7 of the Most Common Social Security Misconceptions

Think you have a good grasp of Social Security? Chances are, you probably don't know enough about Social Security -- arguably the most important program for seniors in this country -- to pass a simple pop quiz about it.

MassMutual Financial Group put more than 1,500 people to the test in 2015 by asking 10 relatively basic true-or-false questions about the program. If you're feeling brave enough, you can try taking the quiz. A mere 28% received a passing grade (at least seven correct questions), with one lone respondent out of 1,513 getting all 10 questions correct. Given this lack of knowledge, it's no wonder that a host of Social Security misconceptions continue to persist.

Here are seven of the most common Social Security misconceptions that need to be put to rest.

Image source: Pixabay.

1. Deciding when to file is cut-and-driedAs MassMutual's data shows, the decision to claim benefits isn't as simple as selecting A or B. Every individual has unique aspects of their life that need to be reviewed to determine when it's optimal for them to file for benefits. Some seniors, such as the rich or highly indebted, might do best to file for benefits early, while seniors with little or no savings would most likely be best off working longer and allowing their benefit to grow. The key point being that no two paths are alike, so you'll need to familiarize yourself with the system to understand how it'll best serve your retirement needs.

2. Your decision to file only affects youSome people believe their decision to file for benefits is a personal one, but for anyone other than single individuals, the decision to file could have an adverse impact on the people they love.

For example, if you're the highest-earning individual in the household and you file for benefits as early as possible (age 62), then you're setting up your spouse to receive a lower survivor benefit if you pass away first. The same can be said for couples with a large disparity in lifetime earnings between the two spouses. It would make more sense for the higher-wage earner to hold off on filing for benefits as long as possible in order to boost benefits for the couple later in life. Deciding when to file for benefits can mean looking at the bigger picture beyond just your own income expectations.

3. You should file for benefits as soon as possible Another common misconception is that filing for benefits as early as possible is your best bet. In some cases this can prove true, such as for persons in poor health, people who desperately need the added income, those who have saved more than enough to cover their retirement needs (and can thus look at Social Security as "bonus" money), and lower-income spouses.

But filing early means accepting lower benefits throughout your lifetime. Your full retirement age, or FRA, is the age at which you become eligible to receive 100% of your benefits. For people born between 1943 and 1954, FRA is 66 years. Filing at age 62 could leave you with a monthly benefit that's just 75% of your FRA. If you don't have adequate retirement savings, then filing for benefits early could put you in a real bind during your golden years.

Additionally, if you file for benefits early while still working, the Social Security Administration could withhold some of your benefits if you earn too much. Granted, you will be recompensated down the road in the form of delayed-retirement credits, and this practice stops once you hit your FRA. Nonetheless, it can be a nuisance for those who were expecting a big income boost from their Social Security income.

Image source: Pixabay.

4. Social Security income will fully fund your retirementA truly scary misconception some seniors have is that Social Security will completely fund their retirement. According to the Social Security Administration, retirement benefits are only designed to cover about 40% of your working wages, meaning you should have a Plan B in place, such as an investment account, a pension, or other sources of income beyond Social Security.

Furthermore, it's important to recognize that benefit replacement isn't entirely commensurate with what you've earned throughout your life. In other words, higher lifetime wage earners will net larger monthly benefits, but the percentage of their income being replaced will be much lower than that of a lower-income individual. Data from AARP recently showed that high-wage earners (defined as $72,138 and above) had approximately 35% of their working income replaced by Social Security compared to a 57% replacement for low-wage earners ($20,289 and below).

5. Social Security income can't be taxedA number of people assume that because Social Security is taken out of their working wages via the payroll tax, they're free and clear of having to pay tax on Social Security income ever again. Not true.

