What's in Biden's $2.25T infrastructure and tax proposal?

It will be funded largely by raising taxes on US corporations

President Biden released a sprawling proposal to rebuild the nation's crumbling infrastructure and pump money into manufacturing, transportation, renewable energy and combating climate change — a $2.25 trillion measure that will be funded largely by raising taxes on U.S. corporations.

The eight-year initiative, dubbed the American Jobs Plan, comes on the heels of Biden's $1.9 trillion American Rescue Plan. The White House said it will pay for the latest package by raising the corporate tax rate to 28% from 21% — rolling back part of former President Donald Trump's 2017 tax cuts — and increasing the global minimum tax on U.S. corporations to 21% from 13%.

The Biden administration is also planning a second major package, which could cost upward of $1 trillion, that it will unveil in April. That measure, which will likely be funded by tax increases on wealthy Americans, is expected to focus on domestic issues, such as expanding health care, providing universal kindergarten, extending the child tax credit and offering paid family leave.

PROGRESSIVES PRESSURE BIDEN TO PASS $10T GREEN INFRASTRUCTURE, CLIMATE JUSTICE BILL

Biden is set to formally introduce the American Jobs Plan in Pittsburgh on Wednesday afternoon, his opening salvo in what's expected to become a contentious, monthslong negotiation with Congress.

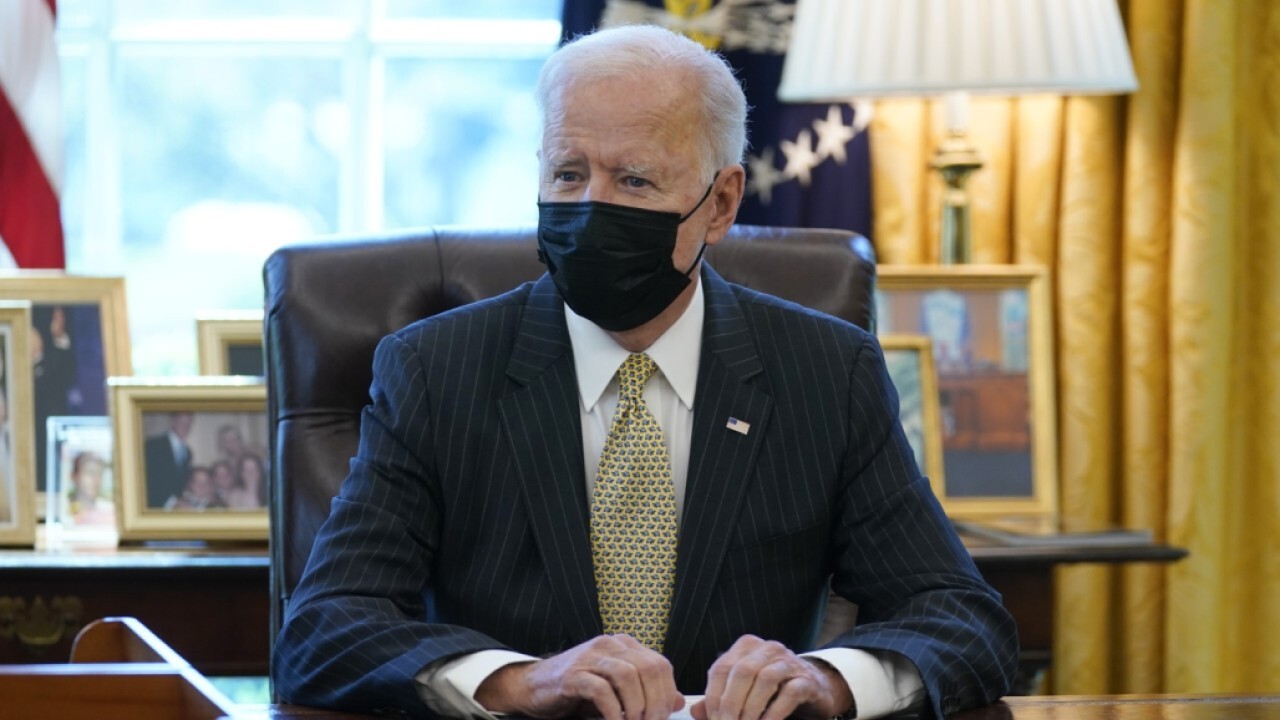

President Joe Biden speaks during an event on COVID-19 vaccinations, in the South Court Auditorium on the White House campus, Monday, March 29, 2021, in Washington. (AP Photo/Evan Vucci)

Here's a closer look at the key elements of Biden's plan:

Transportation

The plan calls for $621 billion in new spending on roads, bridges, rail, ports, waterways, airports, public transportation and electric vehicles.

About $115 billion of that money would go toward modernizing 20,000 miles of highways, roads and main streets that are "in most critical need of repair," as well as repairing the most "economic significant large bridges" and roughly 10,000 smaller bridges, according to a fact sheet released by the White House.

