Biden administration restricting Nvidia’s sales of AI chips to some countries in Middle East

Nvidia said in a regulatory filing this week it was notified by the US government about new export controls covering some countries in the Middle East

Nvidia soars following record earnings beat

Nicholas Wealth Management CEO and founder David Nicholas says Nvidia will corner the stock market on ‘Making Money.’

The Biden administration is moving to restrict exports of Nvidia’s artificial intelligence (AI) computer chips to certain countries in the Middle East, the company said in a regulatory filing.

Nvidia, headquartered in Santa Clara, California, has become an AI powerhouse because of its advanced graphics processing units (GPUs) and semiconductors used to power and train AI platforms.

The U.S. government has imposed export controls that require the company to get a permit to sell covered products to specified overseas customers due to concerns the advanced technology could aid adversaries like China.

Nvidia noted the new export controls related to the Middle East in a portion of a quarterly regulatory filing published Monday that discussed other export controls with which the company must comply.

NVIDIA CONTINUES AI-DRIVEN SURGE, ANNOUNCES $25B STOCK BUYBACK

Nvidia is facing new export restrictions covering the sale of its advanced technology to some countries in the Middle East. (Jakub Porzycki/NurPhoto via Getty Images / Getty Images)

"During the second quarter of fiscal year 2024, the [U.S. government] informed us of an additional licensing requirement for a subset of A100 and H100 products destined to certain customers and other regions, including some countries in the Middle East."

Based on the company’s quarterly filing, it’s unclear which countries in the Middle East are subject to the latest U.S. export controls on Nvidia’s advanced chips.

Nvidia did not immediately respond to a request for comment.

"The administration has not blocked chip sales to the Middle East," a spokesperson for the Commerce Department's Bureau of Industry and Security, which typically administers export controls, told FOX Business. "As a general matter, 50 USC 4820 (h) restricts BIS from publicly releasing information related to specific licenses and related information and as a consequence we are not in a position to confirm or deny any company-specific actions."

CHIPMAKERS PUSH BACK ON US SEMICONDUCTOR EXPORTS TO CHINA

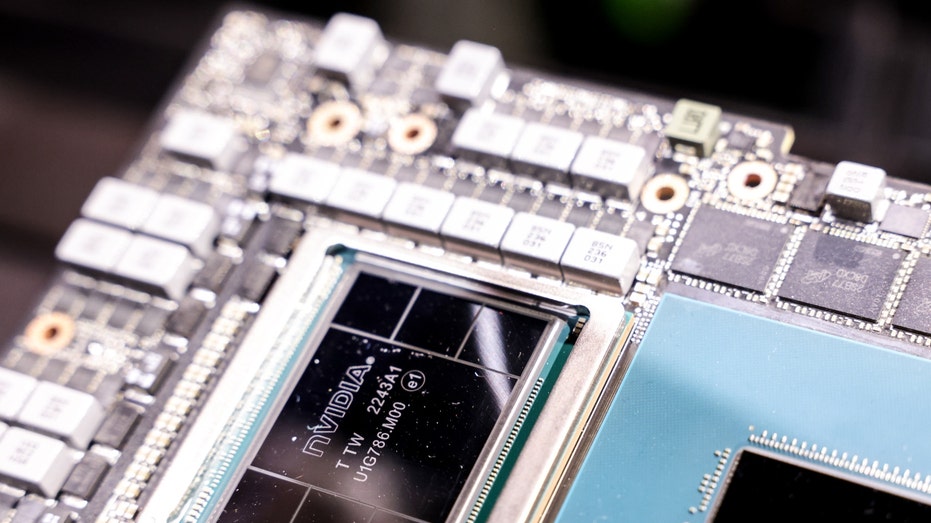

To comply with the export controls covering China, Nvidia reworked some of its products to be less powerful and avoid running afoul of the regulations.

"We have sold alternative products in China not subject to the license requirements, such as our A800 or H800 offerings," the company noted in this week’s filing.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| NVDA | NVIDIA CORP. | 185.41 | +13.53 | +7.87% |

WHAT IS ARTIFICIAL INTELLIGENCE (AI)?

Nvidia developed an alternative, less powerful AI chip to sell to Chinese customers that was designed to be compliant with export controls. (REUTERS/Tyrone Siu / Reuters Photos)

The U.S. government is in the process of weighing additional export controls covering the sale of advanced chips and AI-related technologies to China over concerns that the advanced technologies could aid China’s military modernization and be used to further internal repression.

Nvidia said in this week’s filing that additional export controls are unlikely to have a near-term impact.

NVIDIA ANNOUNCES NEW CHIP TO POWER AI MODELS, REDUCE COSTS

Nvidia says broader export controls aren't likely to hurt its financial performance in the near term but could have a negative impact on its long-term competitiveness. (I-Hwa Cheng/Bloomberg via Getty Images / Getty Images)

"Given the strength of demand for our products worldwide, we do not anticipate that additional export restrictions, if adopted, would have an immediate material impact on our financial results," the company wrote.

"However, over the long term, our results and competitive position may be harmed, and we may be effectively excluded from all or part of the China market if there are further changes in the [U.S. government’s] export controls, if customers in China do not want to purchase our alternative product offerings, if customers purchase product from competitors, if customers develop their own internal solution, if the [U.S. government] does not grant licenses in a timely manner or denies licenses to significant customers, or if we incur significant transition costs."

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Nvidia’s stock price has risen this week from over $464 per share at Monday’s open to more than $492 a share as of Wednesday’s close. The stock rose by $1.06 in after-hours trading as of 6:30 p.m. Wednesday.

Over the course of 2023, Nvidia’s stock has surged by 244%, rising from $143 per share Jan. 3.

Reuters contributed to this report.