Trump vs. Biden: Where the presidential candidates stand on taxes

Compare the tax proposals supported by Biden, Trump

Presidential debate likely to be filled with ‘insults and accusations’: Ken Coleman

America's career coach Ken Coleman breaks down voters’ top economic concerns ahead of the 2024 election during an appearance on ‘The Big Money Show.’

When President Biden and former President Donald Trump meet on the debate stage Thursday evening for the first time in four years, both candidates are expected to tout their vision for tax policy in coming years.

The coming election is particularly consequential because whichever party voters select to control the White House and Congress next year will determine the fate of the Tax Cuts and Jobs Act.

Enacted in 2017 by Republican lawmakers and Trump, the law drastically overhauled the nation's tax code, including reducing the top individual income tax bracket to 37% from 39.6% and nearly doubling the size of the standard deduction. However, those changes to the individual section of the tax code are poised to sunset in 2025, meaning that many taxpayers – including those who earn less than $400,000 – will face steeper levies if the law is not extended.

SENATE DEMOCRATS PLAN FOR A 'TAX ARMAGEDDON' IN 2025

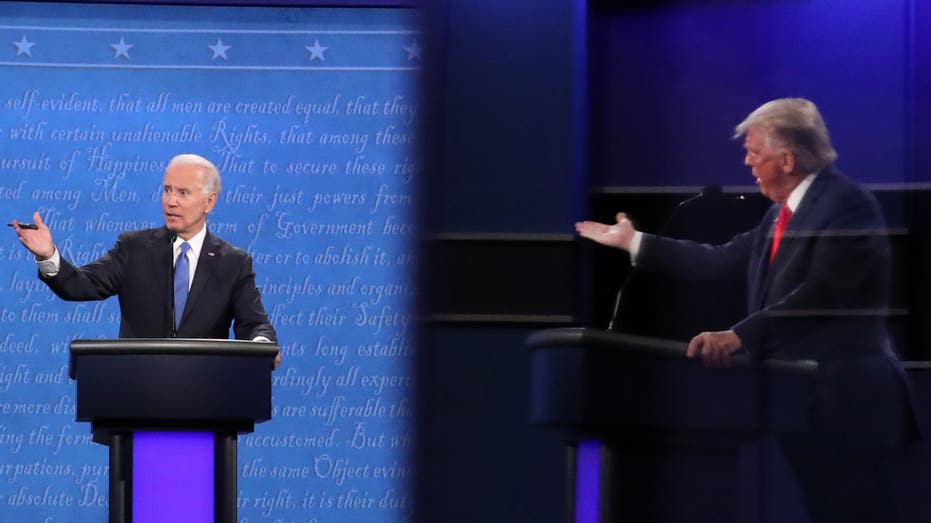

President Biden and former President Donald Trump participate in the final presidential debate at Belmont University on Oct. 22, 2020, in Nashville, Tennessee. (Photo by Chip Somodevilla/Getty Images / Getty Images)

More than $3.4 trillion in individual income and estate tax cuts are set to expire next year if Congress does not act.

Both Biden and Trump – the presumptive Democratic and Republican nominees – have already laid out how they would handle the lapsing Tax Cuts and Jobs Act in 2025 if they are elected to a second term.

Here's everything voters need to know about their positions on the coming tax cliff.

Joe Biden

Biden has said that he would allow the tax cuts for the wealthy to expire, while preserving the reductions for those making less than $400,000.

"Donald Trump was very proud of his $2 trillion tax cut that overwhelmingly benefited the wealthy and biggest corporations and exploded the federal debt. That tax cut is going to expire. If I’m reelected, it’s going to stay expired," Biden wrote on X in April.

