US, Europe tussle over frenzy of clean-energy subsidies

EU competition chief calls U.S. legislation ‘toxic,’ says bloc is preparing firm response

White House says Biden will fix ‘glitches’ in Inflation Reduction Act, address Europe’s concerns without going to Congress

White House press secretary Karine Jean-Pierre said Monday that President Biden had ways to address Europe's concerns about the Inflation Reduction Act without going to Congress.

The already-frantic global competition for green-energy investment escalated Wednesday with the European Union’s competition chief calling massive incentives from the U.S. "toxic," as the bloc prepares its own countermeasures.

The U.S. incentives, included in last year’s Inflation Reduction Act, have spurred companies to rethink where to spend billions of investment dollars and increasingly prompted America’s trading partners to consider their own subsidies.

On Wednesday, the EU’s Margrethe Vestager said more climate-related spending is good for the environment and European companies, but the act contains what she called questionable provisions that run the risk of diluting the shared sense of purpose on tackling climate change.

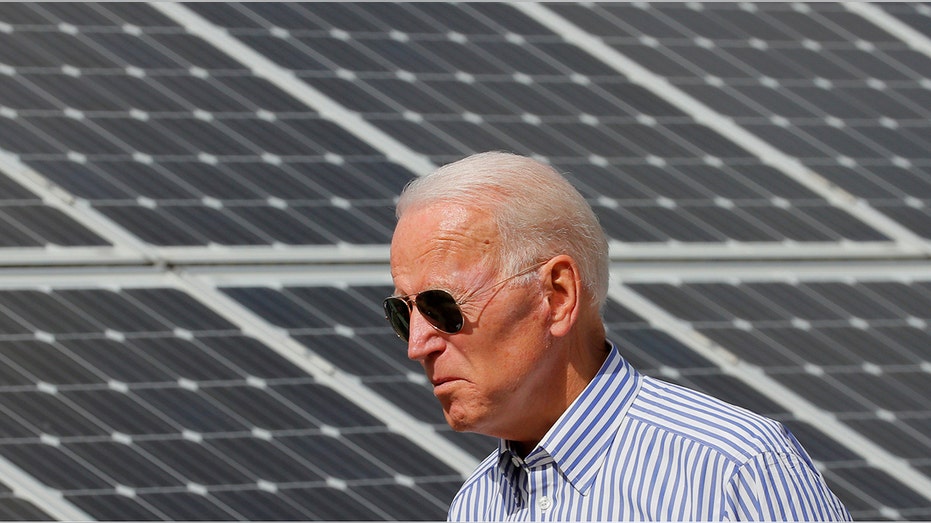

The Inflation Reduction Act includes $369 billion in incentives and funding for clean energy, mostly via tax credits for projects such as solar farms. REUTERS/Brian Snyder/File Photo

The EU’s response to the legislation "will be firm, but of course remain proportionate," Ms. Vestager said at a clean-tech conference in Brussels. The bloc wouldn’t "go down the slippery slope" of using procurement to favor European businesses, she said.

IMPACT OF GEOPOLITICAL TUMULT ON BUSINESSES TO CONTINUE IN 2023, SAY RISK EXPERTS

She later told reporters on the sidelines of the conference that the U.S. legislation was "toxic" in part because of Europe’s high and volatile energy prices, which jumped last year as Russia squeezed the continent’s natural-gas supplies.

Ms. Vestager said the EU’s plan to relax government-subsidy rules is broadly expected to focus on the same clean-tech sectors as the U.S. legislation. Adaptations to state aid rules "must be targeted to the sectors that are really strategic," she said.

Commerce Secretary Gina Raimondo, left, speaks with European Commission Executive Vice President Margrethe Vestager during a U.S.-EU Stakeholder Dialogue during the Trade and Technology Council (TTC) Ministerial Meeting, Monday, Dec. 5, 2022, in Coll (AP Newsroom)

Companies such as Swiss solar-panel maker Meyer Burger Technology AG and the battery-making unit of Turkey’s Kontrolmatik Technologies Energy and Engineering say the U.S. incentives have already prompted them to shift their investments. They also say that future investment in the U.S. could come at the expense of their home regions.

"You can spend every dollar or euro only once," said Gunter Erfurt, Meyer Burger’s chief executive.

The Inflation Reduction Act includes $369 billion in incentives and funding for clean energy, mostly via tax credits for projects ranging from solar farms to battery manufacturing to facilities that remove climate-warming carbon dioxide from the air.

Global renewable-energy manufacturers and developers have announced tens of billions of dollars in new U.S. investments in the past half year alone, with many saying the subsidies spurred their decisions.

The shifting investment landscape has prompted a backlash in Europe, Asia and Canada, with some governments exploring policies to keep green investment at home. Politicians and companies like South Korea’s Hyundai Motor Co. argue some of the incentives are unfair for favoring manufacturers that produce in the U.S., and are lobbying for the rules to be interpreted in ways that would get them a bigger chunk of support.

U.S. President Joe Biden, left, listens to Hyundai Motor Group Executive Chair Euisun Chung, at the Grand Hyatt Seoul, Sunday, May 22, 2022, in Seoul. (AP Photo/Evan Vucci) (AP Photo/Evan Vucci / AP Newsroom)

SOUTH KOREA SEEKS 3-YEAR GRACE PERIOD ON US EV TAX INCENTIVE LAW

European Commission President Ursula von der Leyen said last week that the bloc intended to develop its own industrial plan that would loosen controls on state aid and offer more funding for the production of clean technology.

