Microsoft's AI engine powering H&R Block's tax filing assistance product

Microsoft's Azure OpenAI service partnered with H&R Block to develop the accounting firm's AI Tax Assist tool

Microsoft hits $3T in market value

Barrons Roundtable panelists discuss the impact of AI in Microsoft as the two tech giants go head-to-head competing for worlds most valuable company.

Microsoft and H&R Block are partnering to bring generative artificial intelligence (AI) to help simplify the do-it-yourself tax filing process for taxpayers.

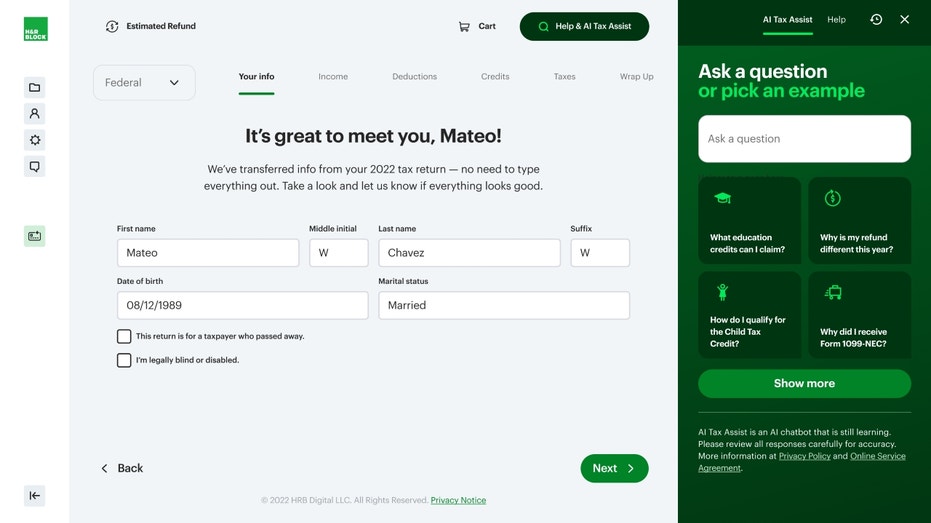

H&R Block launched its AI Tax Assist product, which was developed in partnership with Microsoft through its Azure OpenAI Service, in December ahead of the tax season, which officially opened last week. AI Tax Assist leverages data from The Tax Institute at H&R Block, as well as the insights of over 60,000 tax professionals to help DIY customers – including individuals, self-employed and small business owners – prepare their own tax returns.

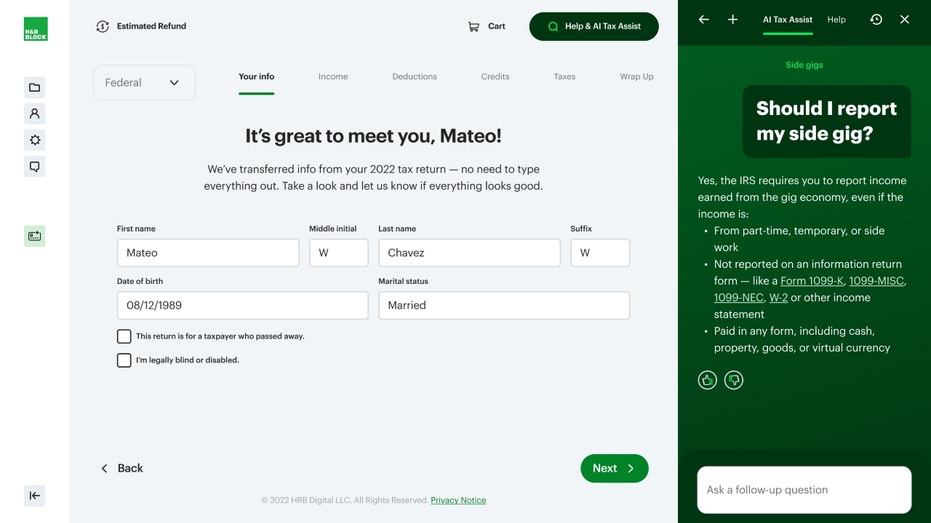

The tool can provide information about tax forms or deductions and credits to help maximize refunds and minimize tax liability. It can also take users through questions as they are preparing and filing their tax returns, answer free-form tax-related questions to clarify tax terms or give guidance on tax rules, as well as answer questions about the tax code and recently changed laws and tax policies.

