5 Brief Observations From Starbucks Earnings

Image source: Starbucks Corporation

Last week's fiscal second quarter 2016 earnings report issued by Starbucks Corporation presented investors with a familiar narrative of record revenue, record operating margin, and record earnings. Nonetheless, investor qualms over valuation sparked fretful selling of the "SBUX" symbol in the trading days following the report. Irrespective of its near-term stock descent, the global coffee retailer's recent corporate actions and long-term plans invite thoughtful scrutiny. To that worthy task, the following are five quick observations gleaned from the April 21st filing.

1) Japan is a double-edged swordWhen Starbucks acquired the 60.5% of Starbucks Japan which it didn't already own in the first quarter of fiscal 2015, the company more than doubled its China/Asia Pacific, or CAP, segment revenue.

While this acquisition boosted the top of the company's income statement, it may have created a bit of unanticipated difficulty. This is because actual quarter-to-quarter consumer consumption growth in Japan is minimal, due to an economy which has been largely stagnant and subject to deflationary pressures for decades.

Investors want to see comparable store sales, or "comps," grow soundly in CAP, which Starbucks continually deems the segment in which it sees the most promise. But Japan comps, which will probably trend for some time in the low single digits, may end up dragging down the faster comps in its group, particularly those of China. Starbucks CFO Scott Maw pointed out during the company's earnings call that "Japan is the largest component of the CAP comp base, with a weighting of just over 50% of the total."

Indeed, comps in the CAP segment expanded by just 3% last quarter, which is well below the company's global average of 6% for the period. The CAP totals were undoubtedly weighed down by the 1,009 Japan stores included in the comps base since the acquisition. Prudent investors will recognize the overweighting of Japan in CAP comps, and factor this in when next quarter's results are released.

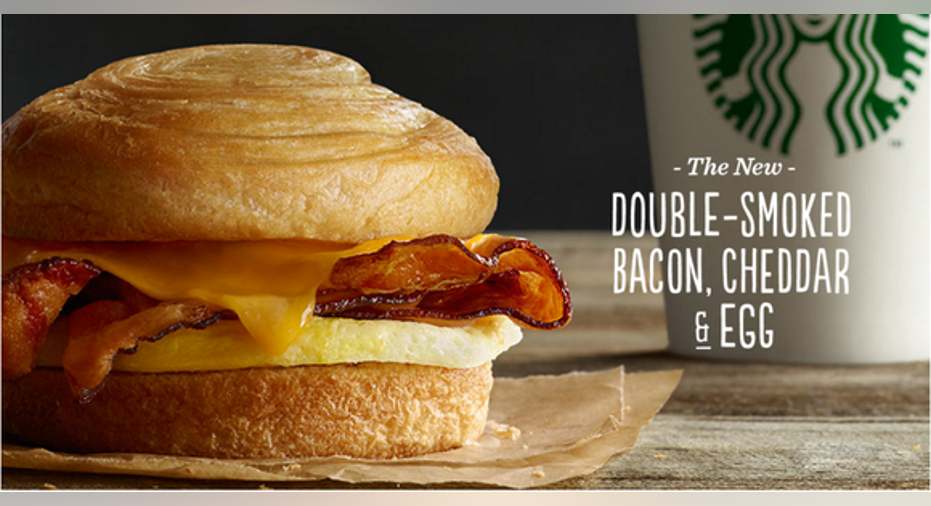

2) Breakfast still rules, despite efforts to catalyze other daypartsWhile Starbucks continues to invest heavily in driving traffic during non-peak hours, evidence that morning remains the most important time window for Starbucks was found all over the company's earnings report.

Morning was once again the fastest growing daypart, increasing by 13%, which the company attributed to adoption of the "Mobile Order & Pay," app feature, breakfast sandwiches, and espresso drinks. Breakfast sandwich revenue alone grew 30% during the quarter.

The inference? Despite the expansion of hot and savory lunch items, the elevation of tea in Starbucks' product mix, and loyalty offers which incentivize late afternoon visits, customers remain sleepy first thing in the morning, and need their coffee fix! I say this not to be flip, but to point out that often the greatest businesses sustain their returns by grasping, and paying attention to, extremely simple directives.

3) Mobile Order & Pay is straight out of central casting for a certain type of orderDuring the second quarter, Mobile Order & Pay continued to enjoy an extremely rapid uptake by customers. Use of this feature grew 40% from the previous sequential quarter, and represented an impressive 24% of total U.S. transaction value between January and the end of March.

Mobile Order & Pay speeds throughput during peak times, enabling the company to record greater sales during those all-important breakfast hours. But as adoption spreads, Starbucks may see this feature benefit non-peak spends as well -- at the drive-through. Starbucks' executives emphasized last week that the company is continuing to experiment with streamlined drive-through formats. Mobile Order & Pay is ideal for those who are in a hurry and prefer to coast up to the window. It's likely only a matter of time before we start hearing executives cite statistics which praise both the technology and order type in the same breath.

4) A massive outflow to shareholdersSubmerged under many other details in the Q2 2016 report was the startling use of cash by Starbucks during the period. The company put $1.6 billion to work between issuing dividend checks, and completing an outsized stock buyback of 23 million shares. As CFO Scott Maw pointed out on the conference call, this was the highest amount of share repurchase in the company's history, equaling nearly all of the share repurchases in fiscal 2015.

The company's board has reupped Starbucks' repurchase authorization to 100 million shares. At today's prices, that's about $5.6 billion worth of stock. If that seems like a number that might take years for the company to absorb, consider that in the first two quarters of 2016, Starbucks has already generated $1.5 billion in free cash flow.

5) A boost to Channel Development profitsAs I wrote recently, Channel Development, which encompasses packaged retail sales, as well as Starbucks' growing business providing coffee and food service to institutions, is rising in importance. Already the organization's most profitable segment, in the second quarter, Channel Development's profitability ramped up by over 300 basis points, to an operating income margin of 39.5%.

As for the factors pushing up operating income, the company listed cost of sales leverage, the effect of lower coffee commodity prices, and higher income from Starbucks' ready-to-drink coffee partnership with PepsiCo, .

The "North American Coffee Partnership," as the joint venture is called, may positively impact results in the back half of the year, when it broadens its reach in Latin America by scaling up distribution of bottled coffees and teas to ten distinct geographical markets.

The partnership is structured to bring incremental profits to Starbucks beyond the company's own 50% equity stake, as the joint venture pays licensing rights to Starbucks for the privilege of manufacturing and marketing its drinks. Starbucks doesn't break out margin information for the partnership, but there does seem to be a correlation between rising sales with PepsiCo, and Channel Development's buoyant margins.Keep an eye on both joint venture sales and Channel Development profits through the end of fiscal 2016: they're likely to rise in tandem.

The article 5 Brief Observations From Starbucks Earnings originally appeared on Fool.com.

Asit Sharma has no position in any stocks mentioned. The Motley Fool owns shares of and recommends PepsiCo and Starbucks. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright 1995 - 2016 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.