Tax Reform: The No Brainer Low Hanging Fruit Needed to Juice The Economy

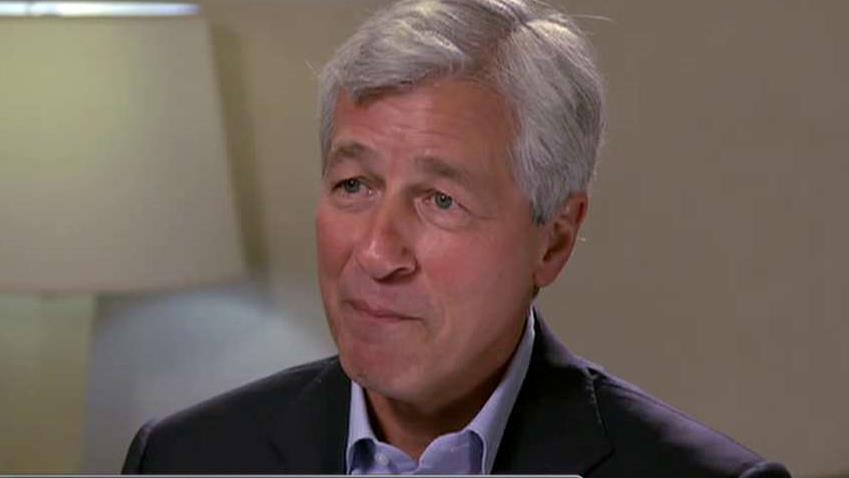

A majority of voters want tax reform at the top of the next administrations agenda. And no wonder. American companies have some $2 trillion in cash sitting overseas, money that can be used here in the US to create jobs and invest in America. Case in point - big tech. Companies like Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT) would rather sit in cash overseas and not pay extra tax on it. Johnson and Johnson (NYSE:JNJ) has $37 billion in cash, largely overseas for the same reason. Then there are so called corporate inversions, where a company merges with a foreign company to move its headquarters to a more business friendly, lower tax environment. At least a dozen companies right now are pursuing moving their headquarters abroad. Pfizer (NYSE:PFE), the nation’s 10th largest company, is merging with Allergan based in Ireland, who last year paid an effective tax rate of 4-percent compared to America’s 35-percent. I asked JP Morgan CEO Jamie Dimon about it in my exclusive interview this week. BARTIROMO: Voters seem to believe tax reform is one of the top issues that need to be on the agenda of the next president, of Congress. Do you think this is important for business right now? DIMON: tax reform, if it's done right, would help business grow faster, and would help all Americans. And, you know, we've had this debate, this corporate tax and individual tax, and we're not going to help the companies, or we don't want to help the individuals. What you want to do is help everyone compete. Remember, when companies do well they also pass better prices onto consumers, and, so -- everyone should pay tax, but our system is driving capital overseas right now. And, I just think that's a mistake, and the damage is permanent. So, the question to me is how long is it going to take before we say let's stop this? And, how long is it going to take before we say that American companies have to compete too? And, I'm not saying individuals shouldn't pay. I don't mind paying personal taxes, I would love to enhance the earned income tax credit. I think there are all things that you can do to make it better, to make it fair for individuals too, but we've got to get on this because this can really damage the country. BARTIROMO: And, you're saying reform taxes, and then use money towards infrastructure and education, the things that actually help people. DIMON: Look, what people are worried about is we raise taxes, and it goes into Washington. It's like a giant sucking sound down there, and that's a legitimate concern, you know? We do waste a lot of money, and, so, I think government has to spend it wisely, intelligently, thoughtfully. Not ideologically on things that work, like education and infrastructure. And, then reform the tax system, and help businesses grow. Businesses create jobs.