, like autos, which is something he has repeatedly, publicly considered throughout his tenure.

Meanwhile, House Democrats introduced another stimulus bill this week, which bears an estimated $3 trillion price tag. Trump deemed the legislation “dead on arrival.”

CORONAVIRUS STIMULUS PHASE FOUR PROPOSALS INCLUDE THESE TAX POLICIES

Despite the battle shaping up in Congress over the new bill, Trump is optimistic about the economic outlook moving forward. He expects a rebound to begin later this year, even though current labor market indicators paint a bleak picture of the U.S. economy – as the unemployment rate skyrocketed to 14.7 percent in April and the U.S. shed an unprecedented 20.5 million jobs.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“I think what’s going to happen is next year is going to be one of our best years,” Trump told Bartiromo. “I feel that we will transition in this third quarter; fourth quarter is going to be good. Next year’s going to be incredible.”

However, while Trump is eager to reopen the economy, some of his top advisers appear to favor taking a more measured approach. Trump is at odds, for example, with top infectious disease expert Dr. Anthony Fauci over reopening schools in the fall. While Fauci has said that it is unlikely a treatment or vaccine will be available by the fall and moving too fast could trigger an uncontrollable outbreak, Trump said he doesn’t consider the country open without schools.