Trump, Republicans look to make tax overhaul permanent in phase two of cuts

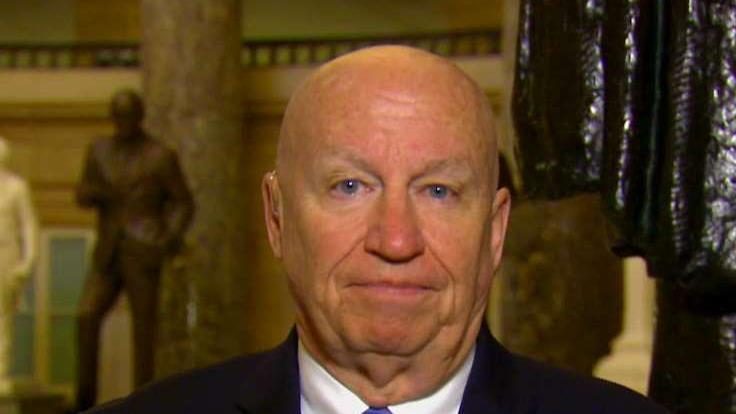

A second round of tax cuts proposed by President Trump and congressional Republicans likely aims to make the temporary personal income tax cuts passed last year into permanent tax cuts, Rep. Kevin Brady said.

The possible addendum to the massive, $1.5 trillion cuts included in the 2017 Tax Act is still in the early stages, the Texas Republican said. That bill, which Trump signed into law in late December, permanently lowered the corporate rate to 21% from 35%, but temporarily lowered individual taxes until 2025.

“We think we can do more to help families stretch their budgets further,” Brady told FOX Business’ Dagen McDowell. “We think we can do more with innovation. Because at the end of the day, the country that wins the innovation race, wins the future.”

Brady also suggested that if other countries slashed their corporate tax rate in order to compete with the U.S., Republicans would do the same in the new legislation. He declined to provide further specifics about what could be included, but did say lawmakers were looking at ways to encourage people to start saving earlier in life.

“I will tell you,” he said, “We did a lot of good things in the Tax Cuts and Jobs Act. But we’re always looking to improve.”

Trump first hinted at a follow-up to the biggest overhaul of the U.S. tax code in 30 years at the White House on Monday, and reiterated it again while visiting the Boeing factory in St. Louis on Wednesday.Since the cuts went into effect in January, a number of U.S. employers have offered some type of financial incentive to employees, including Apple, which is offering $2,500 bonuses to employees below the senior level title of “director”; Boeing, which announced $300 million in investments; and JPMorgan Chase, which will hike hourly wages to between $15 and $18 for roughly 22,000 employees.