US debt explosion funded by Americans, not foreign countries, posing risks to economic growth

US treasury holdings by China and Japan have been falling

Pullback ‘double whammy’ on jobs, debt will create economic ‘storm’: Brenberg

Fox News contributor and The King's College economics professor Brian Brenberg reacts to November's ADP report.

The explosion in U.S. government borrowing over the last 15 years has been fueled not by lending from China and Japan but through the purchase of treasuries by U.S. financial institutions, state governments and other domestic entities.

Experts said this radical shift in borrowing trends is one that poses a significant long-term threat to U.S. economic growth.

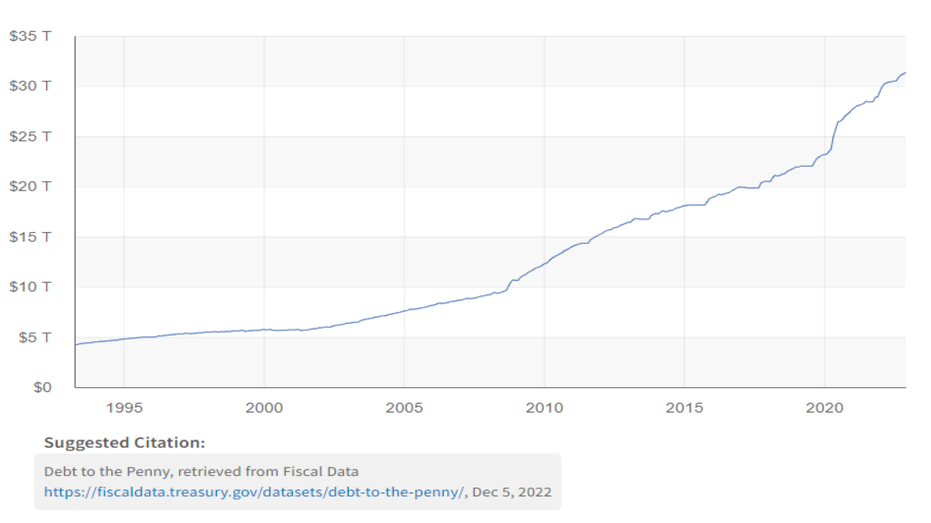

Federal borrowing has more than tripled since the housing crisis in 2008. Before the housing bust, the government was $9 trillion in debt, a number that ballooned to $31 trillion this year. But while new government debt is usually thought of in terms of borrowing from overseas, most of the new debt seen since the housing crisis has been funded by domestic entities.

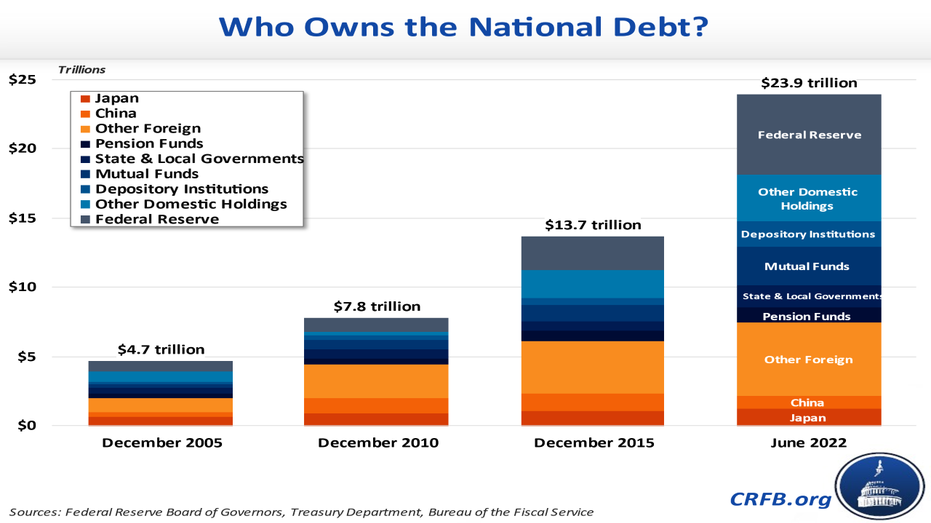

In late 2010, shortly after the housing crisis, federal debt owned by the public totaled $7.8 trillion, and close to two-thirds of that represented lending from Japan, China and other foreign nations. By the summer of 2022, total debt owned by the public more than tripled to $23.9 trillion – a jump of $16 trillion that was mostly financed by U.S. banks, mutual and pension funds, state and local governments and other domestic entities, according to federal data analyzed by the Committee for a Responsible Federal Budget (CRFB).

DEBT CEILING BOMB NEARS AS GOVERNMENT SPENDING BALLOONS

The Biden administration is wrestling with a $31 trillion national debt that is growing thanks to borrowing from domestic U.S. entities.

Over that same time period, the amount of U.S. debt held by China and Japan fell and borrowing from other nations accounted for just $3 trillion of the $16 trillion increase.

Of the $31 trillion national debt, foreign nations account for more than $7 trillion, nearly $7 trillion more is debt created by the government borrowing from itself, $5.5 trillion is held by the Federal Reserve, and more than $10 trillion is held by U.S. companies, insurers, state governments and other domestic entities.

Analysts say the shift in who lends to the U.S. government in part reflects the waning interest that foreign nations have in financing the ever-expanding U.S. debt.

"Foreign governments are waking up to the reality that the United States government is never going to be able to repay all this debt," Heritage Foundation economics research fellow E.J. Antoni told FOX Business. Antoni added that China, Japan and other countries represent a much smaller proportion of U.S. debt holders today because their central banks are buying up their own domestic debt, which means there is less of an international market for treasuries.

DEMOCRATS COULD ADD $500B IN NEW DEBT DURING FINAL WEEKS OF CONGRESSIONAL CONTROL

Federal debt held by the public created since the housing crisis has mostly been the result of borrowing from U.S. domestic entities, not foreign nations. (Committee for a Responsible Federal Budget)

For those reasons, the U.S. has turned to domestic lenders, a move that analysts said will likely have serious repercussions for U.S. economic growth. CRFB President Maya MacGuineas said locking up domestic funds to buy treasuries is a drag on growth that makes the idea of paying down the federal debt through expanded economic activity even more daunting.

"Now that domestic investors are mainly buying our debt, they aren’t investing elsewhere in our economy, and the economy grows slower as a result," she told FOX Business. "Under either scenario, our borrowing causes us to grow less or keep less of the gains, and interest payments on the debt soar."

"As interest payments grow by hundreds of billions of dollars per year, you wonder when our lawmakers will stop their borrowing frenzy," she added.

BIDEN'S DEFICIT REDUCTION BRAG MASKS COLOSSAL WAVE OF NEW SPENDING

Total U.S. government debt exploded after the housing crisis in 2008 and has continued to surge higher. (Treasury Department)

Antoni at the Heritage Foundation agreed that the U.S. government is now effectively borrowing from U.S. businesses to stay afloat, which reduces the amount of "productive activity" in the country.

"When the government borrows money from the private sector, there’s less money available to provide companies," he said.

CLICK HERE TO ADD THE FOX BUSINESS APP

Antoni said the trillions of dollars being added in debt financed by domestic U.S. companies could also pose risks for those companies if the U.S. ever hits a debt crisis in which both domestic and foreign lenders no longer have the capacity to keep up with government spending demands.

"That will be a pretty darn bad day for the global financial economy," Antoni said.