Aditya Thadani, vice president of AI platforms at H&R Block, told FOX Business that the company is leveraging the most current models from Azure OpenAI and partnered "very closely with Microsoft engineers because it’s all new to us, and it was critically important that as much as we wanted to move fast, we wanted to do it in a way where we build all the controls and assurances that clients expect from our brand."

TAX SEASON HAS OFFICIALLY STARTED: HERE’S EVERYTHING YOU NEED OT KNOW BEFORE FILING

H&R Blocks AI Tax Assist can answer tax filers' questions about forms, credits, deductions and policy changes. (Courtesy of H&R Block / Fox News)

Microsoft’s Eric Boyd, corporate vice president of Azure AI Platform, told FOX Business that H&R Block is the only tax industry firm it is partnering with as part of its AI 100 initiative – an exclusive group of industry-leading companies that prioritize the development and deployment of solutions using Azure OpenAI services.

"Of course, we’re the platform company, and so we look for key partners to go and bring this technology to all the different industries," Boyd explained. "We don’t have a tax accounting product, and it doesn’t make sense for us to get into that field, but H&R Block is obviously a leader in that space."

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| MSFT | MICROSOFT CORP. | 401.14 | +7.47 | +1.90% |

| HRB | H&R BLOCK INC. | 32.89 | -0.84 | -2.49% |

"We’ve built Copilots for developers and Copilots for knowledge workers within 365 and all across Microsoft, and it’s now exciting looking at companies like H&R Block who are taking something like doing your taxes – which, of course, all of us are familiar with and can be really intimidating, right? You have all of this jargon and things that you don’t know, and you’re worried about getting it wrong," Boyd said. "To now have that assistant that can really look over your shoulder and help you with it – those are the types of partnerships we’re really looking forward to."

MICROSOFT LAUNCHES SUBSCRIPTION-BASED CHATBOT, AI COPILOT PRO FOR $20 A MONTH

H&R Block's AI Tax Assist can help do-it-yourself tax filers prepare their returns. (Photographer: Angus Mordant/Bloomberg via Getty Images / Getty Images)

Thadani explained that the AI Tax Assist "is where our expertise in the tax domain comes to bear" in terms of leveraging the knowledge from its Tax Institute and using the new platform to convey those insights to DIY tax filers.

"We have built over the years this Tax Institute which is people who live and study that domain. They know it intimately. They follow it before it becomes law, as it turns into regulations and specific guidance – they follow it, and they actually create a lot of content," he explained. "Historically, that content was available internally to our tax preparers, but now through AI Tax Assist we are able to take all of that knowledge and content and ground the solution in that content and make it available to our DIY users."

"So now, suddenly they can benefit from that rich expertise and be able to ask questions just speaking normal English – like you don’t have to be an attorney to ask a question, you have to be an attorney to answer a question and we have been able to bring those two together effectively," Thadani added.

WHAT IS ARTIFICIAL INTELLIGENCE (AI)?

Microsoft's Azure OpenAI Service helped H&R Block develop the AI Tax Assist tool. (Photo Illustration by Pavlo Gonchar/SOPA Images/LightRocket via Getty Images / Getty Images)

Boyd explained that Microsoft is accustomed to working with companies’ sensitive data, and the company brings "all of that experience into the Azure OpenAI service and so all of the data customers give to us are completely controlled and managed by the customer." As a result, Microsoft is not able to access the data, and it is not used to train another AI model and the data remains with H&R Block.

"We do not use the actual data that they’re putting in to do their taxes in the Tax Assist to answer their questions about tax regulations," Thadani explained. "We’ve maintained that separation between Tax Assist and the actual tax preparation software. So those kinds of controls, we continue to refine those and make sure we’re always very diligent about how to use the client data and to be very transparent with our clients on when we’re using the data, for what purpose, and to make sure there is an informed consent there."

H&R Blocks AI Tax Assist uses generative AI to help tax filers prepare their returns. (Courtesy of H&R Block)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Thadani added that H&R Block will continue to offer its accuracy guarantee through AI Tax Assist.

"Even before AI Tax Assist, we have had this 100% accuracy guarantee to our clients who are using our software to prepare taxes, file taxes, and that guarantee stays with them even now," he said. "We continue to provide all those warranties and guarantees that we have provided to clients and offer that with this."