Biden proposed investing $85 billion to modernize the public transportation system and help agencies expand their systems to meet demand. This would double federal funding for public transport.

Another $80 billion would go toward addressing Amtrak's backlog repair and modernizing the Northeast Corridor, the line that connects Washington and New York City, as well as Biden's hometown of Wilmington, Delaware.

The president would direct $25 billion to airports and $17 billion to inland waterways, ports and ferries.

Finally, the plan includes $20 billion for a new program that would connect neighborhoods cut off my historic investments and ensure "new projects increase opportunity, advance racial equity and environmental justice, and promote affordable access."

BIDEN'S TAX-HIKE PLAN FACES OPPOSITION FROM MODERATE DEMOCRATS

Electric vehicles

The proposal also includes $174 billion to invest in electric vehicles, money the White House said will "enable automakers to spur domestic supply chains from raw materials to parts, retool factories to compete globally, and support Americans workers to make batteries and EVs."

It will also provide sales rebates and tax incentives to encourage Americans to buy electric vehicles, and offers grant and incentive programs to state and local governments to expand the number of electric-vehicle chargers that are available. The plan will replace 50,000 diesel transit vehicles and switch at least 20% of school busses to electric vehicles.

President Joe Biden speaks about COVID-19 vaccinations and response, in the South Court Auditorium on the White House campus, Monday, March 29, 2021, in Washington, as Vice President Kamala Harris listens. (AP Photo/Evan Vucci)

Manufacturing

Biden will call on Congress to invest $300 billion to boost American manufacturing, including allocating $50 billion for semiconductor manufacturing and research and $50 billion for the National Science Foundation to create a technology directorate.

He is also asking $50 billion to create a new office at the Department of Commerce dedicated to monitoring domestic industrial capacity and funding investments to support production of critical goods.

Research and development

The measure also seeks to address future pandemics and includes $30 billion over four years to make major investments in medical countermeasures manufacturing, research and development, and related biopreparedness and biodiversity.

MANCHIN CALLS FOR 'ENORMOUS' INFRASTRUCTURE BILL FUNDED BY NEW TAXES

That includes funding to shore up the nation's strategic stockpile, accelerate the timeline to research, develop and field tests and therapeutics for emerging and future outbreaks, accelerate response time by developing prototype vaccines and ensure sufficient production capacity in case of emergency.

"The risk of catastrophic biological threats is increasing due to our interconnected world, heightened risk of spillover from animals to humans, ease of making and modifying pandemic agents, and an eroding norm against the development and use of biological weapons," the White House said.

Clean water

The American Jobs Plan directs $111 billion to rebuild the nation's water infrastructure and would replace all of the lead pipes and services lines in order to improve children's health and that of communities of color.

The proposal would also upgrade the country's drinking water, wastewater and stormwater systems.

Schools

Biden is calling for $100 billion to build new public schools and upgrade existing buildings with better ventilation systems and indoor air quality. The money will also go toward investing in energy-efficient and electrified school buildings in order to reduce greenhouse gas emissions.

Another $12 billion would go to states to improve physical and technological infrastructure at community colleges. Biden also proposed sending $25 billion to upgrade child-care facilities and increase the supply of child care in areas that need it most.

BIDEN WANTS TO RAISE TAXES ON AMERICANS WHO GOT RICHER DURING PANDEMIC

Broadband internet

The measure includes $100 billion to bring high-speed broadband internet to all Americans. The White House said the plan will also make pricing more transparent and competitive and includes short-term subsidies for low-income households.

Housing

The plan invests $213 billion to build more than 2 million affordable homes. It would also include tax credits to build housing for low-income families and $40 billion for public housing.

Hospitals, home-care services

Biden would provide $400 billion to bolster caregiving for elderly and disabled Americans and would expand access to long-term care services through Medicaid. The proposal also calls for directing $18 billion to modernize the Veterans Affairs' hospitals and $10 billion to modernize federal buildings.

Corporate tax increases

The proposal will raise the corporate tax rate to 28% from the current rate of 21%. Republicans dramatically cut the corporate tax rate in 2017 with the passage of the Tax Cuts and Jobs Act, slashing the rate paid by U.S. businesses from 35% to 21%.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The plan would also institute a 15% minimum tax on a corporation's profits for financial-reporting purposes.

International taxes

The plan would also impose a minimum tax on the profits U.S. corporations earn overseas, increasing the rate to 21% from about 13% paid by corporations now.

It also creates new measures that would stop companies from claiming tax havens as their residence and would penalize companies for moving jobs overseas.

CLICK HERE TO READ MORE ON FOX BUSINESS

Eliminate tax breaks for oil, gas companies

Biden has called for eliminating special preferences for the fossil-fuel industry, including oil and gas companies, and would require those companies to pay into the Superfund Trust Fund to help cover the costs of pollutant clean-ups.

IRS audits

Finally, the American Rescue Plan would provide additional funding to the Internal Revenue Service in order to ensure the agency is able to increase tax audits on corporations.