Warnock, Ossoff victories in Georgia could bring state's top tax rate to 55%

Biden's tax-the-rich agenda hinges on the outcome of Georgia's 2 Senate runoffs

If Democratic candidates Raphael Warnock and Jon Ossoff win the Georgia Senate runoffs in January, wealthy Americans living in the Peach State could see their top tax rate climb to 55%, according to a new analysis.

Party control of the Senate hinges on the pair of respective Jan. 5 contests between incumbent Republican Sens. Kelly Loeffler and David Perdue and Warnock and Ossoff. If Warnock and Ossoff win, Democrats would secure a 50-50 split in the upper chamber, with Vice President-elect Kamala Harris then casting tie-breaking votes.

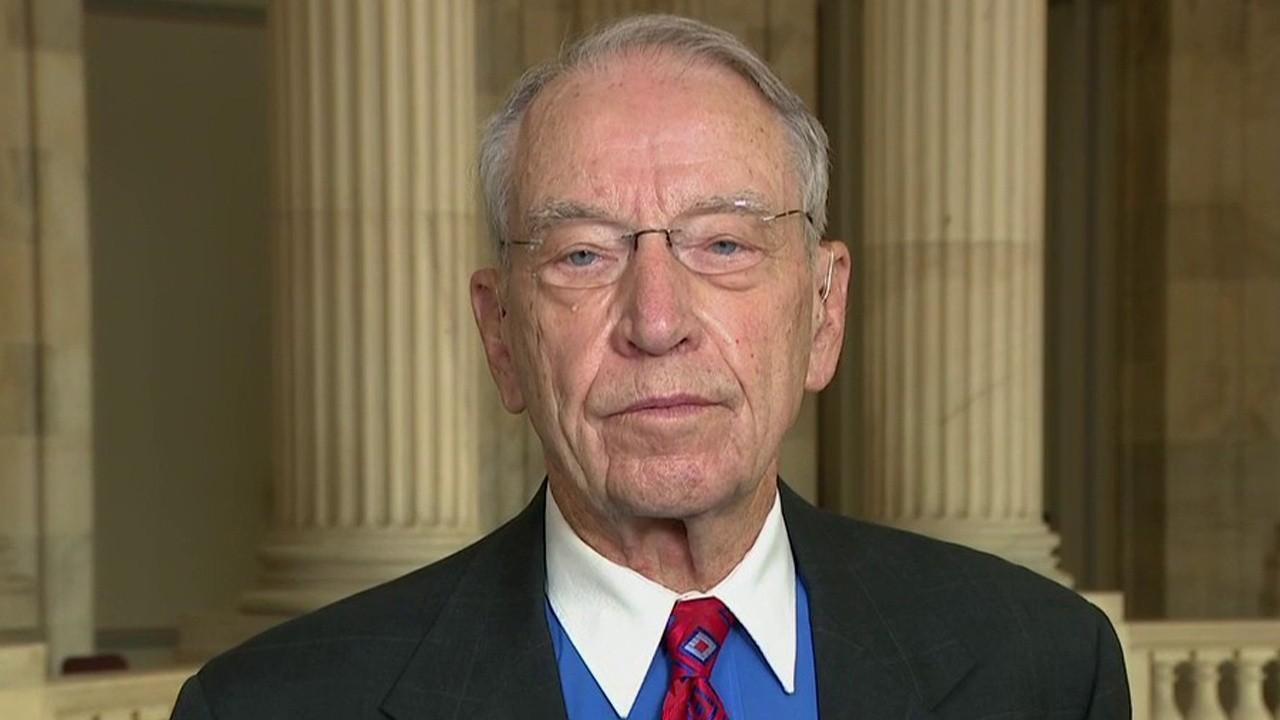

“We are the last line of defense,” Perdue said last week during an interview on "Fox & Friends." “These two seats here will determine the majority in the Senate. Because of that, we're going to deny [Sen. Chuck] Schumer that majority, protect everything that President Trump has accomplished in the last four years, and make sure that the people of Georgia know that.”

GOP VIEWS GEORGIA SENATE RUNOFFS AS 'FIREWALL' AGAINST BIDEN'S AGENDA

If Republicans maintain control of the Senate, President-elect Joe Biden's tax-the-rich agenda faces an immediate roadblock. Experts have said that Biden's ability to impose new taxes on individuals earning more than $400,000 may be severely limited if the GOP retains control of the upper chamber.

“One thing to remember in presidential tax plans, the president doesn’t write the tax code, Congress writes the tax code," said John Gimigliano, head of tax legislative services at KPMG. "So, we can take Biden’s tax plan as important directionally but not necessarily as gospel. While we may have a tax plan from President-elect Biden, without a Democratic sweep in Congress, much of his proposed agenda will be moot.”

Biden has unveiled a multitrillion-dollar agenda that would be funded in large part by higher taxes on wealthy U.S. households – which he describes as anyone earning more than $400,000 annually – and corporations. That includes higher income tax rates, an expansion of the payroll tax for Social Security, new tax credits and fewer deductions.

SENATE REPUBLICANS TOUT MAJOR INVESTMENT IN GEORGIA RUNOFF ELECTIONS

Under that plan, Georgians would face a top tax rate of more than 55%, according to an analysis by Americans for Tax Reform.

Biden has repeatedly said he would roll back Trump's 2017 Tax Cuts and Jobs Act and raise the corporate tax rate to 28% from 21%, restore the top individual tax rate to 39.6% from 37%, tax capital gains as ordinary income, cap deductions for high earners, expand the Earned Income Tax Credit for workers over the age of 65 and impose the Social Security payroll tax on wages above $400,000.

But under a divided Congress, those tax increases are likely off the table.

"While Ossoff and Warnock would support these tax increases on Georgians, Republican Senators Kelly Loeffler and David Perdue will hold firm against the Biden plan of higher taxes on families and businesses," the analysis said.

CLICK HERE FOR THE LATEST FOX NEWS REPORTING ON THE GEORGIA RUNOFFS