US executives 2024 election talk rises amid policy uncertainty

Executives are noting the uncertainty over the direction of federal policy in areas like corporate taxes

Kamala Harris is campaigning on vibes, not policy: Marc Thiessen

Fox News contributor Marc Thiessen discusses the importance of Kamala Harris' DNC speech on 'Varney & Co.'

Top executives at U.S. companies are talking more about the upcoming presidential election than they did four years ago as a wide policy gap between the campaigns of Vice President Kamala Harris and former President Trump prompts questions about how taxes, tariffs and pricing power will impact corporate America's bottom line.

Executives' mentions of "election" or "White House" in the last two months were up 34% compared to the corresponding period in 2020, according to an LSEG Workspace screen of S&P 500 companies.

A separate analysis by FactSet found that the most talked about policy topics in executives' discussions of "elections" during second-quarter earnings calls were energy and carbon emissions, including renewables and electric vehicles, the Inflation Reduction Act, tariffs and trade.

Sam Stovall, chief investment strategist at CFRA Research, said in a Reuters report, "Company profits could be affected materially, depending on which party gains the White House, and especially if it is either a blue or red wave."

Leading executives at U.S. companies are increasingly addressing what uncertainty about federal policy after this fall's election means for their businesses. (Getty Images / Getty Images)

The uncertainty over future federal policy comes after President Biden's withdrawal from the race in July and his replacement with Harris at the top of the Democratic ticket. Harris' campaign has released some economic policies, but much of her agenda remains unclear.

"We have an idea as to what Trump is planning, but we have less clarity on Harris' plan," Robert Pavlik, senior portfolio manager at Dakota Wealth Management, said in the report. "We have a belief that it's going to be somewhat [a] continuation of the Biden administration, but a little different."

TRUMP VOWS TO REPEAL NEW EPA POWER PLANT RULE

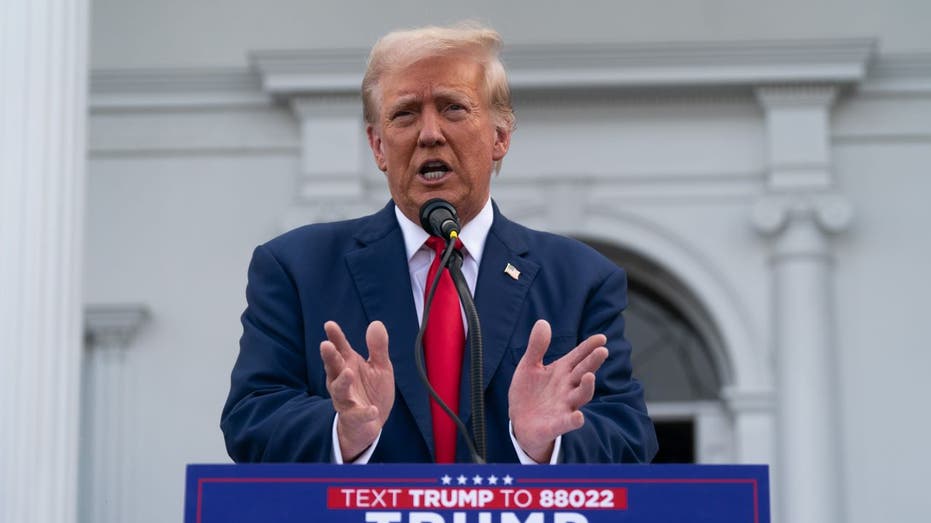

Former President Trump and congressional Republicans lowered the corporate tax rate from 35% to 21%. (Adam Gray/Getty Images / Getty Images)

Citi Research said in a note that taxes and tariffs, which are taxes on imported goods, are the most relevant policy areas to the fundamentals of U.S. equities, adding that higher corporate tax rates pose a bigger risk to companies' earnings than tariffs do.

"It all comes down to taxes… that's the rally killer for this market," David Wagner, portfolio manager at Aptus Capital Advisors, said in the report. "The new corporate tax rate is an instant haircut to earnings growth. That's why a lot of these companies are really starting to talk about this to get ahead of the curve."

HARRIS CALLS FOR RAISING CORPORATE TAX RATES TO 28%

Vice President Kamala Harris' campaign said she supports raising the corporate tax rate from 21% to 28%. (Bing Guan/Bloomberg via Getty Images / Getty Images)

During his first term in office, former President Trump and congressional Republicans enacted the Tax Cuts and Jobs Act, which cut the corporate tax rate from 35% to 21%. Unlike some other tax reforms included in the legislation that were temporary in nature to comply with Congress' reconciliation rules and have either expired or are scheduled to do so, the corporate income tax rate reduction was a permanent policy.

Harris has proposed raising the corporate tax rate to 28%, aligning herself with President Biden's budget in what marks a departure from her unsuccessful 2020 presidential campaign's call for the rate to be returned to 35%.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

While much of the focus has been on the presidential race, the ability of either Harris or Trump to advance their preferred policies will depend in large part on whether Democrats or Republicans control Congress.

"The key will be who controls the House and the Senate, irrespective of who is the president," said Thomas Hayes, chairman and managing member at Great Hill Capital, LLC, in the report.

Reuters contributed to this report.