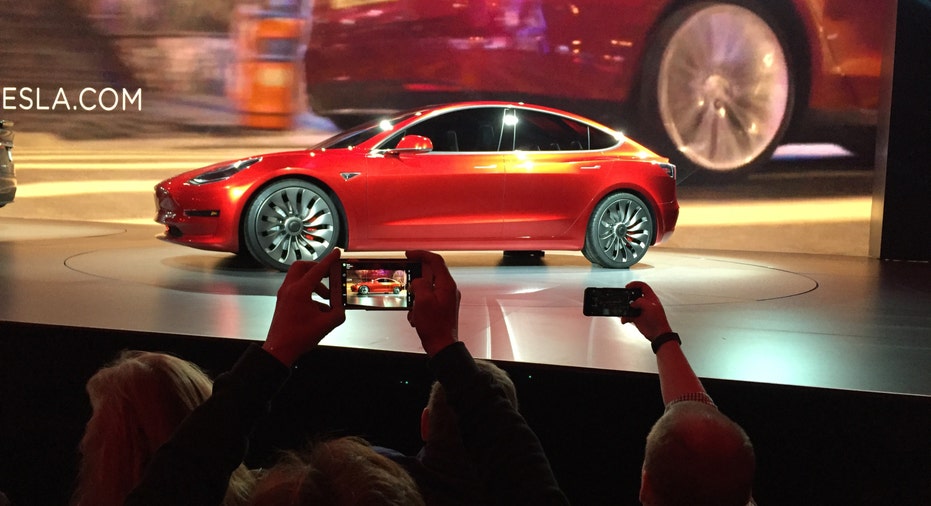

Will Tesla's Magic Work on Mass-Market Consumers?

You’ve got to marvel at the man’s sense of timing and showmanship. Whenever there’s bad news on the horizon, Tesla CEO Elon Musk just takes off his top hat, waves a magic wand, and pulls out a shiny new rabbit. He may have missed last quarter’s production target, but then, he pulled out the shiny new Model 3. And all is forgiven.

Well, not exactly.

The master of hyperbole has proven that Tesla can ship tens of thousands of luxury electric cars – albeit years later and for $30,000 more apiece than originally promised. And, even at $106K, Tesla still burns cash on every car sold, not to mention all the quality and production growing pains the company’s been experiencing.

While that sleight of hand has worked on Musk’s wealthy Silicon Valley fan boys and cult-crazed investors, I doubt it will be effective with everyday consumers as Tesla attempts to challenge the likes of GM, Toyota and Mercedes as a mass-market supplier of a broad range of cars.

Of course, I could be wrong. Maybe this is just another example of an innovative tech entrepreneur disrupting an age-old market like Amazon did in retail, Google in advertising, Netflix in video, Uber in ground transportation, Airbnb in hospitality and GrubHub in food delivery.

Besides, it’s not as if up-selling is limited to tech. Consumers didn’t always fork over $100 for a pair of blue jeans or sneakers. Who knew you could triple the price of a $20 sweatshirt just by calling it a hoody? Or get millions of people to feel good about not working out by selling them a whole new wardrobe of athleisure wear.

Far be it from me to suggest that the same sort of disruption that worked for clothing may not work when the product in question has all those zeros on the price-tag – not to mention one that’s advertized as sub-$30K for delivery in 2017 and turns out to be more like $40K or $50K in 2018 or 2019.

Make no mistake, that’s exactly the kind of differential we’re talking about as the Mighty Musk tests his magic on mainstream America. Wait, I know what you’re thinking. Tesla got a whopping 300,000 orders since its big Model 3 launch event. That’s $10 billion of revenue in less than a week. Talk about demand, right?

Not so fast. Those were not bookable orders but fully refundable $1,000 deposits. That amounts to a $300 million interest-free loan to Tesla but zero commitments and zero dollars in actual revenue. For all I know, half of those are the Silicon Valley elite thinking Tesla might actually deliver by the time their grade school kids need cars.

Let’s give Musk the benefit of the doubt and assume that all those deposits are from regular folks looking to get their hands on the world’s first affordable electric car. Fair enough. Let’s talk about Tesla’s history of hitting price and delivery targets.

The Model S was announced in June of 2008. It was supposed to sell for $60,000 or, as Musk said in 2010, “about half the price [of the roadster],” which sold for about $110K. While Tesla showed a prototype in March 2009, the first production units didn’t start shipping until mid-2012. And the average transaction price is actually $106K.

Meanwhile, a prototype of Tesla’s first electric SUV, the Model X, was unveiled in February of 2012. It was originally supposed to start shipping two years later, but the first production units weren’t delivered until September of 2015. And while the Model X was supposed to be priced the same as the Model S, it’s actually quite a bit pricier.

To summarize, it usually takes Tesla about three and a half years to go from prototype to initial production. That’s fairly consistent within the automotive industry. Besides, these are not generic, cookie cutter cars. They’re sophisticated and mostly uniquely designed.

And while Musk and company seem to be getting better at price predictability, they differ from traditional auto makers in that consumers end up paying an average of nearly twice Tesla’s quoted base price before they get to drive off with the car.

With that perspective, let’s discuss the Model 3. Musk says shipments will begin in late 2017, but even if Tesla manages to trim a year off its historical time to market, the first units won’t be delivered until late 2018. So, if you make a deposit today, I wouldn’t bet on getting the keys before 2019.

In the meantime, competitors like GM, BMW and Nissan won’t be standing still. And Tesla has just given a whole bunch of automakers with far deeper pockets and experience everything they need to know to compete, should they choose to target the same market. Not exactly the smartest move, in my opinion.

Musk says the Model 3 will have a base price of $35K and he expects the average sale price to be $42K, but no worries, there’s a $7,500 federal tax incentive. Actually, you might want to check his sleeves on that slight of hand. Each carmaker gets 200K incentives total, so by the time the Model 3 ships, Tesla will almost certainly have used up its full allotment on Model S and X customers.

And if history is any indication, the average selling price may end up far north of $42K. And since a new car sells for $33K on average in the U.S., that doesn’t make the Model 3 cheap, by any stretch. If you’re beginning to wonder just how many of those 300,000 depositors will actually write a check three years from now, join the club. It’s anyone’s guess.

On top of which, Tesla will have to raise boatloads of capital and figure out how to mass produce and ship cars without the myriad of quality and delivery problems that have plagued the company in the past. That’s no small feat. Bottom line: If Musk thinks that getting to this point has been challenging, he’d better work on his magic. He’s going to need a whole new set of tricks to pull this rabbit out of a hat.