BIDEN TRAILS TRUMP IN MOST BATTLEGROUND STATES AS VOTERS SOUR ON THE US ECONOMY

In addition to lowering the top tax bracket for wealthy Americans, the Trump-era law raised the thresholds for several income tax brackets – essentially lowering the liability for many households. The expiration of the tax law on Dec. 31, 2025, will mean that many Americans will be forced to pay anywhere between 1% to 4% more in taxes unless certain provisions are extended or made permanent, according to the Tax Foundation, a nonprofit group that advocates for lower taxes.

President Joe Biden speaks at the Pieper-Hillside Boys & Girls Club in Milwaukee, Wisconsin on March 13, 2024. (Alex Wroblewski for The Washington Post via Getty Images) / Getty Images)

Biden has proposed offsetting that cost by raising taxes on wealthy Americans and big corporations. While the president has not yet released a blueprint for how to address the upcoming tax cliff, he called for a number of tax hikes in his fiscal 2025 budget proposal.

That includes raising the top individual income tax rate to 39.6% from 37%, implementing a 25% minimum tax rate on households worth more than $100 million, raising the capital gains tax rate, quadrupling the corporate stock buyback tax to 4%, raising the corporate tax rate to 28%, increasing the Medicare tax paid by wealthy Americans, implementing a global minimum tax on multinational corporations and closing the carried interest loophole used by private equity and hedge fund managers.

"Biden's stance is fairly predictable: no new taxes for those earning under $400,000, with a focus on raising corporate rates and championing a global minimum tax," John Gimigliano, principal-in-charge of the federal tax legislative and regulatory services group at KPMG, told FOX Business.

BIDEN VOWS TO LET TRUMP-ERA TAX CUTS TO EXPIRE, MEANING HIGHER RATES FOR MANY

The Congressional Budget Office estimates extending the TCJA would add roughly $3.7 trillion to the federal budget deficit.

Donald Trump

Trump has pledged to make the entirety of the tax law permanent if he is re-elected in November and has slammed Biden for his position.

"He wants to let our tax cuts expire," Trump said at a rally last month in New Jersey. "Instead of a Biden tax hike, I’ll give you a Trump middle-class, upper-class, lower-class, business-class — big tax cut. You’re going to have the biggest tax cut."

Former President Donald Trump speaks to reporters before his speech at the annual Conservative Political Action Conference (CPAC) at Gaylord National Resort & Convention Center on March 4, 2023, in National Harbor, Maryland. (Anna Moneymaker/Getty Images / Getty Images)

Additionally, Trump has promised to eliminate taxes on tips for service workers.

"This is the first time I've said this, and for those hotel workers and people that get tips, you're going to be very happy, because when I get to office we are going to not charge taxes on tips," Trump said during a rally in Las Vegas earlier in June.

Beyond that, the former president has not yet laid out a clear vision for taxes should he win the November election.

"Trump remains the wildcard," Gimigliano said. "While he's been vocal about new tariffs, his broader tax strategy is less clear. We can expect him to push for extending the 2025 tax cuts, but the real question is how he plans to offset the substantial cost. This debate could offer crucial insights into both candidates' fiscal philosophies – or leave us all still guessing."

Fox News Channel will air the CNN Presidential Debate Simulcast at 9:00 p.m. ET on Thursday, June 27.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Tax brackets for single individuals pre-TCJA:

The individual income tax brackets in 2017, before Trump's tax law took effect:

- 10%: Taxable income up to $9,525

- 15%: Taxable income over $9,525

- 25%: Taxable income over $38,700

- 28%: Taxable income over $93,700

- 33%: Taxable income over $195,450

- 35%: Taxable income over $424,950

- 39.6%: Taxable income over $426,700

Tax brackets for single individuals under TCJA:

The individual income tax brackets in 2024, under current tax law:

- 10%: Taxable income up to $11,600

- 12%: Taxable income over $11,600

- 22%: Taxable income over $47,150

- 24%: Taxable income over $100,525

- 32%: Taxable income over $191,950

- 35%: Taxable income over $243,725

- 37%: Taxable income over $609,350