Inflation causing increased ‘concern’ for homebuilders: NAHB CEO

Builder confidence took a steep drop in May: NAHB data

Inflation impacting new construction: NAHB CEO

National Association of Home Builders CEO Jerry Howard argues there's 'more than a one in three chance that we’re going to have a recession in the coming months.'

National Association of Home Builders CEO Jerry Howard said on Tuesday that he is "very concerned" over the new data showing a steep drop in new construction and warned that inflation is causing increased "concern" for the industry.

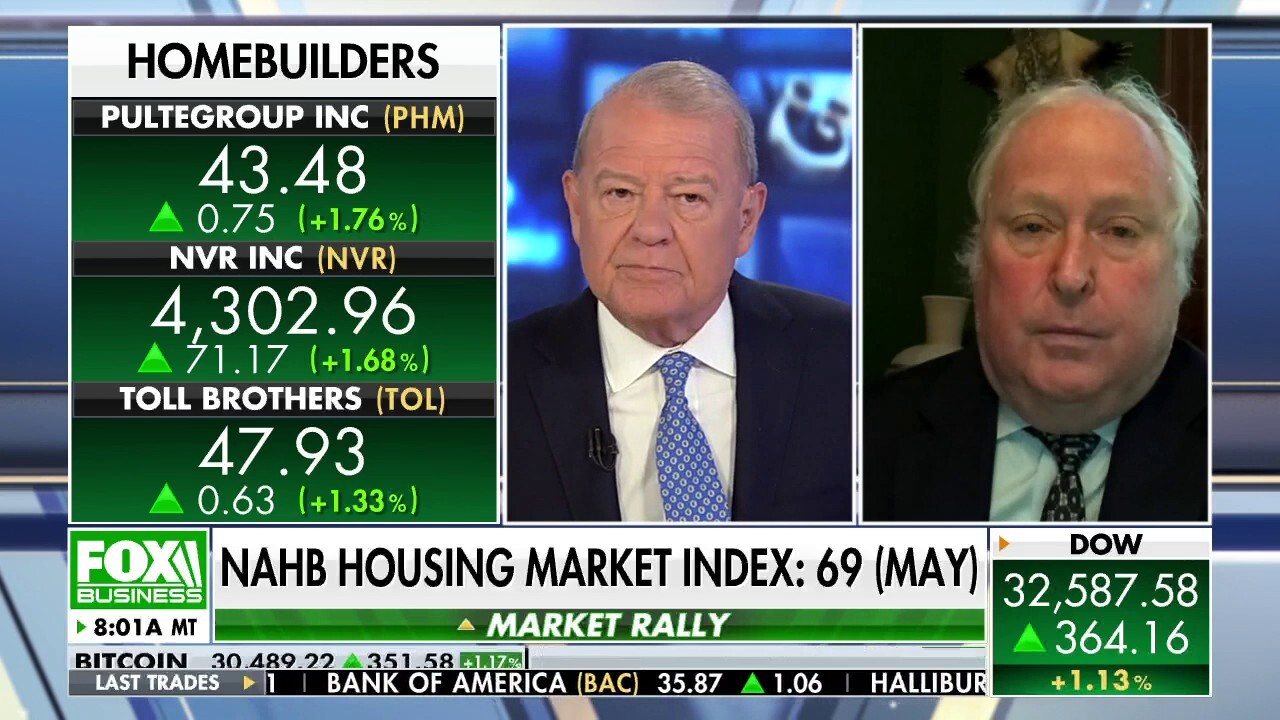

Howard made the comments on "Varney & Co." on Tuesday, shortly after the release of the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for May, which revealed that builder confidence in the market for newly-built single-family homes fell eight points to 69.

The association noted in a news release that the drop depicts the fifth straight month that builder sentiment has declined and is the lowest reading since June 2020.

The index can range between 0 and 100 with any print over 50 indicating positive sentiment. Any reading above 80 signals strong demand.

"We’re facing a perfect storm here," Howard told host Stuart Varney. "We have increased costs of construction. We have a supply chain that’s broken. We have inflation that’s bringing up interest rates for buyers and also interest rates for builders at the front end of the transaction."

National Association of Home Builders CEO Jerry Howard warns inflation is causing increased "concern" for the industry. (Fox News | iStock / iStock)

"Right now we are increasing our concern about inflation," he continued, noting that "we’re saying that there is more than a one in three chance that we’re going to have a recession in the coming months."

Howard provided the insight one week after it was revealed that inflation cooled on an annual basis for the first time in months in April, but rose more than expected as supply chain constraints, the Russian war in Ukraine and strong consumer demand continued to keep consumer prices running near a 40-year-high.

The Labor Department said Wednesday that the consumer price index, a broad measure of the price for everyday goods including gasoline, groceries and rents, rose 8.3% in April from a year ago, below the 8.5% year-over-year surge recorded in March. Prices jumped 0.3% in the one-month period from March.

Those figures were both higher than the 8.1% headline figure and 0.2% monthly gain forecast by Refinitiv economists.

Inflation for April hotter than expected

FOX Business' Cheryl Casone reports on the highly anticipated consumer price index report moments after the Labor Department posted the data.

NAHB noted in a news release that the "steep drop in May" is "a sign that the housing market is now slowing" as "growing affordability challenges in the form of rapidly rising interest rates, double-digit price increases for material costs and ongoing home price appreciation are taking a toll on buyer demand."

NAHB Chief Economist Robert Dietz pointed out that building material costs are up 19% compared to the same time last year and that in less than three months, mortgage rates have surged to a 12-year high.

INFLATION SOARS 8.3% IN APRIL, HOVERING NEAR 40-YEAR HIGH

Dietz also noted that based on current affordability conditions, less than half of new and existing home sales are affordable for a typical family.

"Entry-level and first-time homebuyers are especially bearing the brunt of this rapid rise in mortgage rates," he said.

For a 30-year, fixed-rate mortgage, the average rate you'll pay is 5.3%, according to Freddie Mac data as of May 12.

"In the months ahead, we expect monetary policy and inflation to discourage many consumers, weakening purchase demand and decelerating home price growth," Freddie Mac wrote.

Increasing 'concern' over inflation: National Association of Home Builders CEO

National Association of Home Builders CEO Jerry Howard says he's 'very concerned' over the new data showing a steep drop in new construction.

"We are starting to see more and more potential buyers walk away and say they just can’t afford to pay these prices," Howard told Varney on Tuesday.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"We’ve had escalator clauses in the contracts, builders have been trying to eat some of the increased costs, but now we are at a point where we can’t do that anymore," he continued.

He also noted that increasing mortgage rates have "a significant impact" on the industry "and once you get over a 5% mortgage rate, you see a real decline in demand, and we are seeing that start to happen."