Trump's tax bill: Unknown details that could impact you

The GOP will release the specific details of its long-awaited tax reform bill on Thursday, which President Donald Trump said this week he hopes will be approved by the House of Representatives by Thanksgiving.

In a budget resolution approved last month by both chambers of Congress, lawmakers set aside $1.5 trillion for a tax cut, but Republicans have been working on ironing out key details up until the final hour, even delaying the release of the plan by one day.

Here are some important things to watch for when the details are finally released.

Corporate tax cut implementation

The corporate tax rate is largely expected to be reduced by 15 percentage points to 20%. However, how that reduction is implemented has been up for debate throughout recent days. There have been discussions among lawmakers about a gradual phase-in of the reduction, meaning the rate would be lowered slowly to the 20% level over the course of a few years, as opposed to being cut by 15 percentage points outright.

The chosen method could have a significant impact on U.S. economic growth.

“A phase-in would reduce the economic growth impact of the cut,” Chris Edwards, director of tax policy studies at the Cato Institute and editor of DownsizingGovernment.org, told FOX Business. “An immediate cut from 35% to 20% would be a huge shot in the arm for American business confidence, and would drive increases in capital investment and hiring for years to come.”

State and local tax deductions

The Trump administration and the tax bill’s writers initially said they planned on eliminating the deduction for state and local taxes (SALT). That announcement incited pushback from a slew of Republican and Democratic lawmakers in high-tax states like New York and New Jersey, whose constituents would experience the biggest impact from eliminating the deduction.

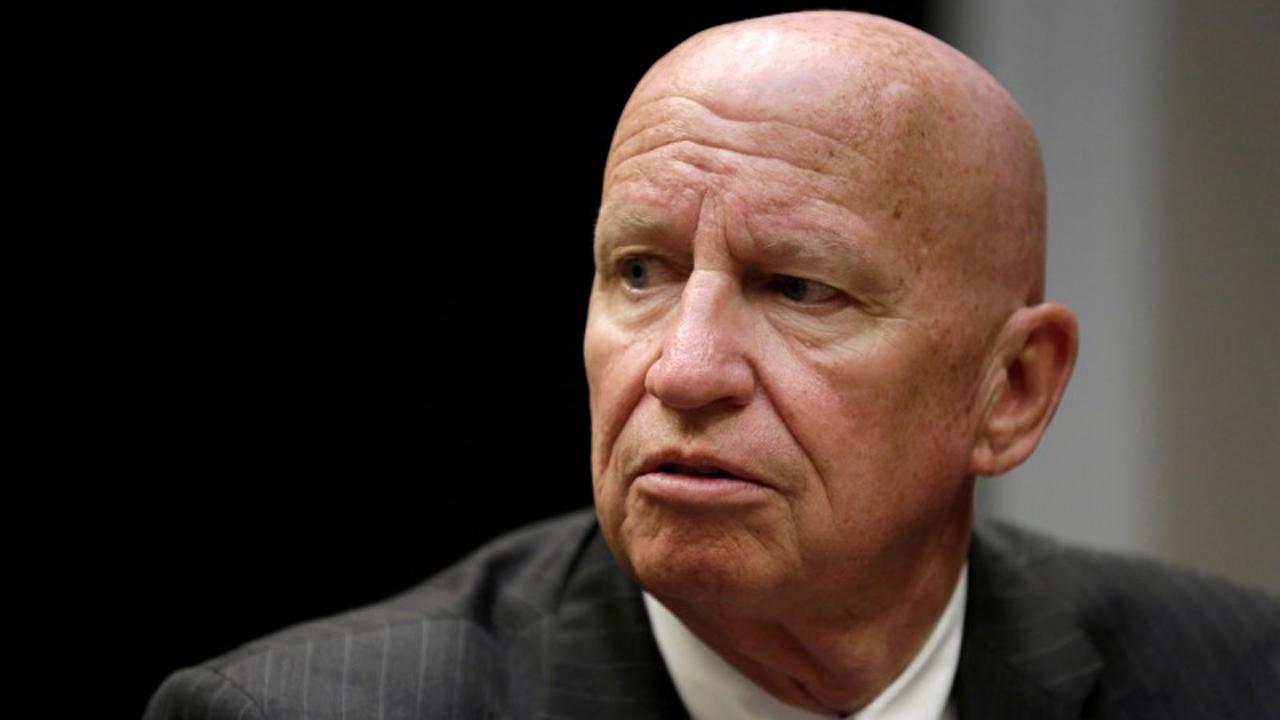

During an interview on Hugh Hewitt’s radio show Tuesday, House Ways and Means Committee Chair Rep. Kevin Brady (R-Texas) said that the GOP plans to maintain the deduction for property taxes, but not for other state and local taxes.

Rep. Tom MacArthur (R-N.J.) told FOX Business on Wednesday that property deductions would definitely remain, but refused to comment on whether SALT would be eliminated in its entirety.

The future of 401(K) savings

The Trump administration and lawmakers have discussed reducing the 401(k) tax-deferred contribution limit for older Americans to $2,400. Currently, the level for the so-called “catch up” contribution for those over the age of 50 is $6,000.

“Will the GOP risk the wrath of 50 million 401(k) plan contributors and fiddle with tax-deductibility?” asked Edwards. “If they do, they had better offer some new and better savings opportunities. The GOP plan may include Universal Savings Accounts, which are like supercharged Roth IRAs, and would be an exciting addition to financial security for millions of families.”

President Trump initially said in a tweet he would not touch 401(k) plans, but Rep. Brady later said that lawmakers were looking at a number of ways to encourage Americans to start saving for retirement sooner.

Income levels

While the main three tax brackets have been public for quite some time, at 12%, 25% and 35%, what Americans don’t know is what income levels will correspond to each of those brackets. Once those numbers are released, it will be easier to evaluate how the reformed tax code can be expected to impact the finances of middle-income individuals.

Fourth bracket?

The GOP and the president have discussed the possibility of adding in a fourth tax bracket on the highest-earning Americans, largely projected to fall between 35% and 39.6%. House Speaker Paul Ryan (R-Wis.) said late last month that the bill would have a fourth bracket in order to ensure that the middle class received all of the bill’s intended benefits.

However, Trump said he would “rather not” implement a surtax on the wealthy, telling FOX Business "the only reason I would have it ... is if, for any reason, I feel the middle class is not being properly taken care of."

Neither the administration nor the GOP have given a sense of what that rate would be nor what income levels would be impacted.

Estate tax

While the initial blueprint called for the complete repeal of the estate tax, also known as the death tax, Republicans seem to have softened their stance on the issue, after even Treasury Secretary Steven Mnuchin said its elimination would largely serve the wealthy.

As Edwards pointed out, the GOP could “bend to the wishes of a few moderates who don’t want a full repeal.” That could mean simply raising the limit so families could keep more untaxed dollars.