Multinational companies are seizing on the moment to press foreign lawmakers for subsidies similar to those in the U.S.

At the World Economic Forum last week, in the Swiss mountain town of Davos, executives clustered around Sen. Joe Manchin (D., W.Va.), one of the principal proponents of the U.S. legislation. Henrik Andersen, the chief executive officer of Danish company Vestas Wind Systems A/S, one of the world’s biggest wind-turbine makers, said he was telling other leaders in Europe to copy the U.S. law and just give it a new name. "Hero," he said, pointing to Mr. Manchin.

Sen. Joe Manchin, D-W.Va.speaks on a panel at the World Economic Forum in Davos, Switzerland Tuesday, Jan. 17, 2023. The annual meeting of the World Economic Forum is taking place in Davos from Jan. 16 until Jan. 20, 2023. (AP Photo/Markus Schreiber) (AP Photo/Markus Schreiber / AP Newsroom)

"Instead of moaning and groaning, Europe should come out with something similar," Mr. Andersen said later in an interview with the Journal.

MANCHIN SLAMS TREASURY DEPARTMENT FOR DELAY ON ELECTRIC VEHICLE TAX CREDITS

But Mr. Manchin was also dealing with blowback from French, German and other delegates at the conference, who are afraid that their companies and communities will lose out if money and jobs flow across the Atlantic.

"We didn’t write this bill intending to harm anybody," Mr. Manchin said in an interview. "I’m talking to France, I’m talking to the U.K., I’m talking to everybody."

Mr. Manchin is also wrangling at home with the Biden administration as the Treasury Department sets rules for exactly who qualifies for the act’s tax incentives. He plans to introduce a bill to block the Treasury from issuing new tax credits for electric vehicles with batteries or other components made outside the U.S. The senator has bemoaned what he sees as loopholes for foreign-made vehicles, saying they undermine attempts to spur domestic production. The bill faces an uphill battle.

Some economists and policy makers warn that wide-ranging government support such as contained in the act isn’t always effective and doesn’t necessarily create the strong industries it is supposed to. Projects might not get built and companies could end up failing, wasting money, they argue.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

But for now, executives and industry experts say the cost of locating clean-energy projects in the U.S. has plummeted, making the country one of the most attractive places in the world to invest. The credits could reduce the cost of manufacturing blades for wind turbines in the U.S. by 34%, solar panels by 29% and battery cells by 28%, according to estimates from energy consulting firm Wood Mackenzie.

More than $35 billion dollars in manufacturing investment for solar, wind and battery components in the U.S. has been announced since the law was signed, according to an analysis by The Wall Street Journal. In the last quarter of 2022, utility-scale solar, wind and battery power developers unveiled more than $40 billion in projects, more than the total investment for all such developments installed in 2021, according to estimates from business lobby the American Clean Power Association.

Andrés Gluski, CEO of Arlington, Va.-based renewable-energy supplier AES Corp., said the company is putting about 70% of its investment into the U.S. already, up from 50% a few years ago. "The IRA will tilt more to the U.S.," Mr. Gluski said, using an acronym for the act.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AES | THE AES CORP. | 16.06 | +0.01 | +0.06% |

| APD | AIR PRODUCTS & CHEMICALS INC. | 286.30 | +3.23 | +1.14% |

In December, AES and industrial-gas manufacturer Air Products & Chemicals Inc. announced plans to build a $4 billion renewable-powered hydrogen factory in Texas, which they said the tax credits make economical.

Tempe, Ariz.-based First Solar Inc., the U.S.’s biggest solar manufacturer, also says it pivoted focus quickly to the U.S. from other markets like India and Europe, unveiling $1.3 billion in new or expanded facilities in Alabama and Ohio.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| FSLR | FIRST SOLAR INC. | 222.13 | +3.40 | +1.55% |

"Unfortunately, Europe’s challenges can’t be solved by incentives alone," said Mark Widmar, First Solar’s CEO, noting the region’s stifling red tape and high energy costs, which have risen in the fallout from Russia’s war on Ukraine.

Before the advent of U.S. subsidies, Turkey’s Kontrolmatik was considering expansions to its first battery factory, which it is building outside of Ankara, as well as a new plant in the U.S., says Bahadir Yetki, chief executive of Kontrolmatik’s U.S. arm.

Kontrolmatik moved to increase the proposed capacity of the U.S. factory and has said it expects to receive tax credits adding up to almost a billion dollars through 2032, when the incentives expire.

"Instead of investing in other factories elsewhere, we will be investing more in the United States," said Mr. Yetki.

CLICK HERE TO GET THE FOX BUSINESS APP

Meyer Burger also decided to more than triple the size of its planned U.S. solar-panel manufacturing factory in Arizona after seeing the clean-energy legislation get passed.

The Swiss company already has factories in eastern Germany and it is still on track for a big increase in capacity there. But Mr. Erfurt, the CEO, said that soon Meyer Burger would be making decisions on where to place its next factory, and would have to choose between the U.S. and Europe.

He said he is encouraged by early announcements from the EU, which have the "potential to be a potent response to the IRA."

But if that response turns out to be insufficient to let Meyer Burger compete with incentives in places like the U.S. and China, then "it’s more unlikely that further expansion is happening in Europe," he said.