Transparency in crypto industry ‘critical’: Ripple CEO

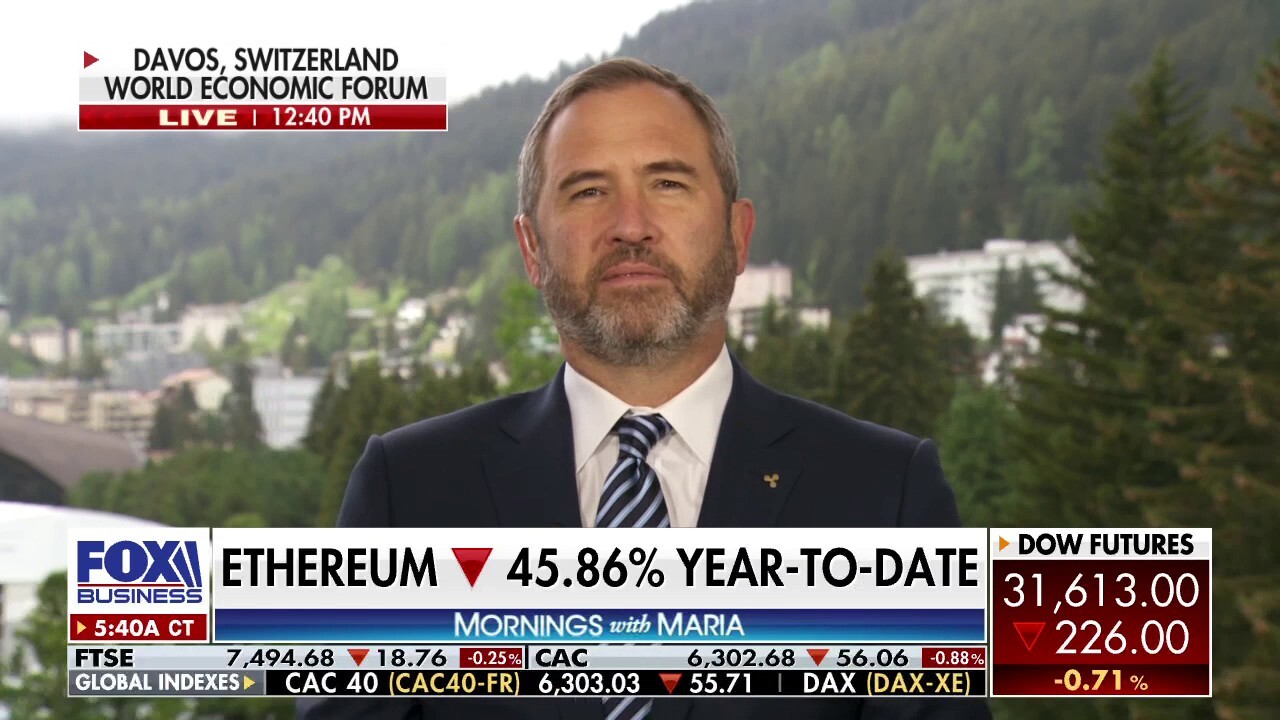

Brad Garlinghouse discusses regulation, volatility in crypto markets from Davos

Ripple CEO on what's needed for the crypto industry to thrive

Ripple CEO Brad Garlinghouse explains a key reason he wanted to participate in the World Economic Forum in Switzerland.

Brad Garlinghouse, the CEO of financial technology company Ripple Labs, argued on Tuesday that the whole cryptocurrency industry "needs to be more transparent."

Speaking with "Mornings with Maria" from the World Economic Forum in Switzerland, Garlinghouse discussed regulation for the industry, noting that he traveled to Davos for the conference to engage with other CEOs and finance ministers from around the world "to talk about how these technologies can actually solve real world problems, and reduce costs and improve efficiency."

Garlinghouse also addressed volatility in the crypto market on Tuesday.

"There’s no question that regulation around crypto is still trying to find solid footing and finding the right posture for the United States," Garlinghouse said before arguing that "the United States has really been behind other G-20 of markets," including the U.K., Switzerland and Singapore.

