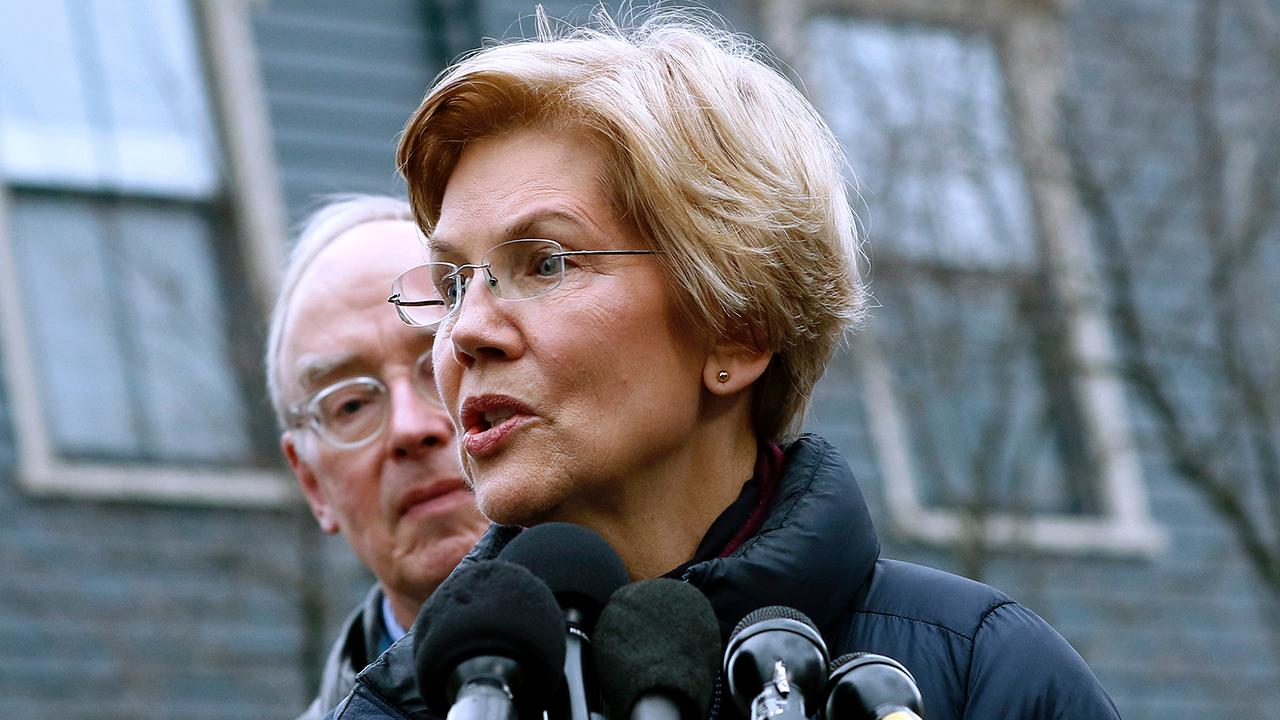

Elizabeth Warren's plan to break up big tech would hurt consumers, innovation

Democratic 2020 presidential hopeful Sen. Elizabeth Warren last week unveiled her plan to break up big tech, ie. Amazon, Google and Facebook. Put simply, the proposal is nothing less than an attack on innovation and consumer choice.

In a Warren administration, large companies that offer an online marketplace, an exchange, or a platform would be prohibited from owning both the platform and any of the companies that compete with each other on that platform. Further, the government would also be empowered to undo previous mergers.

There is no question that Amazon, Google, Facebook and others have gotten large. But they have not grown through unfair means; they have provided consumers with what they want and used profits to invest in new technologies and better services. Collectively, they drive U.S. progress in technologies including internet applications, automated vehicles, artificial intelligence and drones. Attacking them just for their size would raise consumer prices, limit choice and discourage innovation.

Warren’s rationale for carving up the tech giants rests on several pillars.

One is that they have hurt innovation. This is hard to argue given that, according to Statista, Amazon and Alphabet (Google’s parent company) invest in R&D more than any other companies in the world (and Facebook ranks 14th on that list). Warren also asserts that “the number of tech startups has slumped.” In fact, according to our research, tech startups have increased 47 percent over the last decade.

A second pillar is that lax antitrust enforcement has allowed these companies to grow too big. She points to Google’s purchase of Waze and Facebook’s purchase of WhatsApp as examples.

But there is no assurance that Waze or WhatsApp could have grown large enough on their own to challenge the tech giants had they not been acquired. More likely, Google and Facebook would have developed their own technologies to compete with the newcomers. Nor does Warren articulate exactly how consumers have been harmed with these free services.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| FB | PROSHARES TRUST S&P 500 DYNAMIC BUFFER ETF | 42.42 | +0.35 | +0.84% |

| AMZN | AMAZON.COM INC. | 210.32 | -12.37 | -5.55% |

| GOOG | ALPHABET INC. | 323.10 | -8.23 | -2.48% |

| GOOGL | ALPHABET INC. | 322.86 | -8.39 | -2.53% |

| AAPL | APPLE INC. | 278.12 | +2.21 | +0.80% |

Third, Warren argues that a lack of competition makes the tech giants impervious to consumer welfare. Yet these companies face heavy competition in the markets where they make most of their money: the advertising market.

In the case of Amazon, its online sales compete with traditional brick-and-mortar stores. More important, there is little question that Amazon’s main influence has been to deliver lower prices and greater choice to millions of buyers.

The most troubling is Warren’s main argument: that companies should not be allowed to both own a major market platform and participate in that platform. Federal antitrust law already gives regulators tremendous power and discretion. And for the last several decades, this power has centered around protecting consumer welfare.

Regulators can block mergers or punish anticompetitive behavior, but only if not intervening would expose consumers to higher prices, poorer quality or reduced innovation. The decision requires a detailed economic analysis of individual markets.

Warren’s plan does raise a number of important issues like privacy, corporate political power and Russian interference in elections. But the answer to these concerns is not to break up tech companies. The answer is to pass a national privacy framework, campaign finance reform legislation and laws regarding political ads.

Legitimate questions have been raised about how companies use personal data, the ability of bad actors to post misleading information, and the legitimacy of particular business practices. Congressional hearings can shed important light into these issues. In clear cases, regulators already have the power they need to take necessary action. Using antitrust policy to deal with unrelated issues is unlikely to work well.

CLICK HERE TO GET THE FOX BUSINESS APP

The American economy remains the most competitive and dynamic in the world. Most leading internet companies were started and grew here – in large part because they were not blocked by government interference. Giving government regulators the power Warren suggests is unlikely to result in faster innovation or greater competition. Instead, it could easily lead to the reverse.

Joe Kennedy is a senior fellow with the Information Technology and Innovation Foundation, where he focuses on tax and regulatory policy.