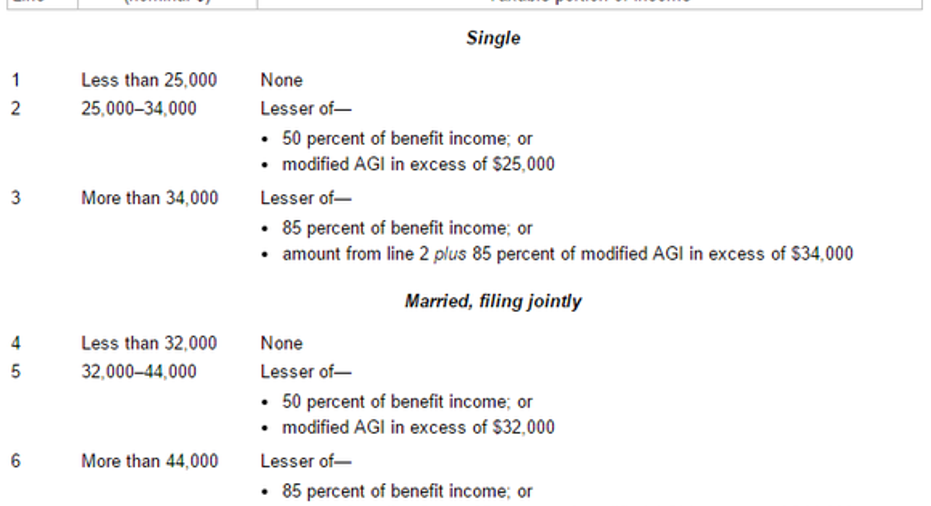

Image source: Patrick Purcell, Income Taxes on Social Security Benefits via IRS.

For single filers with $25,000 to $34,000 in modified adjusted gross income (MAGI), and joint filers with $32,000 to $44,000 in MAGI, up to 50% of Social Security benefits can be taxed by the federal government. Earn more than $34,000 in MAGI as a single filer, or $44,000 as a joint filer, and up to 85% of your Social Security benefits become taxable. This doesn't even take into account that 13 states also tax Social Security benefits, four of which -- Minnesota, North Dakota, Vermont, and West Virginia --offer no exemptions.

6. Your filing claim can't be undoneSome retirees dread the decision to file for benefits because they believe that once they lock in their application for benefits, it can't be undone. In reality, the Social Security Administration allows seniors to use Form 521 to undo an application for benefits as long as they change their mind within 12 months of signing up for benefitsand repay every cent they've received from the SSA.

For instance, assume an unemployed 62-year-old files for benefits because they're having no luck finding a job. However, six months after they begin receiving benefits, they land a well-paying job. Our fictitious 62-year-old could use Form 521 to undo their benefits application, repay all income received from Social Security, and allow their benefit to grow at roughly 8% per year as if their original filing never even happened.

7. Social Security is going bankruptLast but not least, we have what's easily the most pervasive Social Security myth of all: that Social Security is going bankrupt.

Image source: Flickr user TaxRebate.org.uk.

According to the SSA's 2015 Board of Trustees report, the Old-Age, Survivors and Disability Insurance Trust is on pace to burn through its existing cash reserve by 2034. The reason the program is expected to burn through its reserves involves two major demographic shifts -- namely, the mass retirement of baby boomers and Americans' rising life expectancies.

But just because the OASDI is running out of cash doesn't mean the program is insolvent. Whether you're retired, about to retire, or a millennial who's three decades from retirement, Social Security will be there for you. In a worst-case scenario, per the trustees' report, benefits could be cut by up to 21% to sustain payments through 2089. Although practically no one likes the idea of cutting benefits, it's one of a few guaranteed ways to fix Social Security for multiple generations to come.

Knowledge is power, and the more you know about Social Security, the better your odds of getting the most out of the program.

The article 7 of the Most Common Social Security Misconceptions originally appeared on Fool.com.

Sean Williamshas no material interest in any companies mentioned in this article. You can follow him on CAPS under the screen nameTMFUltraLong, track every pick he makes under the screen name TrackUltraLong, and check him out on Twitter, where he goes by the handle@TMFUltraLong.The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter servicesfree for 30 days. We Fools may not all hold the same opinions, but we all believe thatconsidering a diverse range of insightsmakes us better investors. The Motley Fool has adisclosure policy.

Copyright 1995 - 2016 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.