Home sale cancellations hit highest rate since start of pandemic

Higher mortgage rates, inflation contributing to cancellations

More real estate inventory 'definitely' coming to market: NY real estate agent

Real estate agent Kirsten Jordan urges sellers should remember it's no longer a 'super aspirational' market, and to take their listings seriously.

Approximately 60,000 home purchase agreements fell through in June, according to a new analysis by Redfin.

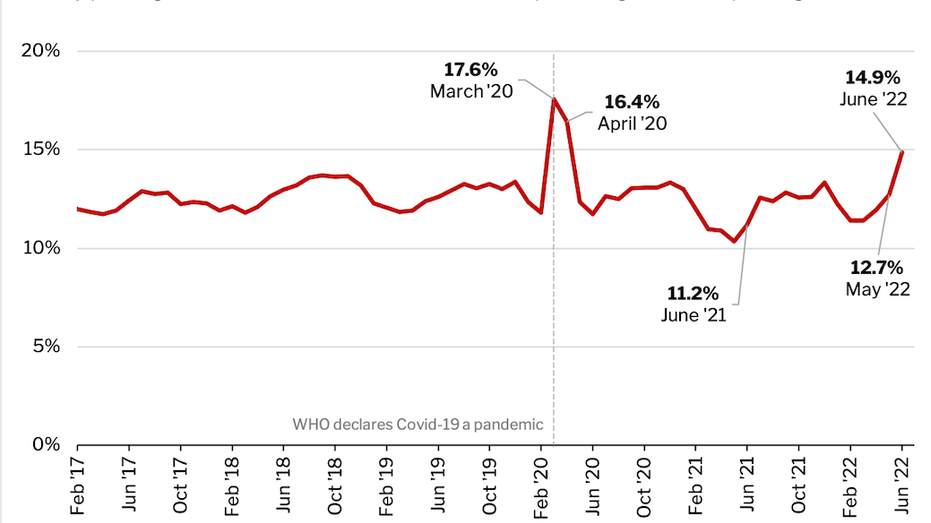

The figure is equivalent to 14.9% of homes that went under contract during the month, an increase from 12.7% in May and 11.2% a year ago.

Approximately 60,000 home purchase agreements nationwide fell through in June, equivalent to 14.9% of homes that went under contract during the month, according to an analysis by Redfin. (Redfin)

June's percentage marks the highest cancellation rate since March and April 2020, when the housing market was rattled by the onset of the COVID-19 pandemic. Approximately 17.6% of homes under contract in March 2020 and 16.4% of homes under contract in April 2020 fell through.

FIXER-UPPER HOMES COST 45% LESS THAN COMPARABLE TURNKEY HOMES: STUDY

Redfin deputy chief economist Taylor Marr attributes June's increase to a slowdown in housing market competition, which has given homebuyers more room to negotiate.

"Buyers are increasingly keeping rather than waiving inspection and appraisal contingencies. That gives them the flexibility to call the deal off if issues arise during the homebuying process," Marr says.

In addition, Marr said that some homebuyers are being priced out of their deals due to higher mortgage rates. Following a 75 basis point hike by the Federal Reserve in June, the average commitment rate on a 30-year fixed mortgage climbed toward 6%.

"When mortgage rates shot up to almost 6% in June, we saw a number of buyers back out of deals," Lindsay Garcia, a Redfin real estate agent in Miami, said. "Some had to bow out because they could no longer get a loan due to the jump in rates. Buyers are also more skittish than usual due to economic uncertainty."

Homebuyers were given some relief last week when mortgage rates fell to 5.3%, the largest one-week drop since 2008.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

In addition to purchase agreement cancellations, home builders have seen an uptick in cancellations.

According to a survey by John Burns Real Estate consulting, the national cancellation rate for home builders jumped to 14.5% in June, up from 10.4% in May and 6.5% a year ago. The figure is above 2018 levels but below the 16.5% cancellation rate hit in April 2020.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| LEN | LENNAR CORP. | 114.02 | -1.35 | -1.17% |

Lennar, which reported an 11.8% cancellation rate in the second quarter of 2022, has said it will adjust its pricing based on market conditions and increase incentives to make up for the cooling in demand.