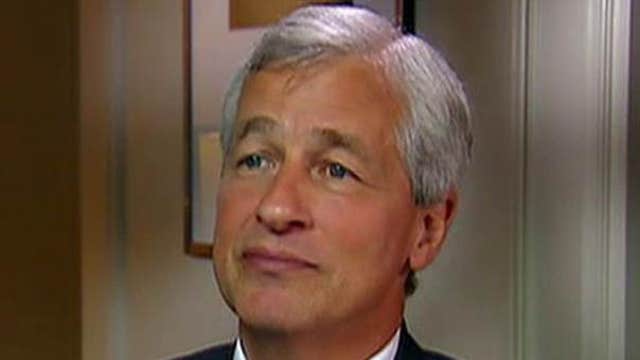

Exclusive: JPMorgan Chase CEO Jamie Dimon Talks Cancer Recovery, Economy

In an exclusive interview Tuesday on the FOX Business Network, J.P. Morgan Chase (NYSE:JPM) Chief Executive Jamie Dimon said the U.S. economy will continue to improve after the Federal Reserve hikes interest rates.

“America looks pretty damn good,” Dimon told FBN’s Maria Bartiromo on Opening Bell, adding that “normalization is a good thing.”

“The more that employment is growing and companies are growing, you know, rates going up would be OK. It’ll be volatile, it’ll be a little scary, but it’ll be OK.”

Dimon, speaking from the 33rd annual J.P. Morgan Healthcare Conference, believes the Fed will follow its guidance that rates will be raised beyond near-zero once “the fundamental economy is growing.”

“And the fed has been very clear that that’s the only time they’re going to raise rates,” he explained. “They’re not going to raise them if things are not going well. So, I take them at their word for that.”

More than 400 healthcare companies are expected to make presentations this week at J.P. Morgan’s conference in San Francisco.

According to Dimon, the event started with 30 companies that held a combined market value of $2 billion. Today, companies in attendance at the conference are valued at a combined $4.6 trillion.

“Even in 2008, 2009, 2010, the bad years, this thing was growing over time. You had entrepreneurs, venture capitalists, big companies, small companies, global companies, and it always reminded me of the raw, utter strength of American business,” he said. “This is capitalism at its best, right here.”

Cancer Recovery

He went on to say that health care companies will continue to grow and save lives, including his own.

Dimon was diagnosed with throat cancer last summer. Tests completed in December revealed he was free of cancer. On Tuesday, Dimon said he will be monitored for the next three years.

“I'm actually doing fine. I never stopped working, but I’m mostly back to full health, back to working full time,” he told Bartiromo, saying his prognosis is “as good as can be.”

Dimon also said the illness hasn’t changed him, and he always puts his family first.

Aiding America

Leading the nation’s largest bank – something he has done since December 2005 – is also the best contribution he can make to the country, Dimon said.

The chief executive lauded J.P. Morgan’s impact on the American economy, such as hiring 8,000 veterans and providing financial support for Detroit.

“If I do a good job here, I can help people with their careers. We help consumers and big businesses. We help countries and banks, central banks, governments, sovereign wealth funds, and we're hugely charitable,” he said.

Status of the Recovery

As for the overall economy, Dimon suggested the outlook for U.S. businesses is looking brighter. He cited job growth, a largely “balanced” housing market and higher consumer confidence.

He said the most significant headwind facing the American economy is coming from overseas. In recent weeks, ongoing concerns over the strength of Europe’s recovery have been fueled by struggles in Greece and speculation that the country could exit the Eurozone.

Business spending in the U.S. remains low but is on a path toward growth, Dimon added. Small business credit has returned to pre-recession levels, and Dimon sees business formation becoming healthier.

The health care sector has done particularly well based on the pace of acquisitions. Irish drug maker Shire (NYSE:SHPG), whose proposed sale to AbbVie (NYSE:ABBV) was terminated last year, said Monday it agreed to buy NPS Pharmaceuticals for $5.2 billion. Also this week, Swiss firm Roche announced a $1 billion deal to purchase a majority stake in Foundation Medicine (NASDAQ:FMI).

In 2014, the health care industry booked its best year ever for mergers and acquisitions, and Dimon thinks 2015 could be even better.

Fighting Against Cyber-Attacks

Dimon also addressed the cyber-attack that compromised accounts for 76 million households and seven million small businesses.

J.P. Morgan has said no financial information was stolen in the breach, which included contact information like addresses and phone numbers. Dimon on Tuesday assured clients that they are “completely safe.”

The bank typically spends $250 million a year on cybersecurity, but Dimon said that number could easily double the next two years. When asked if J.P. Morgan fends off hundreds of attacks every day, Dimon suggested that it’s closer to 300,000.

“It’s incumbent upon all of us – merchants, banks, retailers, everyone – to come up with a better system,” he said, noting that banks pay the price for credit-card breaches that occur elsewhere.

The most recent high-profile hack targeted the Pentagon. The Twitter and YouTube accounts for U.S. Central Command were taken over for a brief period Monday with messages in support of terrorist group ISIS.

Last year, Sony’s (NYSE:SNE) movie division was hacked in a cyber-attack that was traced back to North Korea, according to the Federal Bureau of Investigation.

“Eventually cyber security is going to be a part of [the World Trade Organization] and public policy and global relations. This can’t go on. I mean, you can’t have it where people are stealing IPs, stealing money, attacking you, and if it’s state-sanctioned, allow it,” Dimon said.

Washington Checklist

Dimon offered five issues that must be addressed to keep America competitive in the long term, saying he has discussed all of them with the White House.

- Corporate taxes and tax reform: “Simplify it, broaden out the base, reduce it, become more competitive globally.”

- Immigration reform: “Most Democrats and Republicans I know support immigration reform. They may differ on pieces of it.”

- Education: “Think of secondary education the most, where we’re failing a lot of kids in inner-city schools.”

- Infrastructure: “Most people agree that we don’t do good infrastructure planning…for roads, bridges, tunnels, schools and hospitals. We need to do that at the city, state, and federal government level.”

- Trade: “Transatlantic and transpacific trade agreements would be a great boon to the American economy and the global economy.”

Dimon said he’s not hopeful that his checklist will be completed in the next year or two, even with a new Congress.

The CEO also downplayed expectations that the Republican-controlled Congress will be less hostile toward banks.

“There’s a lot of hostility toward banks still that comes out of the population, and even some Republicans,” Dimon said. “What I always hope for is kind of collaboration [and] working together to come up with a better outcome.”

He emphasized that J.P. Morgan in particular wasn’t the cause of the issues that ignited the 2008 financial crisis.

The notion that every bank was bailed out by the Troubled Asset Relief Program (TARP) “is just not true,” Dimon said. “That was like the scarlet letter for every bank.”

For more in-depth analysis on the current health care environment and innovation on the horizon, don't miss Wednesday's continued live coverage beginning at 9 a.m. ET from the conference in San Francisco. Maria Bartiromo will sit down with Eli Lilly (NYSE:LLY) Chairman and CEO John Lechleiter, and have an exclusive interview with Kimberly Popovits, Genomic Health CEO.