‘Very hot’ housing market 'sustainable' if cost of building capped: Industry expert

National Association of Home Builders CEO argues that home prices are 'rising too fast'

Home prices are 'rising too fast': Industry expert

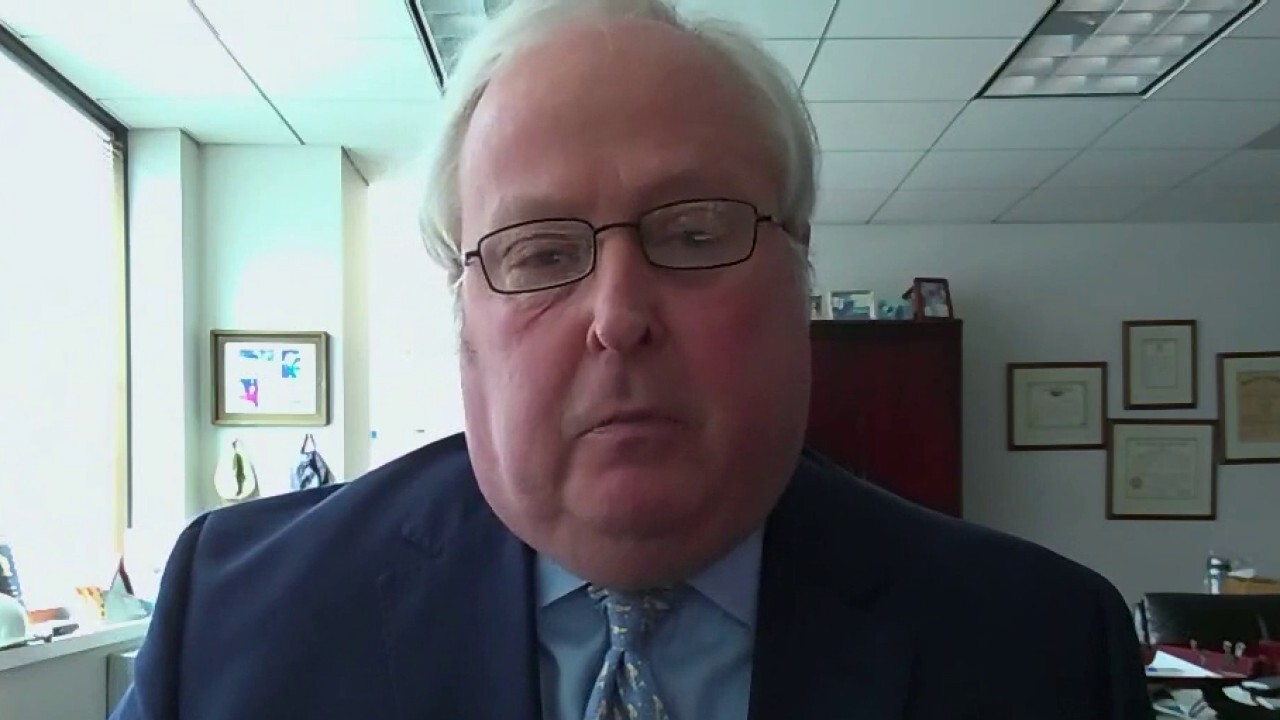

National Association of Home Builders CEO Jerry Howard attributed the spike in home prices to the 'complete breakdown in the supply chain for building materials.'

National Association of Home Builders CEO Jerry Howard noted on "Cavuto: Coast to Coast" on Tuesday that the housing supply shortage is driving increased prices for homes, and argued that it would be "much less inflationary" if supply increases to about six months of homes on the market.

He also stressed that the home prices are "rising too fast," and pointed out that the "very hot" housing market would be "sustainable" if the cost of building is capped.

"Prices are going up incrementally, way more than they should," Howard told host Neil Cavuto. "Obviously when people invest in the house, they hope the prices go up some and that's to be to be expected and to be hoped for, especially with the amount of demand we have out there right now — but they're rising too fast."

He explained that "the reason for that is a complete breakdown in the supply chain for building materials."

"Building materials across the board are going up," Howard said. "They continue to go up, but most importantly, lumber has gone up over 400 percent from where it was last year, and lumber is the number one commodity in a house."

RED-HOT LUMBER PRICES MAY COOL HOUSING BOOM

Hot housing market 'sustainable' if cost of building capped: Industry expert

National Association of Home Builders CEO Jerry Howard notes that the housing supply shortage is driving increased prices for homes and argues it would be 'much less inflationary' if supply increases to about six months of houses on the market.

U.S. home prices in March posted their biggest annual increase in more than 15 years as the COVID-19 pandemic sped up the flight from city centers to the suburbs, which also caused demand to outstrip an already tight supply.

HOUSING SHORTAGE CROPS UP AS MILLENNIALS START BUYING HOUSES

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| WOOD | ISHARES TRUST GLOBAL TIMBER & FORESTRY ET | 80.09 | -0.61 | -0.75% |

| XLB | MATERIALS SELECT SECTOR SPDR ETF | 52.84 | -0.18 | -0.34% |

Howard argued that the "supply shortage" is what’s driving the spike in home prices more than demand, and stressed that if supply is increased, "it'll cool things down" and make the housing market "much more sustainable."

On Tuesday it was revealed that home prices rose 13.2% year over year in March, according to the national Case-Shiller index, making for the largest increase since December 2005. Prices are now 32% above their 2006 peak.

The 20-city composite jumped 13% compared to a year ago, up from a 12% gain the previous month. All 20 of the cities in the index reported higher prices in March than in February with Phoenix (+20%), San Diego (+19.1%) and Seattle (+18.3%) continuing to see the biggest gains. Chicago (+9%) was the only city to see a single-digit increase.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"We've revised our forecast down a little bit, and that's because we just see it being very, very difficult to build housing at an affordable price right now," Howard said on Tuesday, noting that the housing "issue" was "exacerbated" recently when the Biden administration reportedly announced "an intention to potentially raise the tariff on Canadian lumber."

"We get 30 percent of our lumber from Canada," Howard said. "If you're going to double the tariff on that lumber, housing affordability becomes a bigger issue."

"We think it'll cause a problem in the market," he stressed.

CLICK HERE TO READ MORE ON FOX BUSINESS

Fox Business’ Jonathan Garber contributed to this report.