VOLATILITY IN CRYPTO MARKETS TO CONTINUE FOR NEXT FEW MONTHS: EXPERT

He said that those markets "have led in establishing a framework that works for investors as well as entrepreneurs who are taking advantage of the new technologies and building the next generations of Google and Facebook."

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| COIN | COINBASE GLOBAL INC. | 165.12 | +19.00 | +13.00% |

| BITQ | BITWISE CRYPTO INDUSTRY INNOVATORS ETF - USD DIS | 19.19 | +2.45 | +14.64% |

Along with the stock market, bitcoin has experienced a lot of volatility recently. Two weeks ago, bitcoin plunged to the $25,000 level, its lowest since December 2020, then bounced back over $30,000, according to CoinDesk. As of Tuesday morning, the crypto was trading around the $29,000 level, down from its all-time high of over $68,000 reached in November 2021.

The crypto is down more than 36% year-to-date.

CLICK HERE FOR FOX BUSINESS' REAL-TIME CRYPTOCURRENCY PRICING DATA

"There’s no question there’s been a lot of turbulence in the crypto market," Garlinghouse said, noting that "if you zoom out, though, over the last two years, you have to remember that bitcoin was at about $8,000 two years ago. Today it’s around $30,000."

Brad Garlinghouse, the CEO of financial technology company Ripple Labs, discussed regulation and volatility in the cryptocurrency markets from the World Economic Forum in Davos, Switzerland. (Photo Illustration by Chesnot/Getty Images / Getty Images)

"This is a new market," he continued. "There’s certainly been a lot of excitement about what’s going on in the market [and] sometimes that excitement gets ahead of the reality."

"We’ve been focused on how do we use technologies to solve real problems for customers and those are the kind of solutions that will scale regardless of the turbulence and volatility of the market," he went on to argue.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Bitcoin and other cryptocurrencies have had some rough weeks in anticipation of and following the half-point interest rate hike by the Federal Reserve. It was the second of several anticipated increases this year as the central bank seeks to combat soaring inflation, which is at a high not seen in four decades.

The expectation now is that the Fed will take aggressive action to try and curb inflation, which remains near 40-year highs, according to the data for April released earlier this month, which has reduced investor appetite to hold assets perceived as higher risk.

Crypto market experiencing 'one of the biggest dips' in a long time: Expert

Delta Blockchain Fund founder Kavita Gupta explains as bitcoin trades below $30,000.

This past year, tighter monetary policy has impacted both stocks and cryptocurrencies.

Adding to more fears of volatility in the crypto market was the decoupling of the TerraUSD, a stablecoin whose value was tied to $1, the Wall Street Journal reported. The world’s largest stablecoin by market cap, tether, also briefly edged down from its $1 peg.

Garlinghouse pointed out on Tuesday that "stablecoins have been in the news because that was one of the catalysts that really drove the market a couple of weeks ago."

Stablecoins are digital currencies with values that are pegged to traditional assets, like the dollar, another currency or gold. Its correspondence with the dollar is what, in theory, makes it stable. However, volatility in the crypto market last week challenged that presumption.

Crypto industry 'needs to be more transparent': Ripple CEO

Brad Garlinghouse, the CEO of financial technology company Ripple Labs, discusses the turbulance in the crypto market from the World Economic Forum in Switzerland.

"I think now more than ever the transparency that companies like Ripple have championed across the crypto industry is critical," Garlinghouse told host Maria Bartiromo.

"That transparency for tether I think is to really make sure the people participating feel, buy and have access to whatever financial information they need to feel comfortable that it is in fact dollar-backed."

U.S. Treasury Secretary Janet Yellen told a House committee hearing earlier this month that the sharp drop in crypto markets highlighted the need for additional federal regulation to respond to the wave of speculative investment in the currency whose secrecy is a major part of its attraction.

In addition, a top official at the SEC indicated that tighter rules around crypto stablecoins could be drawing closer, Reuters reported.

CLICK HERE TO READ MORE ON FOX BUSINESS

The Associated Press contributed to this report.