Venmo woes pile up following FOX Business report

When I pitched a first-person analysis on the downside of Venmo, the payment app that is becoming ubiquitous in the lives of millennials and Gen Zers, I expected some nice feedback from family and friends. Maybe even a “good job” from my praise-stingy boss.

Yes, I got all of that and a lot more. In the days following my report, I was inundated with even more tales of Venmo woes. The crux of my story was that the use of Venmo has made dealing with money – and all the messy human interactions that go with it – well, less human, and in the process ruined relationships because it feeds our need to be less confrontational (or at least passive aggressive).

What I found was pretty interesting: When people don’t have to argue about who’s paying the bill at the dinner table, and just Venmo their friends later on, lots of bad stuff follows.

Most notably, you start losing friends.

In the report, I cited real examples gleaned from conversations with family and friends. I even threw in some personal anecdotes. Some of the people I highlighted in my report, my friends Becca and Emily, achieved semi-cult status on Twitter when the story hit. (Emily, you might recall, is still raw after she was Venmoed for her share of a bill after a date didn’t work out, while Becca says her roommate uses Venmo to overcharge her on the electricity bill).

One reader even offered to be Emily’s life coach after reading about her Venmo date-gone-awry.

Then, in the “imitation is the sincerest form of flattery” category, it seems that my piece even awakened our friends at the mighty Wall Street Journal to publish their own first-person account of Venmo millennial angst. There appears to be so much angst around Venmo that one millennial said he wanted to “opt out” of our generation entirely. He was embarrassed by all the millennial Venmo pettiness I reported on.

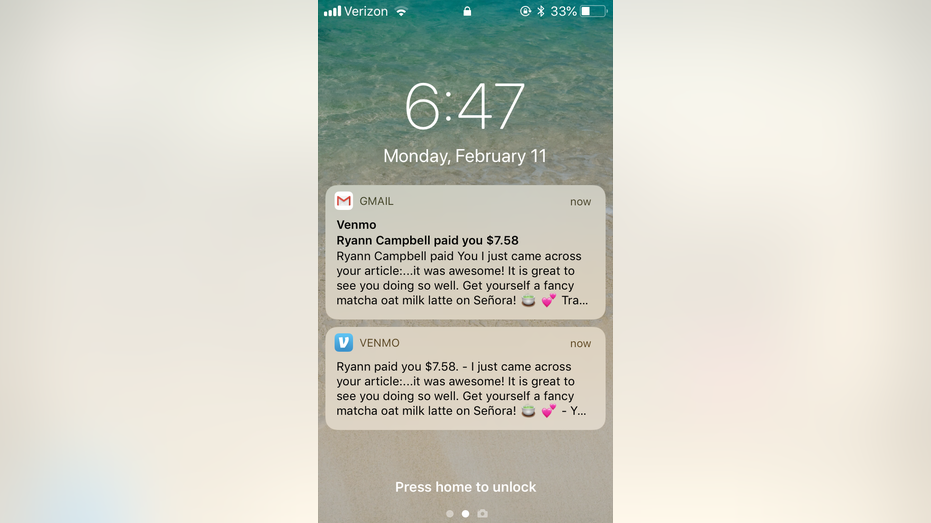

Oddly, I received a Venmo request with the green tea emoji for $20 from someone I don’t know named Nika Wu. I’ll just ignore it my typical millennial, non-confrontational way. What I won’t ignore was a payment of $7.58 from my high school Spanish teacher, who read how I was unfairly (IMHO) Venmoed that amount by a “friend” for a matcha latte with oat milk.

Gracias, Mrs. Campbell!

Yes, a payment app that allows people to split a dinner bill really is upending lives, ruining relationships and, if you believe the post-publication comments, has the potential to start World War III (consider what might happen if President Trump Venmoed Kim Jong Un after they chowed down on some KFC).

As Venmo users have reacted to the story, other key themes of Venmo abuse have emerged. For starters, Venmo makes it easier to be cheap, which I didn’t fully appreciate until now.

That’s because, as I reported in my last piece, there is a peer pressure to pay your Venmo request. The flip side of this, of course, is that since Venmo isn’t a compulsory system and you don’t have to put your money down up front, there is no requirement that you pay your share. You can simply ignore Venmo requests, which I am told happens far too often no matter how much peer pressure there is to pay.

Yes, there are plenty of Venmo deadbeats, I discovered.

On the other end of the spectrum is another, albeit much rarer, specimen: The munificent millennial. This person’s biggest fear is taking advantage of someone. So, they “over-Venmo,” going above and beyond to make sure they are always chipping in.

Take my friend Amanda – one of the most generous people I know. When she stopped by my apartment a few months ago, we munched on goat cheese, fig jam, crackers and whatever else was in my fridge. About five minutes after she left I received a $10 payment. The way the app works, you can’t deny payments that come into your account, so I promptly paid her back.

I love Amanda, but I want to remind her that it’s a tough world out there, and there are plenty of Venmo sharks looking to take advantage of her generosity.

Older generations who read the FOX Business article noted that Venmo has jeopardized the concept of “paying it forward.”

Instead of treating a friend to drinks or letting them crash on your couch, the ability to split costs equally means millennials rarely practice generosity. Even naturally generous millennials have realized they don’t want to be the chump who never charges anybody – thus, creating a vicious cycle that incentivizes you to make sure you are “charging your fair share.”

Again, I hate to pick on Venmo because it has made my life easier in many ways (as Venmo pointed out in a comment for my last story), and a lot more awkward in others. But writing about Venmo at least gave me some satisfaction that I’m not the only millennial out there who would prefer to argue about money face-to-face instead of through an app.

As for this column, Venmo declined to comment.